In the 1990 war thriller “The Hunt for Red October” Sean Connery plays the role of Marko Ramius, a Soviet Union submarine captain who plans to defect. Marko’s intentions are misinterpreted by the United States as a potential nuclear attack. What ensues is a tense and tangled search for the Soviet submarine Red October.

Growing up, The Hunt for Red October was one of my father’s favorite movies. He must have watched it a thousand times.

Looking at financial markets in the month of October, I couldn’t get the movie title out of my head. There would be no hunt for red in October, the color red was all around us. Investors pretty much hated everything.

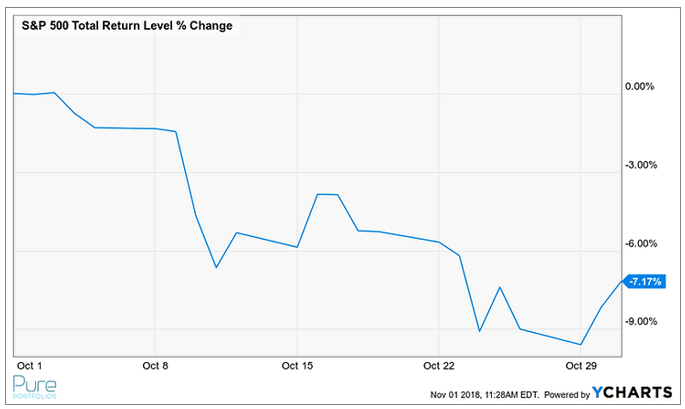

S&P 500

Source: YCharts

The S&P 500 posted the 11th worst October on record. Things were looking much worse until a Halloween mini rally.

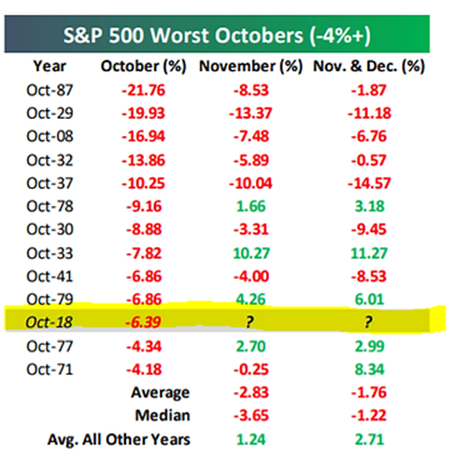

Source: Bespoke Investment Group

The above graphic shows ugly Octobers have historically led to ugly Novembers & Decembers (1933,1977-1979 being the exceptions).

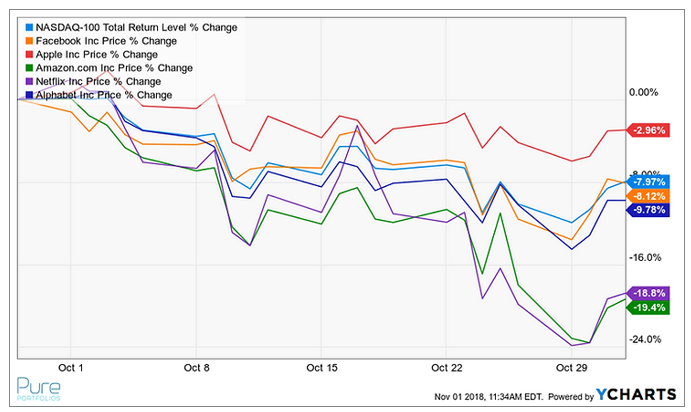

NASDAQ + FAANG

Source: YCharts

The faster they rise, the harder they fall. The NASDAQ (blue) took it on the chin the month of October. Netflix (purple) and Amazon (green) saw almost a 20% decline.

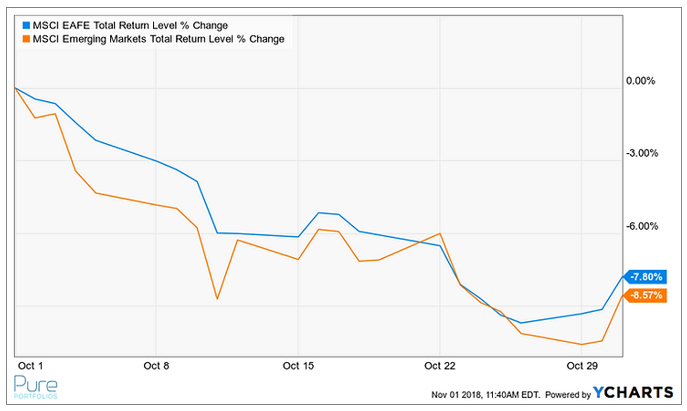

Foreign Equities

Source: YCharts

The global sell-off continued with International (blue) and Emerging Markets (orange). The good news? Foreign equities are cheap.

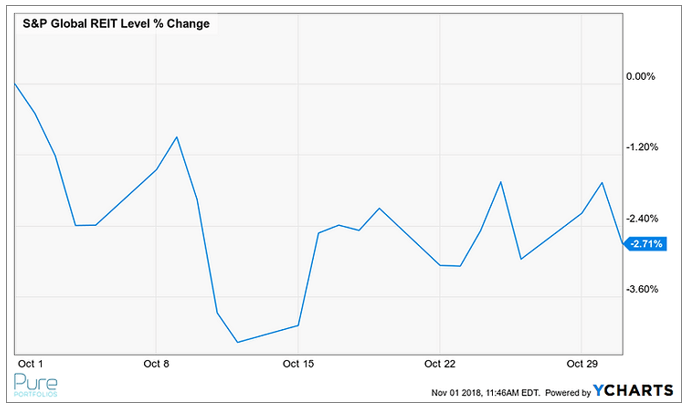

Global Real Estate (REITs)

Source: YCharts

Global REITs (real estate) held up relatively well during the month of October. We are intrigued by the behavior of REITs during the month of October.

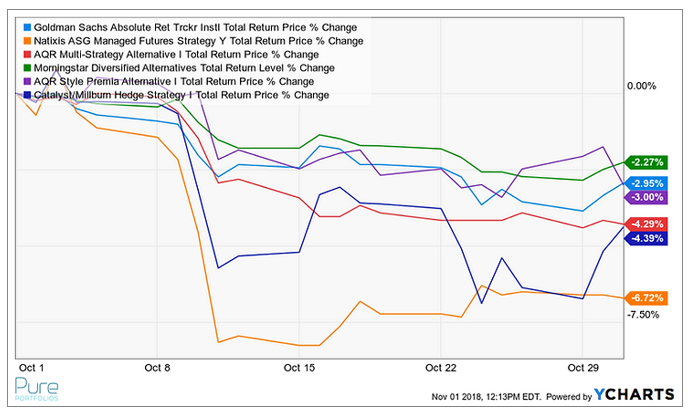

Various Alternative Strategies (Hedge Funds, Managed Futures, etc.)

Source: YCharts

We searched high and low for a hedge fund strategy that held up in the month of October. After reviewing five different mutual funds and a broad hedge fund index (green), we failed. It seems the hedge fund managers did as well; what exactly are they “hedging” if they participate in a broad market selloff? As a bonus, investors get the privilege of paying through the nose for these exotic strategies. The Catalyst/Millbum fund (dark blue) charges 3.62% per year!

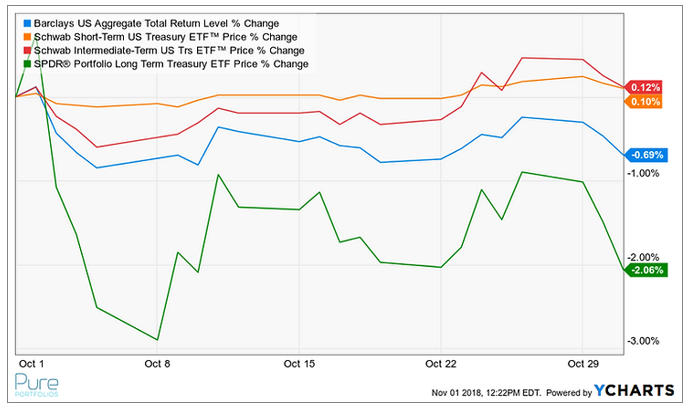

U.S. Bonds

Source: YCharts

Bonds aren’t going to win any beauty contests for 2018, but they did their job in the ugly month of October. Sometimes, boring is beautiful!

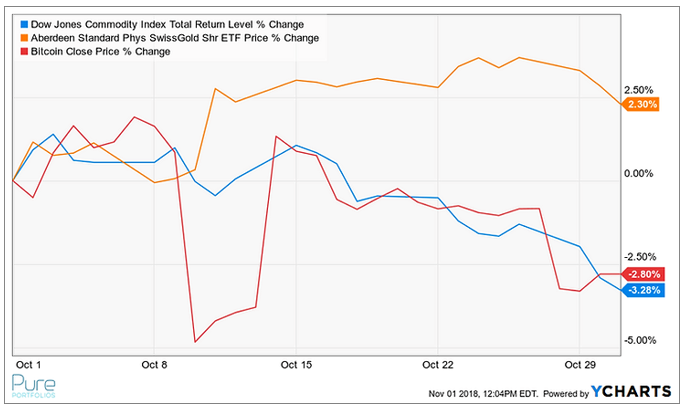

Commodities, Gold, and Bitcoin

Source: YCharts

Broader commodities (blue) started the year strong, but are struggling to hold onto gains. Gold (yellow) proved its worth as a safe-haven asset posting a +2.30% return for the month of October.

Rather than assigning a reason for the October carnage (many folks like to do that), we can simply say that sometimes markets need a breather. After all, the last nine years have been pretty much uninterrupted bliss for investors.

In our opinion, the recent market action warrants more defensive positioning. Don’t anchor to a static asset allocation. For example, we’ve heard investors proudly proclaim, “I’m a 60/40 investor.” Being tactically overweight equities or riding the same asset allocation after a great market run might not be the best approach. As the No Hunt for Red October has shown us, sometimes you win by not losing.