“This is the single worst time to be a passive investor since they started passive investments. The S&P 500 index is highly likely to not make money over the next 10 years.” – Bill Smead, chief investment officer of Smead Capital Management.

I knew the above lead-in was world class click-bait from Yahoo! Finance. But I couldn’t help myself.

Predictably, it would go something like this…

Passive investors are doomed.

This is a stock picker’s market.

Oh by the way, I run an expensive mutual fund that picks stocks.

These cats need new material.

Despite this tired narrative, my biggest gripe is the misguided notion that passive investing is plowing money into the S&P 500.

The old guard thinks you’re either an active mutual funds investor or you are a passive investor with 100% exposure to the S&P 500. This is antiquated thinking.

Here’s the truth; unless you own a portfolio that mirrors every global publicly traded asset, we are all active investors.

The whole passive vs. active debate needs to be thrown in the trash. It should be reframed as high-cost vs. low-cost investing.

In other words, we can be active investors (which most of us are even if we don’t realize it) and embrace low-cost investing.

Here’s a sample portfolio of ETFs:

$200,000 iShares Exponential Technologies ETF (XT) Expense ratio 0.47%

$200,000 Global X Video Games & eSports ETF (HERO) Expense ratio 0.50%

$200,000 ARK Israel Innovative Technology ETF (IZRL) Expense ratio 0.49%

$200,000 The 3D Printing ETF (PRNT) Expense ratio 0.66%

$200,000 Global Short-Term High Yield ETF (PGHY) Expense ratio 0.35%

$1,000,000 Portfolio. Averaged weighted expense ratio – 0.49% or $4,940 per year.

Is the above portfolio passive? No.

Active? Very.

Low-cost? Yes.

Let’s mirror the above portfolio with active mutual funds:

$200,000 USAA Science & Technology (USSCX) Expense ratio 1.04%

$200,000 T. Rowe Price New Horizons (PRNHX) Expense ratio 0.75%

$200,000 Timothy Plan Israel Common Values (TPAIX) Expense ratio 1.84%

$200,000 Fidelity Disruptive Automation (FBTLX) Expense ratio 0.75%

$200,000 Fidelity Advisor Global High Income (FGHIX) Expense ratio 1.00%

$1,000,000 Portfolio. Averaged weighted expense ratio – 1.07% or $10,760 per year.

Is the above portfolio passive? No.

Active? Very.

Low-cost? Absolutely not, it’s more than twice the cost.

Is the active mutual fund portfolio twice as good as the lower cost ETF portfolio? Maybe. Maybe not. Empirical evidence would suggest active managers can get lucky now and again and outperform, however, sustained success is often fleeting.

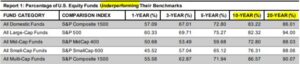

The latest SPIVA scorecard from S&P Global (as of year-end 2020) shows the underperformance rate for U.S. mutual funds across various market caps:

Source: SPIVA Scorecard S&P Global

The above shows the percentage of U.S. equity funds underperforming their benchmarks over various time periods. You can see that in the 1-year period, roughly half of the managers underperform their benchmarks. When you extend the time period, the underperformance rate skyrockets.

Based on the dismal track record of active mutual funds, it would seem that net of fee returns matter.

In 2021, we can build active, intentional portfolios without paying an arm and a leg. Due to the proliferation of ETFs, being an active and low-cost investor is not mutually exclusive.

Throw the obsolete active vs. passive debate in the trash can. The question should be reframed; are you a high-cost or low-cost investor?

In investing, you get what you don’t pay for.