“When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients.” Warren Buffett, Berkshire Hathaway

Imagine doing your grocery shopping at the same store every week. The store is clean and conveniently located down the street from your house. One day, as you’re unloading your groceries, a neighbor walking their dog stops to chat.

Neighbor: Hey there! I see you shop at Broker Foods. Have you heard of Good Index Foods?

You: No, I haven’t.

Neighbor: Good Index Foods has the exact same inventory as Broker Foods, but is forty to fifty times cheaper depending on what you buy.

You: (Slightly embarrassed). I’ll check it out. Thanks.

It seems too good to be true. After unloading the groceries, you head over to Good Index Foods. You feel a sharp pain in the pit of your stomach. Your neighbor was right. You’ve been blowtorching money at Broker Foods, while Good Index has been offering the same stuff at a fraction of the cost.

You might say there’s no way you would ever fall for such nonsense. This happens every day to unsuspecting investors.

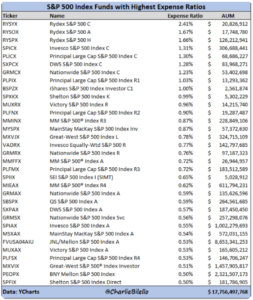

Look no further than the egregious expense ratios that fund companies are charging for owning the S&P 500…

Source: Charlie Bilello, Compound Capital Advisors

The above graphic shows the most expensive S&P 500 index funds and the assets managed by each fund. In total, $17 billion dollars of investor money is being slowly siphoned off to these fund companies and the advisors that sell these garbage funds. Every one of these mutual funds owns the exact same thing, the S&P 500, but the cost per year ranges from 0.50% to 2.41%.

Any investor can get S&P 500 exposure through an ETF at a fraction of the cost…

Vanguard S&P 500 ETF (VOO) at 0.03% per year

SPDR S&P 500 ETF (SPY) at 0.09% per year

iShares Core S&P 500 ETF (IVV) at 0.04% per year

We should note the high expense S&P 500 funds are not sought out by individual investors. These ridiculous funds are sold by financial advisors (we use the term loosely) costing investors thousands or even millions depending on time and dollars invested.

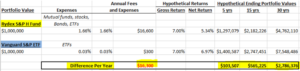

How much would a high fee S&P 500 fund cost an investor over 5, 15, and 30 years?

The amounts are staggering…

Source: Pure Portfolios

The above spreadsheet shows the Rydex S&P 500 H Fund (1.66% cost per year) vs. Vanguard’s S&P 500 ETF (0.03% per year). Assuming a $1,000,000 portfolio, the difference in net of fee portfolio values is greater than $2.7mm after 30 years!!! Even worse, the above funds own the EXACT same basket of securities. An investor is simply lining the pockets of the advisor and mutual fund company.

How is this legal?

Technically, it may not be. An advisor has to document and justify using a higher cost fund when the exact same fund is available at a lower cost.

100% of the time, there is no rational justification.

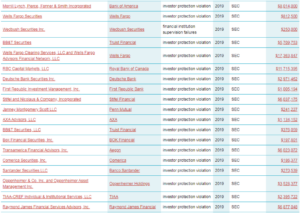

The SEC has started to sniff this injustice out, fining financial services companies that offer high fee funds when lower cost options of the same fund is available.

The names on the below list shouldn’t surprise anyone.

Source: Good Jobs First. Violation Tracker.

The above graphic shows 2019 SEC investor protection fines. Slapping sales organizations with fines relating to mutual funds sales practices was by far the most common infraction of the past few years. Does your broker make the list?

How can you avoid owning a high cost fund when a lower cost alternative is available?

• Grab a recent statement

• Find the holdings page

• Find the ticker symbols (they are the non-sensical letters next to the funds you own i.e. RYSYX)

• Go to Morningstar.com and enter in a few ticker symbols to view the expense ratio

Just last month, we onboarded a new client from a mega Wall Street bank. The client was involved in the management of their finances having regular meetings with their advisor.

The client owned an S&P 500 index fund with an expense ratio of 1.86%.

It can happen to anyone (and is happening every day).

Investors aren’t scouring the internet to find funds that charge 50x market rates. These are very much sold by lousy advisors. Our biggest frustration is that people think all advisors are the same. There is a trove of evidence to the contrary.

There’s a dark corner of financial services that preys upon people who do not know better. Our mission is to teach people to know better. Investing is hard enough without fighting an enemy (or conflicted advisor) that should be your ally.

Not sure if your advisor is in your corner or not? Shoot us a note insight@pureportfolios.com.