“This year’s top-performing mutual funds aren’t necessarily going to be next year’s best performers. It’s not uncommon for a fund to have better-than-average performance one year and mediocre or below-average performance the following year.” – SEC Website

I settled into a client review by catching up on their summer travels and learning of a new grandchild that was a welcome addition to their growing family.

As the conversation pivoted to financial affairs, I was confounded on what happened next. A Money Magazine cover was strewn across my desk with a headline that read “Top Performing Mutual Funds of 2017.”

The client asked, “Why don’t we invest in the best performing funds from last year?”

Two weeks later, I was meeting with a do-it-yourself investor and prospective client in a crowded Mexican restaurant. After getting acquainted and ordering tasty burritos, he shared his portfolio construction approach.

“I got on the TD Ameritrade site and chose the five best performing funds from last year.”

I’m not bringing this up to shame anyone. Humans are pattern seeking. We like certainty. We try to make sense of an uncertain world by anchoring to recent events or our own experiences.

I totally get it.

Heck, even investment consultants that earn hundreds of thousands (even millions) in fees to advise pensions, insurance companies, and family offices on asset allocation & manager selection fall into the “past performance” trap. Their manager screens almost always include the top performing funds from the past 3 or 5 years.

On the surface, it’s not the worst conclusion. After all, the fund manager has recently proven competence and the ability to beat a benchmark. Is it sustainable? Lucky for us, S&P Dow Jones Indices publishes a semi-annual report that measures the persistence of performance.

Does past performance really matter?

For the record, it’s not uncommon for an active manager to outperform over a short-period of time (one or two years). What really defines successful active management, is the ability to consistently outperform over a longer time period (3+ years). That’s how we can separate real skill from luck.

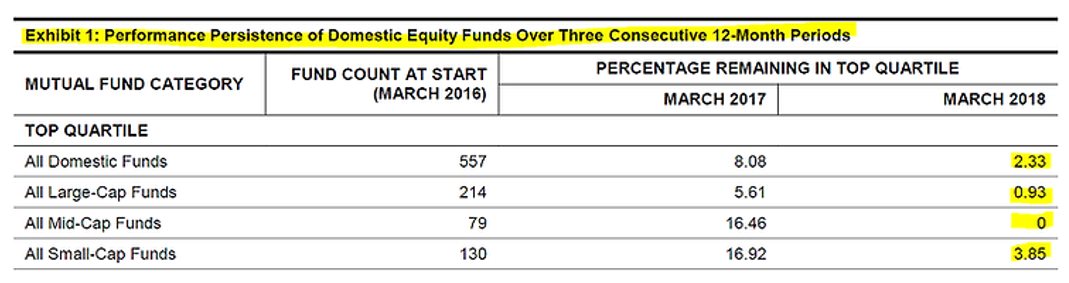

The numbers aren’t pretty for the active mutual fund community. Some highlights from the S&P Persistence Scorecard (March 2018):

Top quartile = top 25% of the data set

- Out of 557 domestic equity funds that were in the top quartile as of March 2016, only 2.33% managed to stay in the top quartile at the end of March 2018.

- For the three-year period that ended in March 2018, persistence figures for funds in the top half were also unfavorable. Over three consecutive 12-month periods, 21.96% of large-cap funds, 7.59% of mid-cap funds, and 13.46% of small-cap funds maintained a top-half ranking.

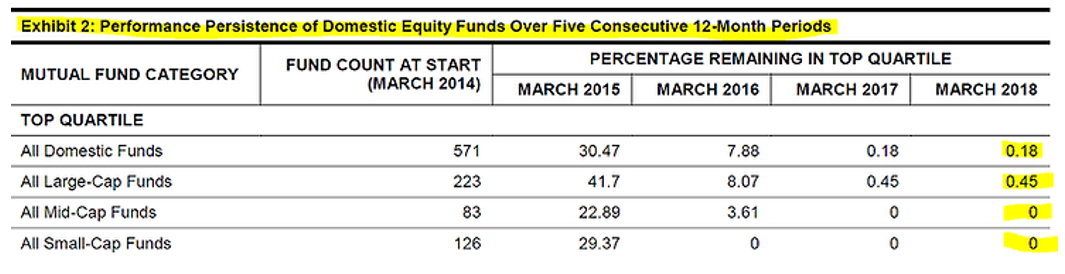

- An inverse relationship generally exists between the measurement time horizon and the ability of top-performing funds to maintain their status. It is worth noting that only 0.45% of large-cap and no mid-cap or small-cap funds managed to remain in the top quartile at the end of the five-year measurement period.

- Similarly, only 11.41% of large-cap funds, 1.2% of mid-cap funds, and 3.57% of small-cap funds maintained top-half performance over five consecutive 12-month periods. Random expectations would suggest a repeat rate of 6.25%.

To summarize, top quartile funds had a minuscule chance to sustain outperformance for the next three years. Looking to the next five years, it was virtually impossible for U.S. large, mid, and small cap managers to continue outperforming.

Source: S&P Persistence Scorecard (March 2018)

The above graphic shows only 2.33% of the top performing domestic funds in March 2016 sustained their outperformance status two years later.

Source: S&P Persistence Scorecard (March 2018)

The numbers were even worse going back five years (March 2014 – March 2018). The top performers in March 2014 were nowhere to be seen four and five years later.

The empirical evidence is overwhelmingly against past performance as a selection criteria for active mutual funds.

Many investors, both recreational and professional, fall into the lure of what just happened. There’s a reason why every mutual fund disclosure and prospectus is littered with language that states, “past performance is no guarantee of future results.”