We talk to clients and potential investors daily. We listen to market experts and consume pages of investment research. It’s interesting to gauge the behavioral tone, either pessimistic or optimistic, based on the current market environment. Our sample size is narrow, but the overall theme amongst our network is one of pessimism regarding future equity returns. On the contrary, the market is dismissing the wall of worry and continues to grind higher.

The financial media attributes the market’s post-election rise to potentially favorable fiscal policy (i.e. infrastructure projects and tax reform). In reality, it’s highly unlikely that meaningful reform will happen in the near term, considering the dysfunction in Washington and the hot-button policy issues. Throw in arguably the most volatile president in U.S. history and virtually zero volatility in financial markets… something has to give.

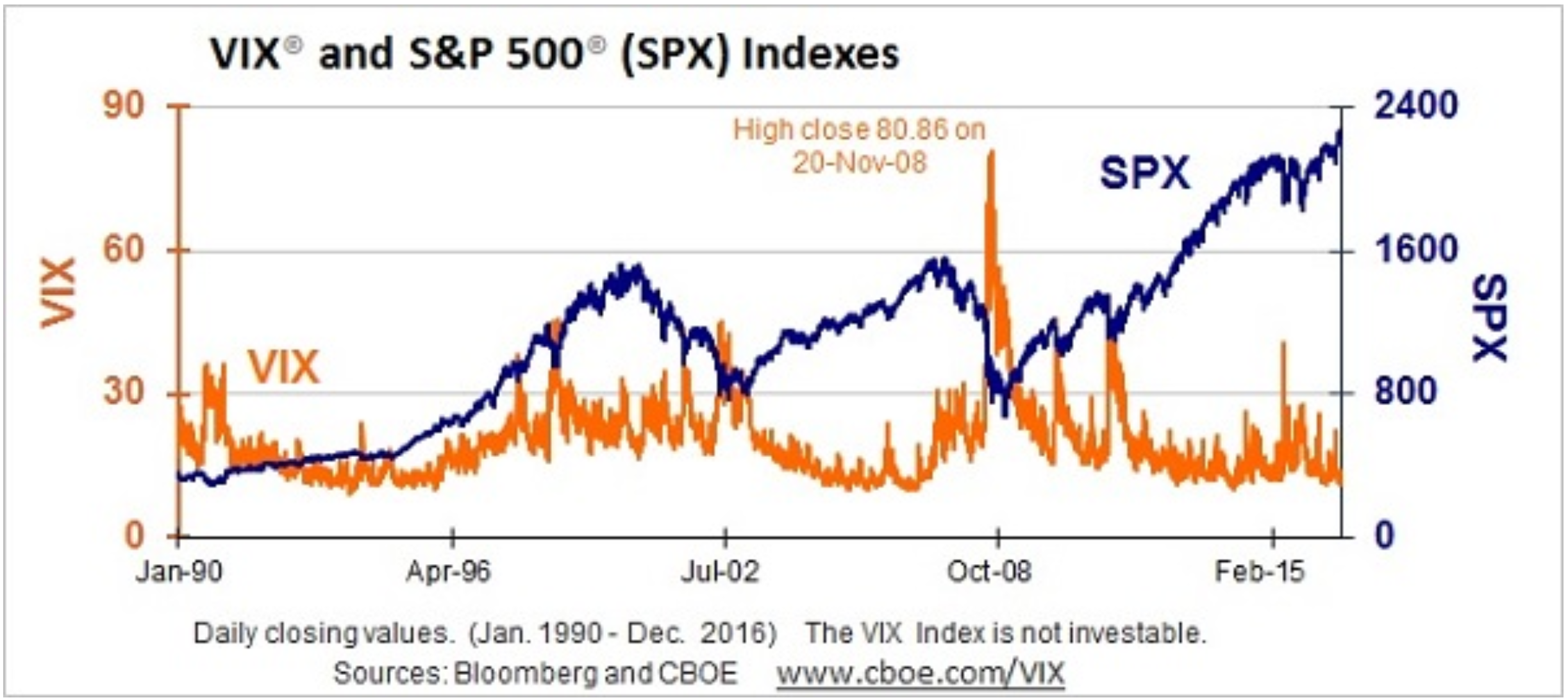

(CBOE Volatility Index or VIX, a popular measure of the implied volatility of S&P 500 index options)

The last meaningful tax reform in the United States occurred in 1986 when Republicans and Democrats came together to pass a package that featured lower personal & corporate tax rates while closing corporate tax loopholes. Fast forward to 2017, Republicans want to lower personal & corporate taxes, while Democrats aim to eliminate tax loopholes enjoyed by powerful corporations that have deep congressional influence. However, the current version of Washington leadership lacks the political will for coming together and getting things done.

The shovel-ready infrastructure projects sounded great on the campaign trail and our country desperately needs new airports, roads, & bridges. Republican Congress has little appetite for the estimated $1 trillion infrastructure spending package which Senate Democrats have proposed. We expect this to be a long, drawn out battle that goes well past President Trump’s promise of an infrastructure deal within his first 100 days in office. So if tax reform and infrastructure spending are unlikely in the near term, what is driving the market higher?

In our opinion, the enthusiasm in the financial markets is being driven by Trump’s aggressive actions toward deregulation (DOL Fiduciary Rule, Dodd Frank, Keystone Pipeline). As we’ve seen, Executive Orders can move quickly without getting bogged down in legislative slog. President Trump even refuses to add a new regulation unless two existing regulations are scrapped.

Pouring over S&P 500 companies’ earnings notes from the past few years, countless CEOs & CFOs reference “fiscal uncertainty” (think healthcare, minimum wage, tax code) as a road block to allocating capital for new investment, expansion, research & development, etc. Instead, companies returned value to shareholders by buying back stock.

These previously paralyzed capital allocators (CEOs, CFOs) will now be more likely to take risks with the promise of lower corporate taxes, less regulation, and a pro-business rhetoric from the White House. In our opinion, deregulation and the power of new capital investment is the undercurrent to the market melt-up.