“We are emotional, irrational beasts who are emotional and irrational in predictable, pattern-filled ways.” – Chris Voss, author of Never Split the Difference.

Stanley sold everything during the massive COVID drawdown. Stocks, bonds, gold, it didn’t matter. There were no safe havens according to what Stanley was reading.

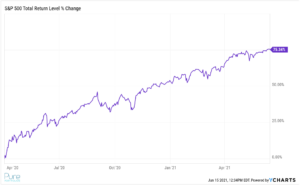

Over the next ~14 months, the S&P 500 did this (4/1/2020 – 6/14/2021)…

Source: YCharts

The above chart shows the S&P 500’s rapid about face after the steep COVID induced sell-off spring of 2020.

Stanley couldn’t believe what was happening. Stanley dug in. This market must be broken. Nothing makes sense. The economy is in the toilet and the market is unhinged.

Stanley was wrapped up in market data, inflection points, narratives, etc. He seemed to be missing a simple truth, financial markets are made up of humans transacting with other humans.

Think about the different agenda’s of market participants. On any given trading day, buyers and sellers of Apple stock might look something like this…

- Norm is looking to sell his Apple stock to buy a new Tesla.

- Jenny wants to buy Apple stock because she likes her new Airpods.

- Jane just retired from Apple. She selling stock to reduce her concentration in the company.

- Bill is selling Apple stock to pay his quarterly Federal taxes.

Now picture the talking head on CNBC trying to explain the intraday movement of Apple stock. Seems a bit ridiculous, right?

Academics will point to the efficient market hypothesis, that current stock prices reflect all available information. The missing pieces in this widely accepted thesis is human emotion, differing goals of market participants, and irrational behavior. A better definition is that current stock prices mostly reflect all available information. On occasion, markets can become unhinged because of unpredictable human behavior.

Investing can make people emotional. If someone is emotional about anything, they will rarely be interested in empirical evidence. This is why unchecked emotions can lead to suboptimal decision making.

I’m fascinated by the human element in financial markets. The discipline is relatively new, emerging in the 1980’s. Researchers, led by Nobel Prize recipient Richard Thaler, began to poke holes in the efficient market hypothesis (the EMH basically stated that markets and investors are rational 100% of the time).

The CFA Institute included behavioral finance in its curriculum. We have wrote about cognitive and emotional investor biases in previous blogs.

Why do we care about human behavior and investing? There’s evidence to suggest investor sentiment is strongly correlated to future returns.

Back to our opening Chris Voss quote, humans are irrational in predictable, pattern-filled ways.

Here are some examples…

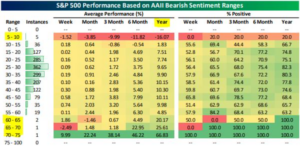

Source: Bespoke Investment Group

The above graph shows bearish sentiment and future S&P 500 performance for various readings (as of May 2021). The more elevated bearish sentiment becomes (bottom portion of the graph), future returns tend to be higher. When investors were least pessimistic (top of graph), future returns were negative and/or much lower.

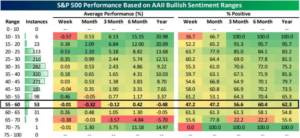

Source: Bespoke Investment Group

The above graph shows bullish sentiment and future S&P 500 performance for various readings (as of May 2021). This is the opposite of the bearish indicator. When investors are the most optimistic (bottom portion of graph), future returns tend to be lower. When investors are least optimistic (top of graph), future returns were much higher.

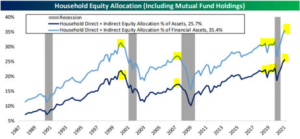

Source: Bespoke Investment Group

The above graph shows U.S. household equity allocation percentages. There is a clear pattern of equity allocation percentages peaking prior to recessions (gray columns).

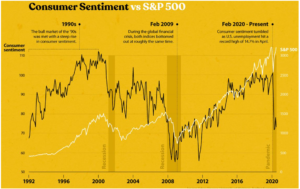

Source: Visualcapitalist.com

The above graph shows consumer confidence (dark line) and the S&P 500 (white line). Consumer confidence tends to peak prior to market crashes, i.e. late 1990s, late 2000s. It also craters priors to market rebounds, most notably in 2009 and 2012.

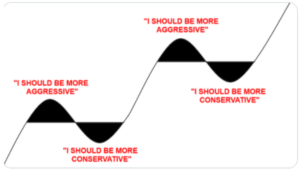

We’ve used the below graph in a past blog post, it sums up investor psychology rather brilliantly…

Source: Unknown Twitter user

The next time you feel great about the future prospects of the market, take a step back and ask “is everyone else around me feeling overly confident?” If so, it might be a good time to do nothing.

The next time you feel awful about the future prospects of the market, ask “is everyone else around me losing their minds?” If so, it might a good time to get more aggressive.

If you can’t explain what’s going on in financial markets, it’s mostly rational humans transacting with other mostly rational humans, except when they’re completely off the rails.