If we tracked the most commonly asked client question over the past six months, a variation of “when is the next big recession coming?” would be leading by a landslide.

My go-to answer is, “avoid operating in the extremes (either too pessimistic or too optimistic) and get your financial house in order before an event happens.” It’s not BS either. There are very few inputs we can control in the financial markets. Tying up our loose ends seems like a no-brainer, but it’s also admittedly boring and leaves the human mind wanting more.

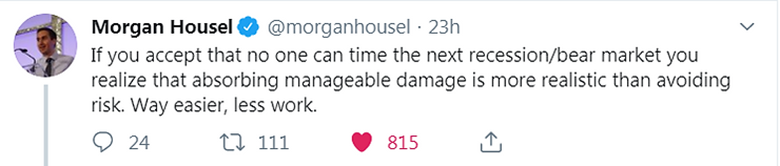

The other night, after putting the kids to sleep, I stumbled upon Twitter gold:

Morgan Housel runs Collaborative Fund, a venture capital fund. He’s also a great writer/blogger.

Our minds search for absolute answers to impossibly complex questions. This leads to nowhere, or poor decision making. Morgan astutely points out that managing “damage” is much more realistic. Said another way, we will all feel pain in the next recession or stock market drop, but what can we do now to mitigate the damage?

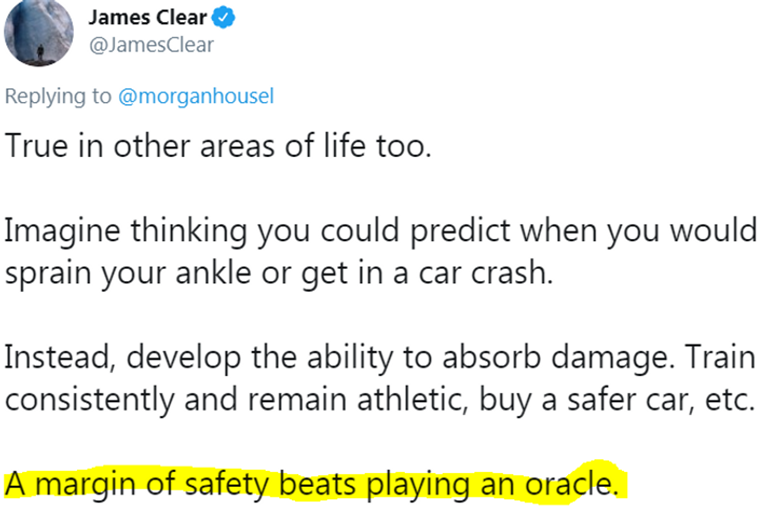

Once we expand this thinking to other areas of life, trying to time the next recession suddenly becomes irrational (bordering on foolish). The below is a brilliant response to Morgan’s original tweet (above):

James Clear is the author of the NYT bestseller, Atomic Habits. He writes about how to build good habits and break bad ones.

If you’re constantly asking or wondering about the next recession or stock market drop, ask yourself what have you done to mitigate or manage risk?

If the answer is nothing, you’re not focused on what you can control.

Here’s a basic list to get you started…

- Identify your range of acceptable investment outcomes. See if your risk profile lines up with how you’re currently invested.

- Stress test your portfolio and financial plan for the worst outcomes. Remember, creating a margin of safety beats playing an oracle.

- Have you historically made emotional decisions during times of economic and market stress? Having guidance from an expert, or using predetermined rules for making decisions could be beneficial.

No one person or data point can predict the next recession. Not the yield curve. Not the talking head on CNBC. Not the Wall Street Journal. Not your golfing buddy. Focus on what you can control. In other words, Take the Low-Hanging Fruit.

If you want to learn more about how Pure Portfolios manages risk for clients, click here.