We are trying something new to convey our view of the world to our readers. We have heard feedback from investors that industry market commentary is too long, confusing, and not relevant. This is our attempt to make Pure Portfolios market content informative and easy to digest. If you’re having trouble viewing the slides. You can get the PDF version here.

Note: Pure Portfolios clients receive a full report uploaded to their online portal. The following is a condensed version.

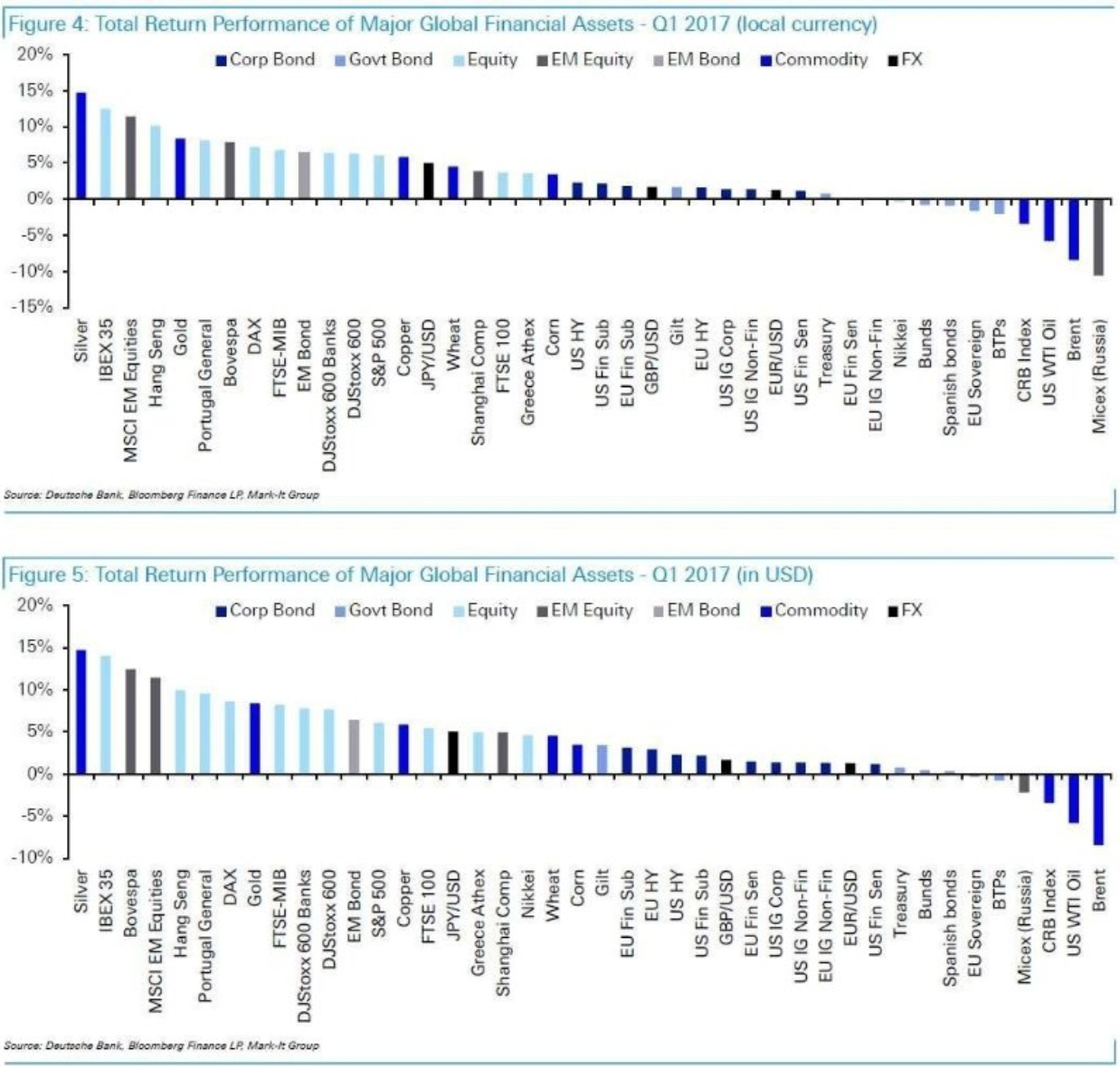

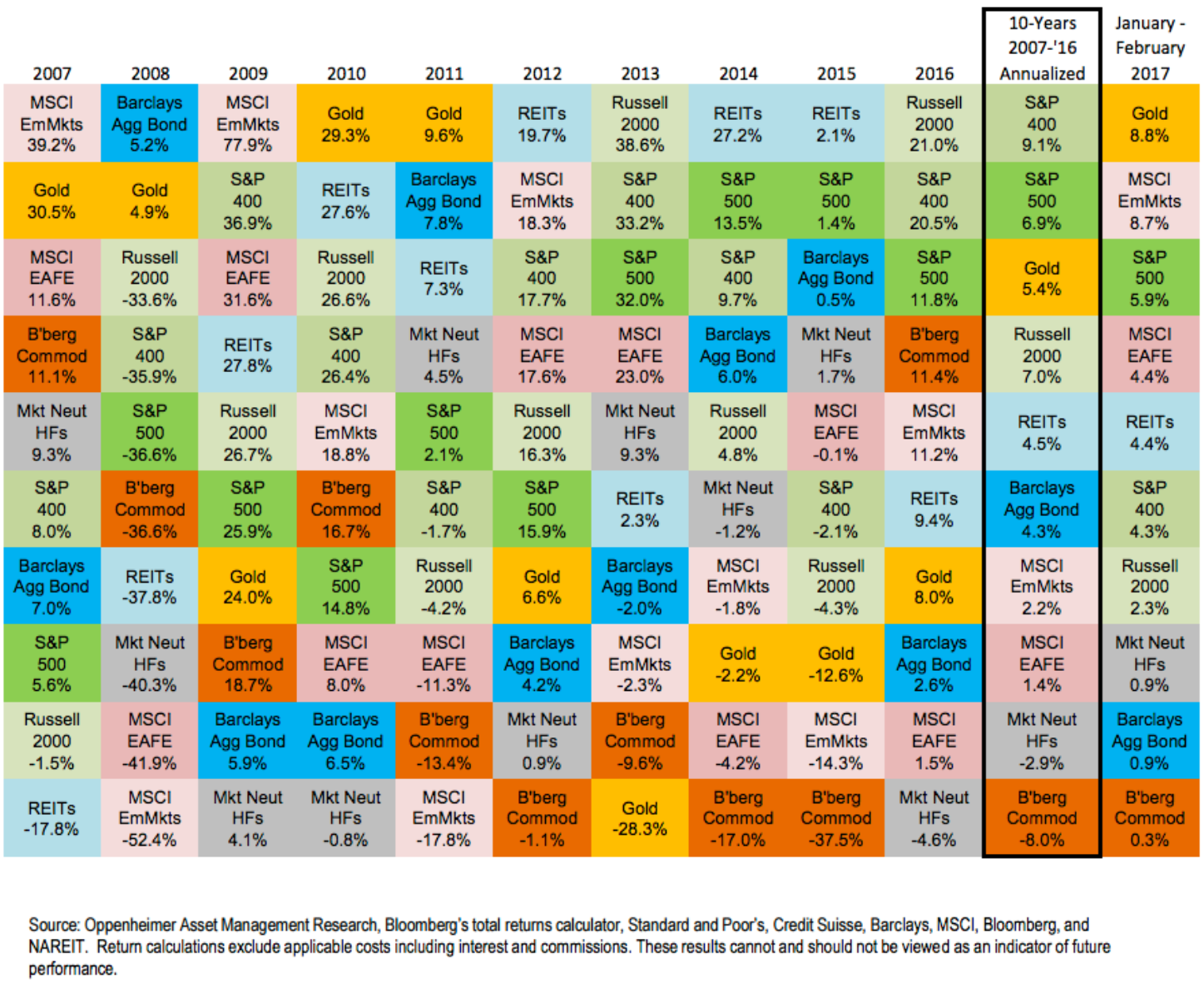

Silver, Gold, Emerging Markets, and Europe outperform to start 2017.

Tax reform? We’re not optimistic.

Investors reset expectations of fiscal reform as Republican healthcare bill dies on the vine.

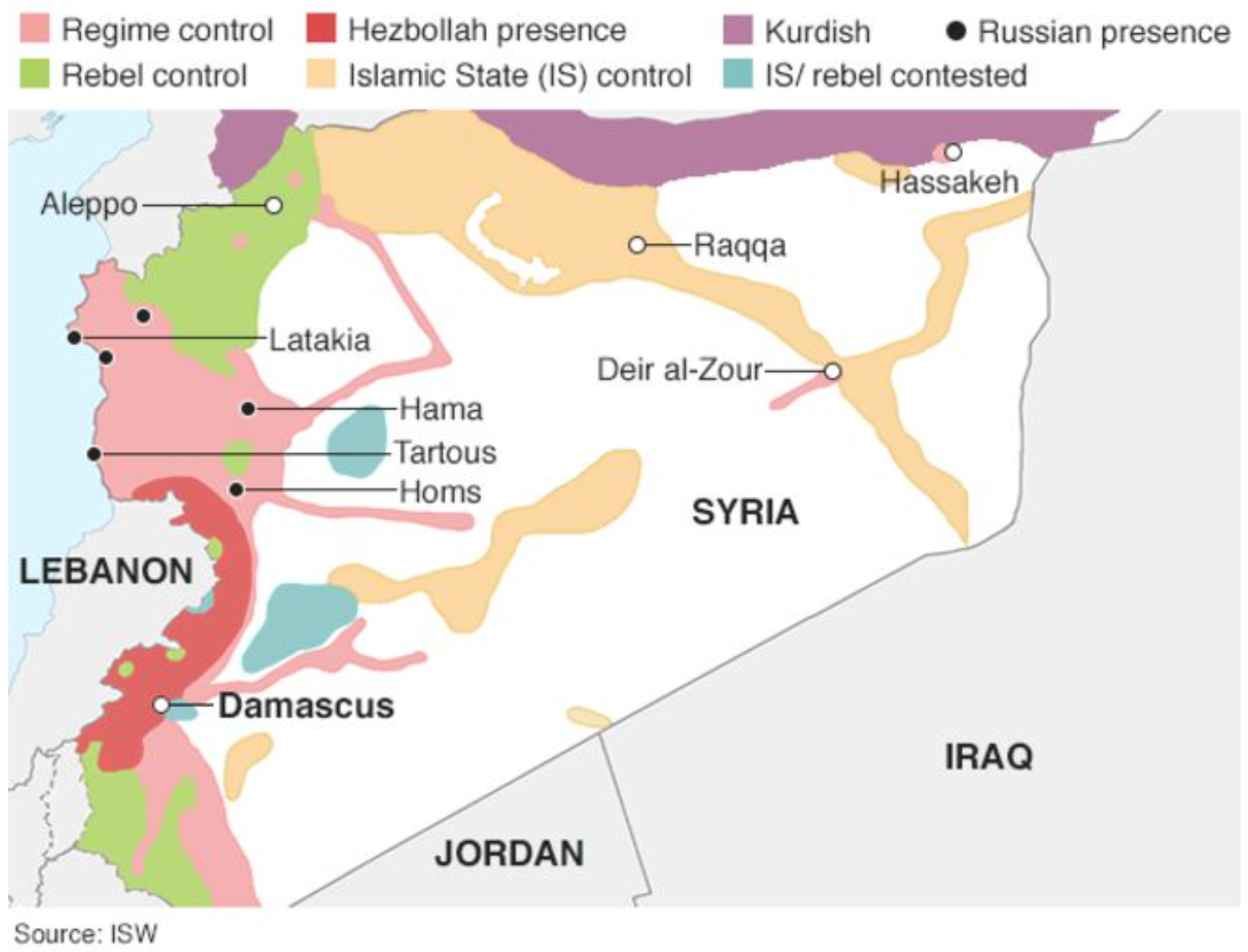

Was U.S. strike in Syria a “one-off” or change in policy? Impact on U.S. – Russia relations?

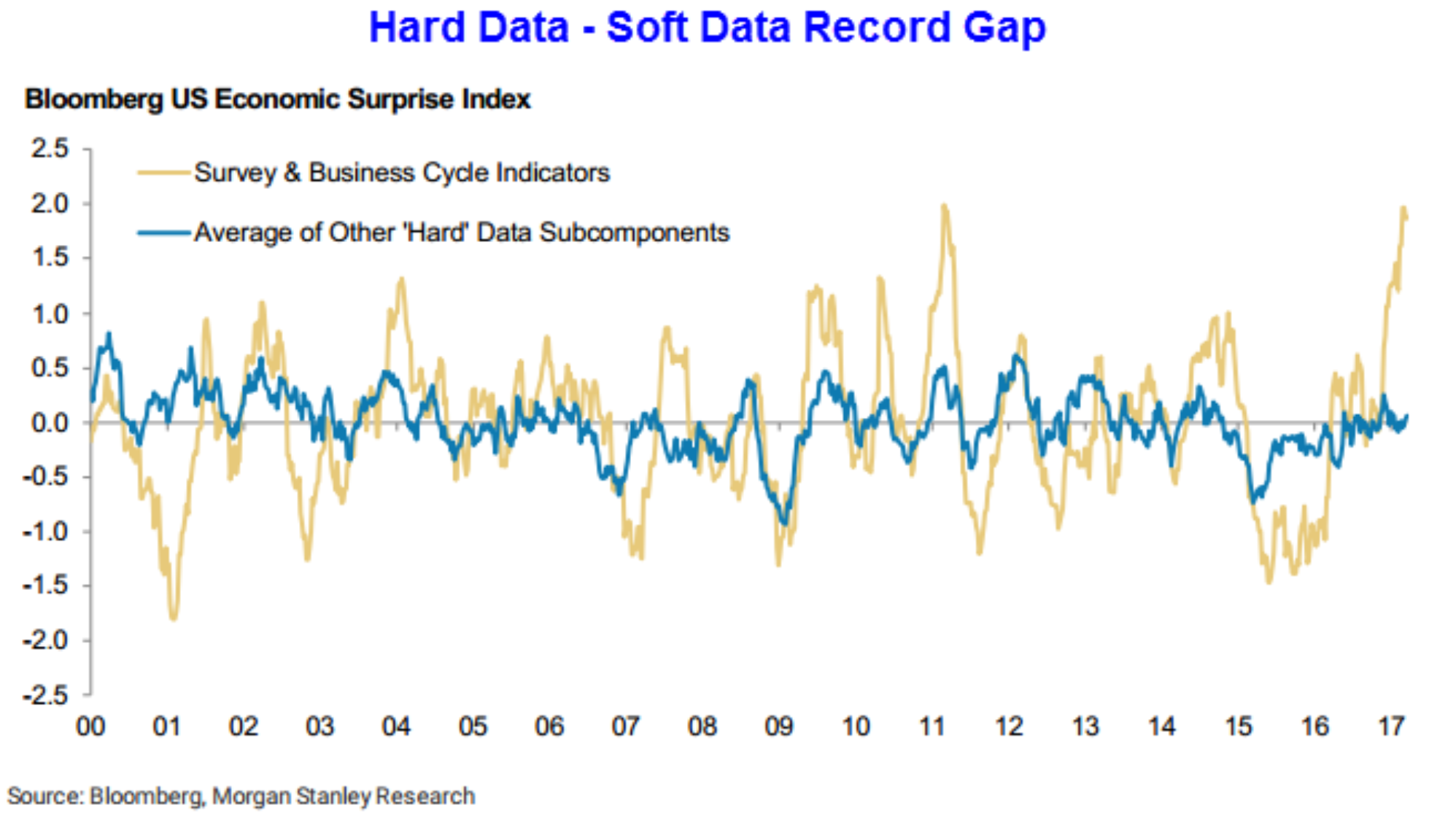

Large divergence between soft (consumer confidence) & hard (GDP, wage growth, etc.).

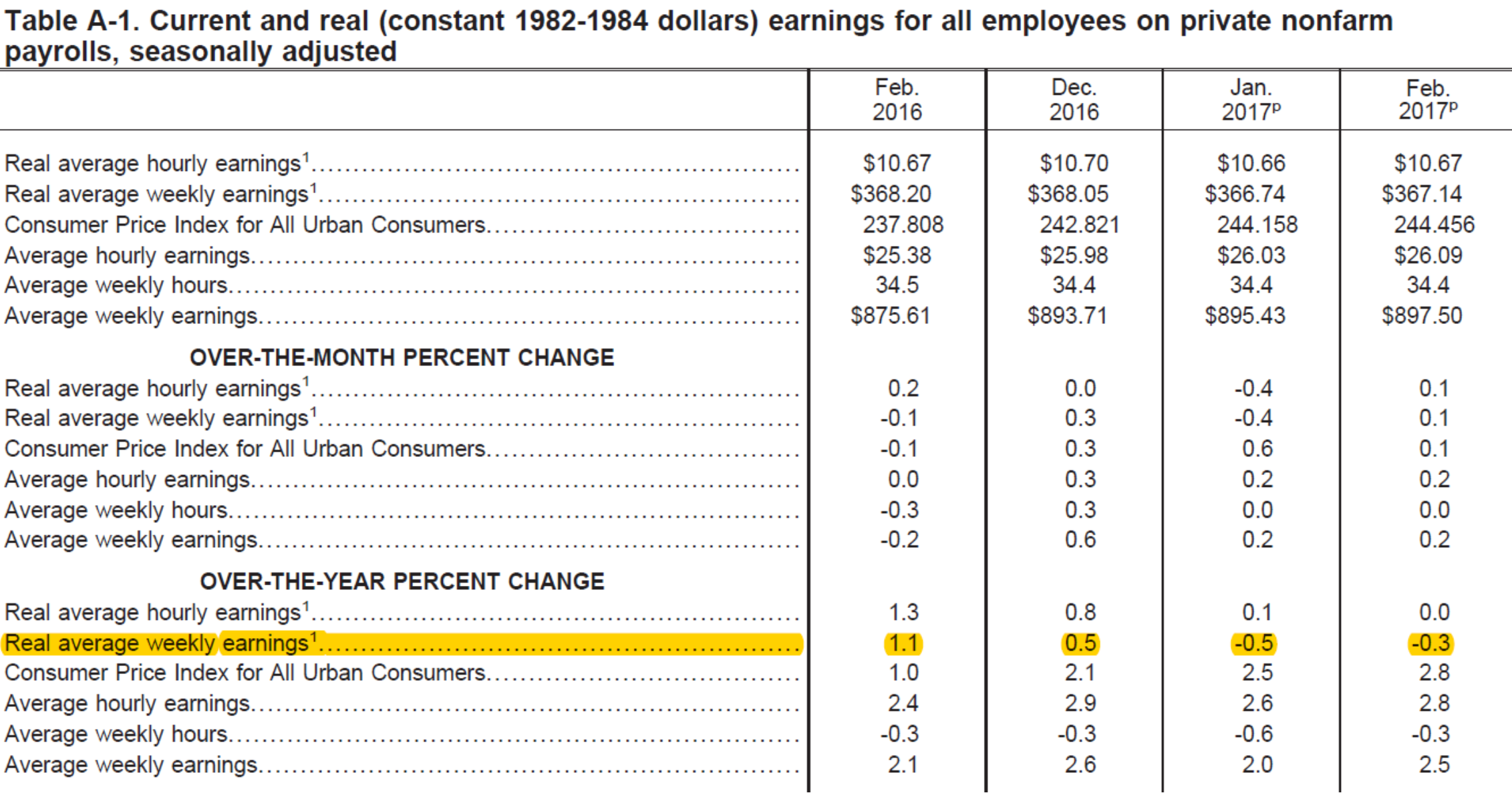

Negative year-over-year wage growth is hardly inflationary. Source: Bureau of Labor Statistics

Low interest rates and bond yields are the new normal. Get used to it.

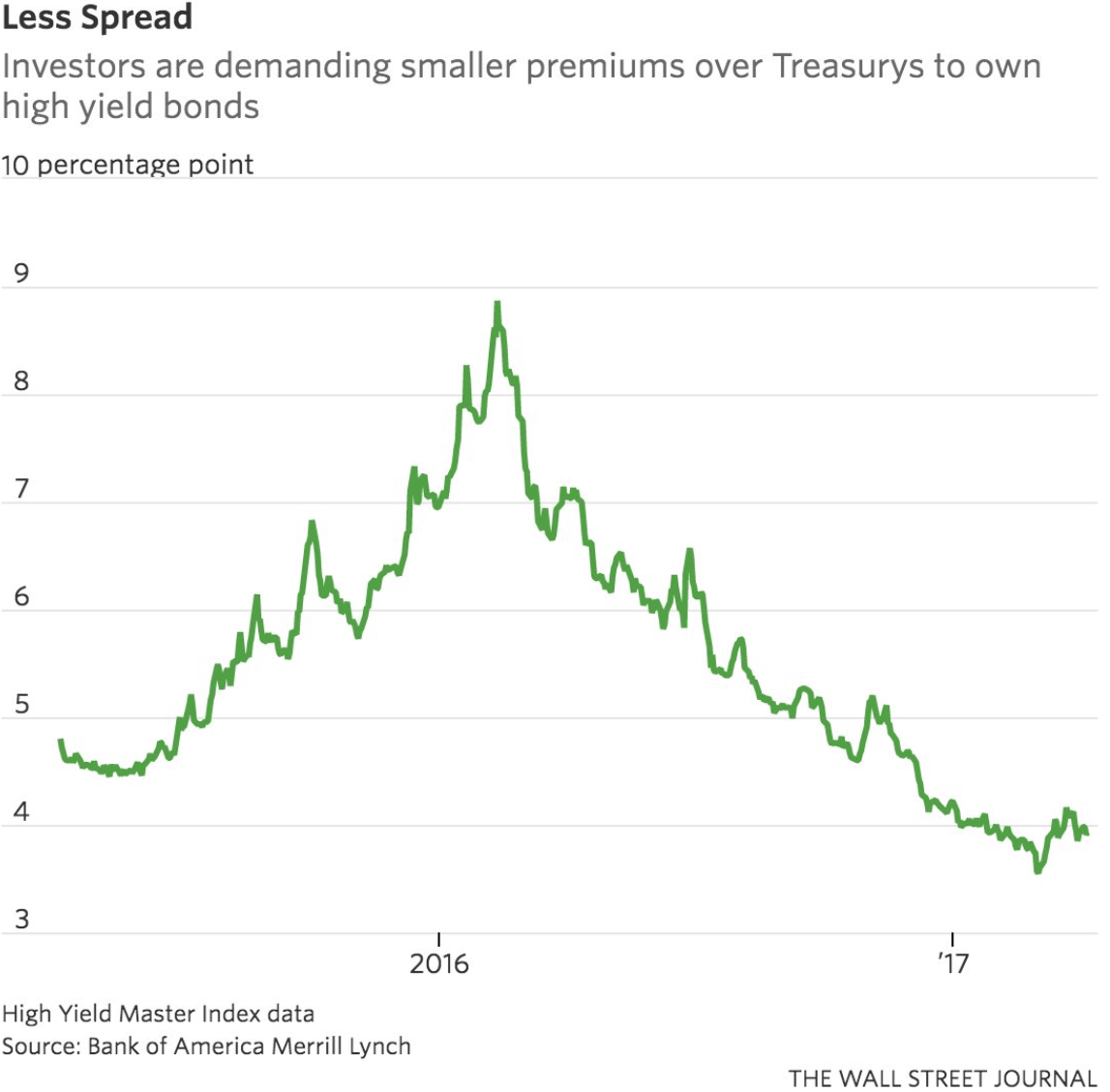

High yield bonds are not rewarding investors for credit risk. Buyer beware.

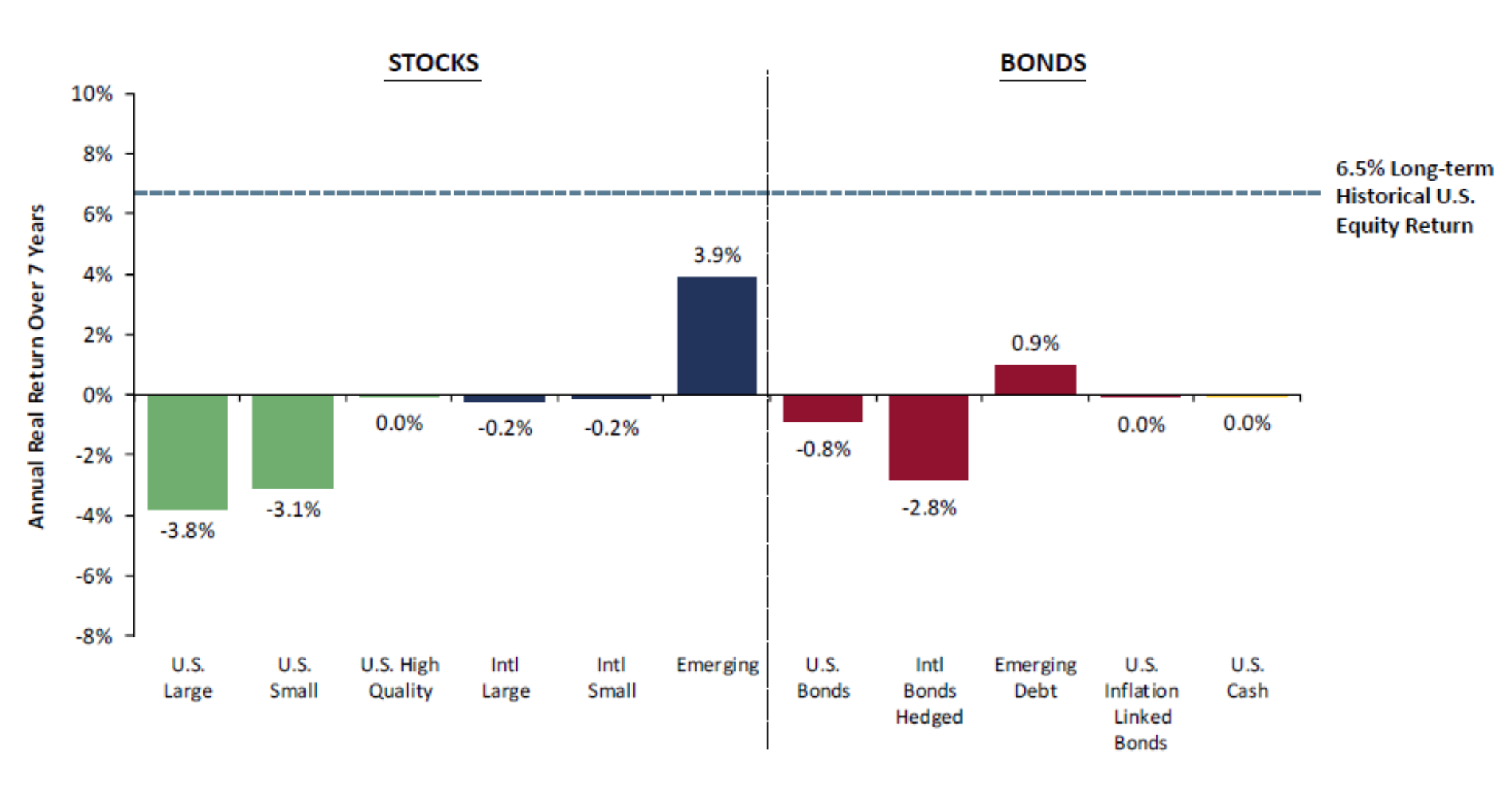

GMO projects U.S. equity returns will be challenged. Emerging markets the source of future returns?

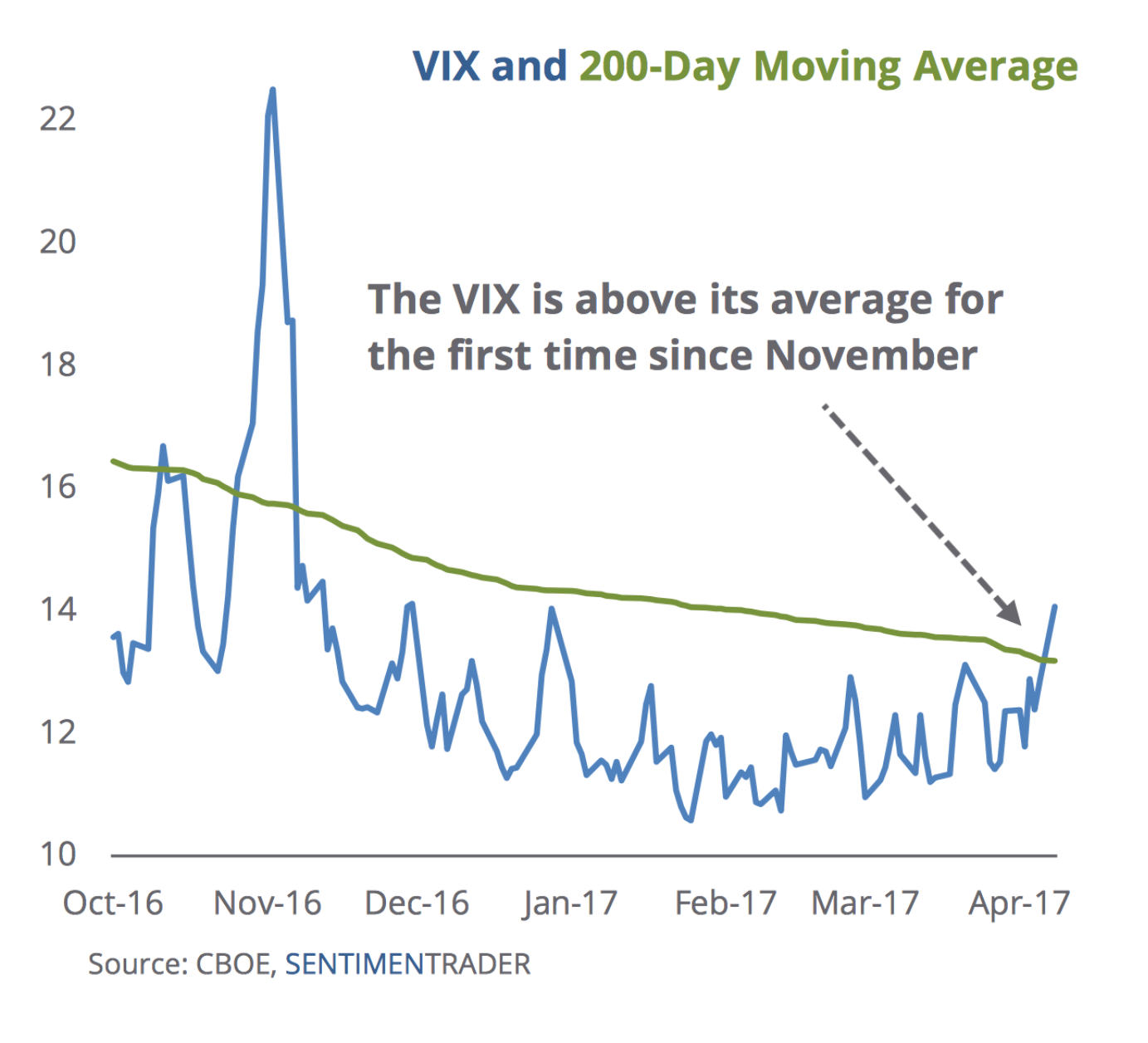

Volatility creeping higher.

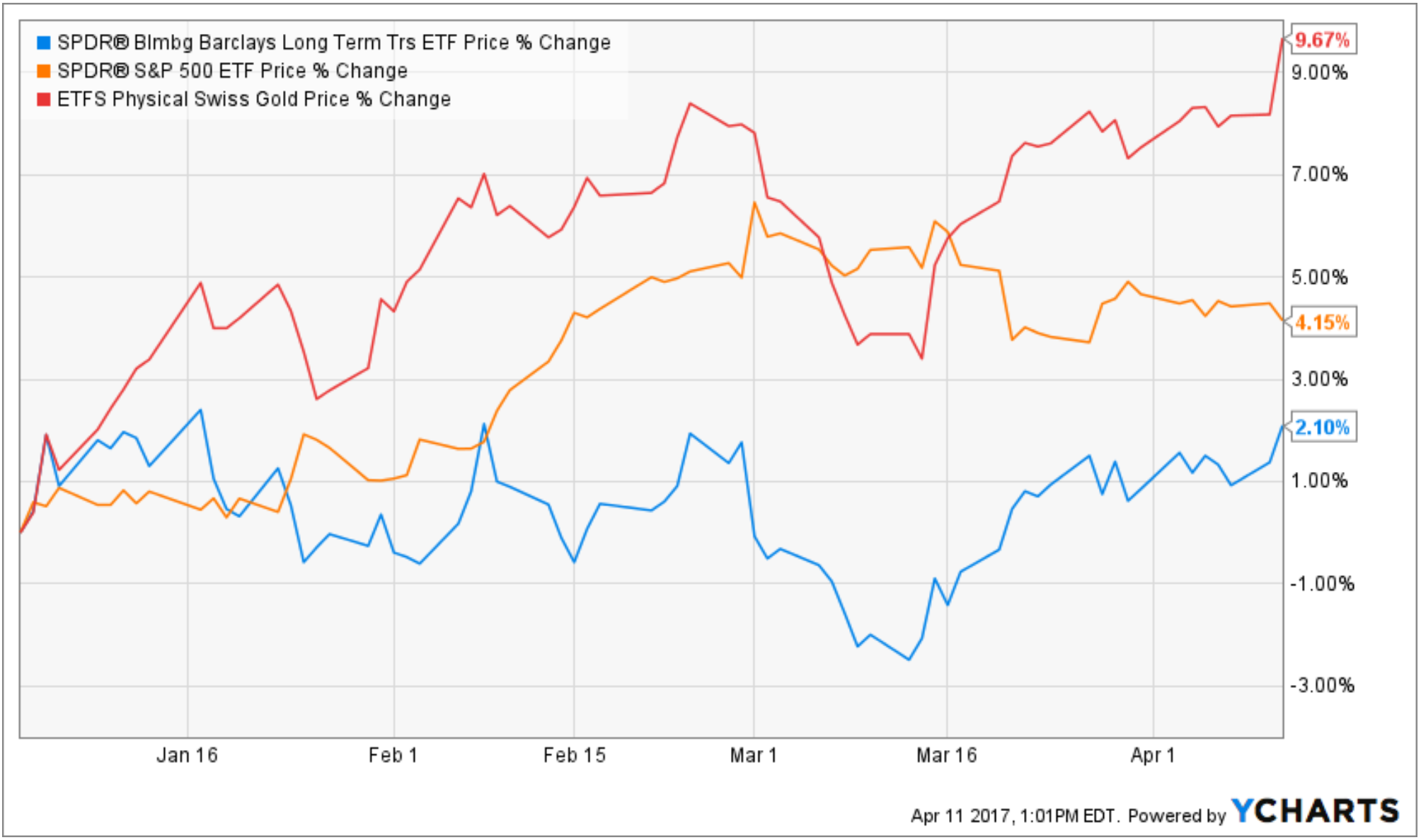

Our Gold and long U.S. Treasury position has reduced risk and added nicely to performance.

Europe met our criteria for tactical exposure i.e. beaten down, outsized yield, and accommodative central bank. We have been rewarded in 2017.

Tough to find value in this environment. Are commodities due for a comeback?

The data provided herein is for illustrative purposes only. Actual client portfolios and performance may vary. Past performance is not indicative of future results.