“The S&P 500 hasn’t seen a down quarter since Q3 2015. The S&P has also seen positive returns in 19 out of the past 20 quarters. If you’re freaking out about the first 3 months of this year being negative you don’t belong in the stock market.” – Ben Carlson, A Wealth of Common Sense Blog

At the beginning of the year, if we told you the S&P 500 would return -0.76% for the first three months of 2018 you wouldn’t blink. Without context, a less than 1% move in any asset doesn’t do much to our emotional state. We might imagine a boring, straight-line journey void of any large deviations in price.

What if we change the journey a bit and add a dash of financial media panic?

The above graph shows the S&P 500 total return (dividends included) during Q1 2018.

We might feel a bit ambushed coming off a magical 2017 that was pure investment bliss:

The story of the two graphs is confirmed by the standard deviation (risk) numbers. In 2017, we wrote about the unsustainable period of market calm that was set to explode. So far in 2018, the underlying movement of the S&P 500 has been ~4.5x of 2017.

2017 S&P 500 standard deviation: 3.89%

Q1 2018 S&P 500 standard deviation: 17.72%

If standard deviation isn’t your thing (we don’t blame you), the return of daily, violent price movements are back (see our post Naked Performance) .

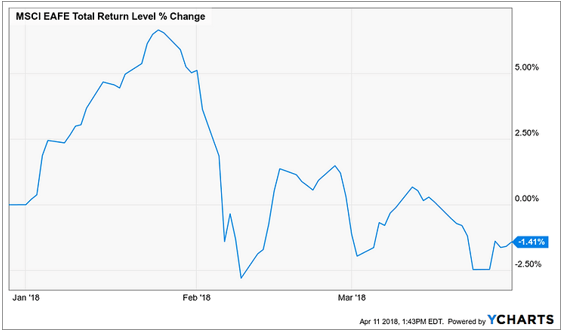

Foreign markets offered much of the same:

International stocks experienced a similar roller coaster in Q1 (MSCI EAFE Total Return Index).

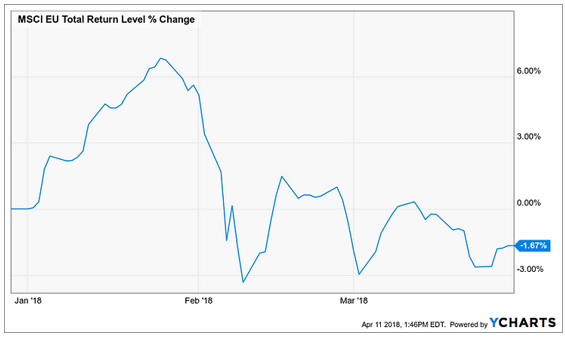

Look familiar? Europe followed a similar path in Q1 (MSCI EU Total Return Index).

Emerging markets had a large peak to trough move in February, but managed to clip a positive 1.47% return in Q1 (MSCI Emerging Markets Total Return Index).

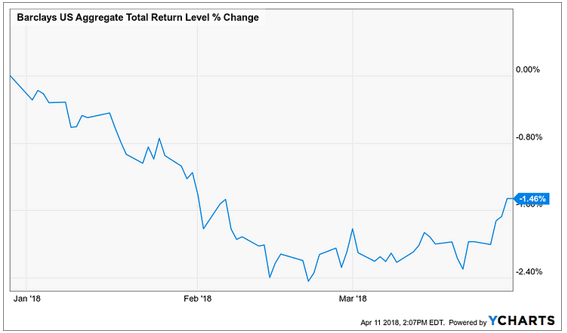

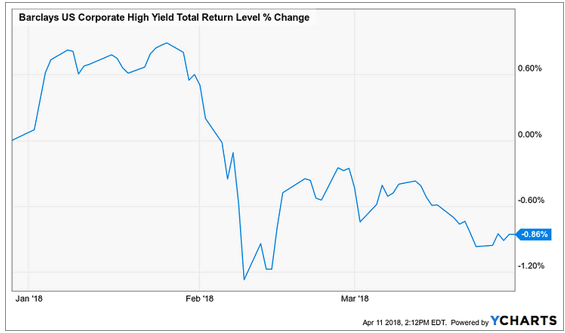

To throw fuel on the fire, fixed income assets provided little diversification benefits:

The U.S. bond market felt the pressure of increased interest rates and elevated inflation expectations in Q1 (Barclays US Agg Total Return Index).

Lower quality bonds fared a bit better due to out-sized yields and low default rates (Barclays US Corporate High Yield Total Return Index).

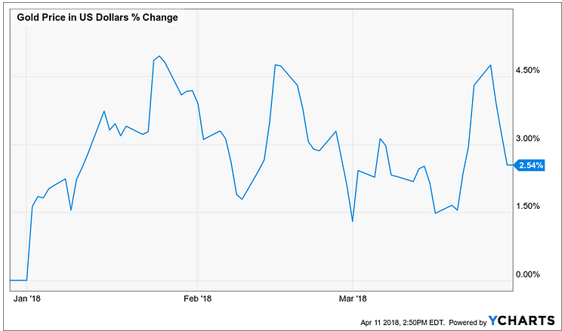

Gold offered a nice hedge against equity risk in Q1 appreciating 2.54%.

The lesson or take-away from all of this? The journey we take to reach our investment outcome matters. The -0.76% Q1 S&P 500 return (in a vacuum) is inconsequential. However, living through the daily swings can cause one to make emotional investment decisions. Investors need to understand not only their performance, but also the risk undertaken to arrive at their destination.

It’s human nature to attribute the current market volatility to something to help make sense of the world (the illusion of control bias). Global financial markets are deeply complex and seldom black and white. We have heard pundits blame political dysfunction, rising interest rates, tariffs, Facebook, etc., but sometimes markets just need a breather. After all, healthy financial markets go up and down.