“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”– Peter Lynch, famous investor.

Entering 2018, we felt it was entirely prudent to lean to a more conservative portfolio positioning. There remains a laundry list of potential landmines that could derail the nine-year bull market run. Throw in a daily avalanche of negative headlines i.e. Trump tariffs, political dysfunction, recession warnings, etc., things certainly feel worse than they actually are. Looking at market returns through Q2 and 2018 year-to-date, there was one overriding theme that didsurprise us, risk-taking was still very much rewarded, especially in U.S. assets.

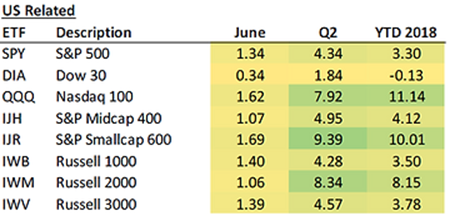

The “exhausted” U.S. equity markets continued their ascension higher, led by technology stocks (QQQ) and small company stocks (IJR):

Source: Bespoke Investment Group

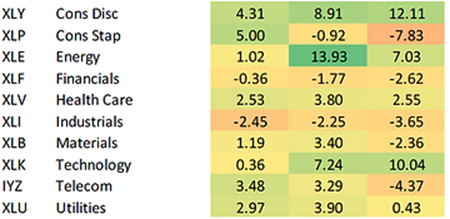

Looking at U.S. sector performance; energy, technology, & consumer discretionary were deep in the green:

Source: Bespoke Investment Group

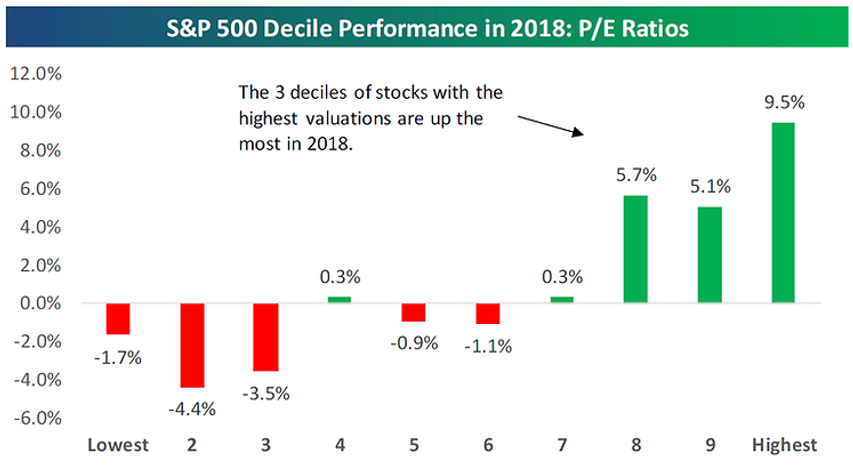

Sticking to the U.S., the most expensive stocks (green bars) outperformed, while the cheapest continued to lag (red bars):

Source: Bespoke Investment Group

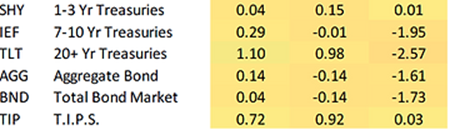

On the perceived safety and soundness of U.S. fixed income, exercising caution was not in favor:

Source: Bespoke Investment Group

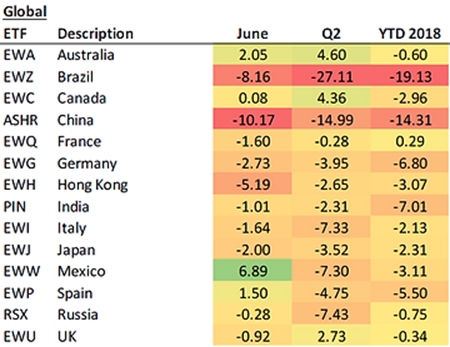

Foreign markets have had a rough go thus far in 2018:

Source: Bespoke Investment Group

Furthermore, U.S. companies that paid zero dividends outperformed those paying the highest dividends. While the most hated stocks (measured by highest short interest) outperformed stocks investors like or wouldn’t bet against going down (companies with the lowest short interest).

This all adds up to risky, expensive, growth, momentum, and perceived low quality outperforming for the quarter and first half of the year. In other words, what’s expensive can get run higher, performance chasing can sometimes work, and lower quality assets can outperform safety and soundness for stretches of time.

*Pure Portfolios’ clients will receive our full Q2 quarterly commentary uploaded to their portal next week*