“No matter how sophisticated our choices, how good we are at dominating the odds, randomness will have the last word.” – Nassim Nicholas Taleb, Fooled by Randomness: The Hidden Role of Chance in Life and in the Market.

That didn’t take long. Fresh off 2020 forecasting season, global markets have made a mockery of those predicting what happens next.

“The markets will be up in the first half of 2020 and turn down in the last 90 days of 2020, because there will be a lot more uncertainty for 2021.” (this was an actual quote appearing in Barron’s from a portfolio manager managing $40 billion, YIKES! Hat tip to Meb Faber for finding the quote).

Barely a month in to 2020, we’ve been hit with pure market randomness. Forecast officially derailed…

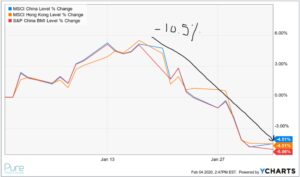

The above chart shows various Chinese stock indexes crashing ~10.5% from mid-January to early February due to the coronavirus (as of 2/4/20).

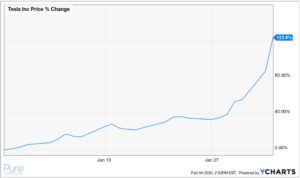

Randomness goes the other way too. Perhaps the most polarizing company in recent memory went parabolic.

The above chart shows Tesla stock +123.8% year-to-date (as of 2/4/20). What used to be one of the most shorted stocks in the U.S., (investors betting the stock goes down), went through the roof.

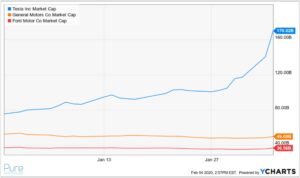

To put Tesla’s meteoric rise into perspective, the EV carmaker’s market cap is 2x the combined value of Ford (red) and General Motors (orange).

We also had the U.S. – Iran flare-up which looked like it could turn to all-out war. Thankfully, after a few tense moments, cooler heads prevailed and the market impact was minimal.

The coronavirus, Tesla’s rise, geopolitical tension, and impeachment proceedings all happened in a condensed period of time. All were highly unpredictable. History is riddled with other random events that no one saw coming, but had a profound impact on financial markets.

Humans thirst to feel like we’re in control, which causes us to ask ridiculous questions like “what does your crystal ball say about the market?” In our opinion, it’s a red flag to pretend to even have a crystal ball. Go ahead, ask your advisor what they think the market will do in 2020. The more specific the answer, the faster you should run out the door.

If you want to be constructive, an introspective assessment would be more useful (instead of focusing on random events you have no control over):

- What holdings in my portfolio would mitigate the downside?

- What are my most risky positions?

- Would my financial plan still be favorable if we get a market correction or a prolonged period of lower future returns?

- Do I have a risk management plan in place to avoid making destructive emotional decisions?

- Does my current plan have any blind spots?

- How can I minimize damage when the cycle turns?

If 2017 & 2019 were case studies on why politics and investing do not mix, 2020 should be a poster child for why forecasting is a fool’s errand. In an environment as deep and complex as global financial markets, forecasting is worse than useless, it’s dangerous.

Why? Because random $%&* happens.