If you’re nearing retirement or already enjoying it, you’ve likely heard about Required Minimum Distributions (RMDs). But for many, the mention of RMDs brings a mix of confusion and anxiety. When do you need to start taking them? How much do you need to withdraw? What happens if you make a mistake? The good news is that with a bit of planning and smart strategies for managing Required Minimum Distributions (RMDs), you can navigate RMDs without stress—and even use them to your advantage.

What Are RMDs?

RMDs are mandated withdrawals from certain retirement accounts. The IRS requires distributions to commence by a specific age, spreading distributions of the account balance over the owner’s life expectancy. This process ensures that retirement funds are used during one’s lifetime and not merely passed on as an inheritance.

Starting Age for RMDs: As of recent regulations, individuals must begin taking RMDs by April 1 of the year following the year they reach age 73. This change reflects updates in tax laws, so it’s crucial to stay informed about current requirements.

RMD Starting Age by Birth Year:

| Birth Year | RMD Starting Age |

| Before 1950 | 70 ½ |

| 1950 – 1958 | 73 |

| 1959 | 73 |

| 1960 or later | 75 |

Accounts Subject to RMDs:

- Traditional IRAs, SEP IRAs, SIMPLE IRAs, and employer-sponsored retirement plans like 401(k)s are subject to RMDs. Notably, Roth IRAs do not require RMDs during the original owner’s lifetime.

Calculation of RMDs:

- The RMD amount is calculated by dividing the retirement account’s prior year-end fair market value by a life expectancy factor determined by the IRS. This ensures distributions are spread appropriately over one’s remaining years.

Example RMD Calculation: If your traditional IRA balance was $500,000 at the end of the previous year, and your IRS life expectancy factor at age 73 is 26.5, your RMD would be calculated as follows:

$500,000 ÷ 26.5 = $18,867.92

Penalties for Missing RMDs: If you fail to withdraw the RMD, the amount not withdrawn is taxed at 50%. This steep penalty underscores the importance of adhering to RMD rules.

Smart Strategies to Manage RMDs:

- Consolidate Accounts: Managing multiple retirement accounts can complicate RMD calculations. Consolidating accounts may simplify the process and reduce administrative burdens.

- Consider Qualified Charitable Distributions (QCDs): Individuals aged 70½ or older can transfer up to $100,000 annually directly to a qualified charity, satisfying the RMD requirement without increasing taxable income.

- Stay Informed: Tax laws and RMD regulations can change. Regularly consult with your financial advisor or tax professional to ensure you’re up-to-date and compliant with current rules.

Maximizing Your “Income Valley” with Roth Conversions

One of the most strategic opportunities for retirees occurs during the “income valley”—the period after retirement but before reaching RMD age. During this phase, retirees often experience lower taxable income, presenting a unique window to manage withdrawals and reduce future RMD obligations through Roth conversions.

By converting traditional IRA funds to a Roth IRA during the income valley, retirees can:

- Reduce future RMDs by lowering the balance of traditional accounts.

- Lock in potentially lower tax rates during low-income years.

- Provide future tax-free growth and withdrawals from the Roth IRA.

- Enhance estate planning, as Roth IRAs do not have RMDs for the original owner.

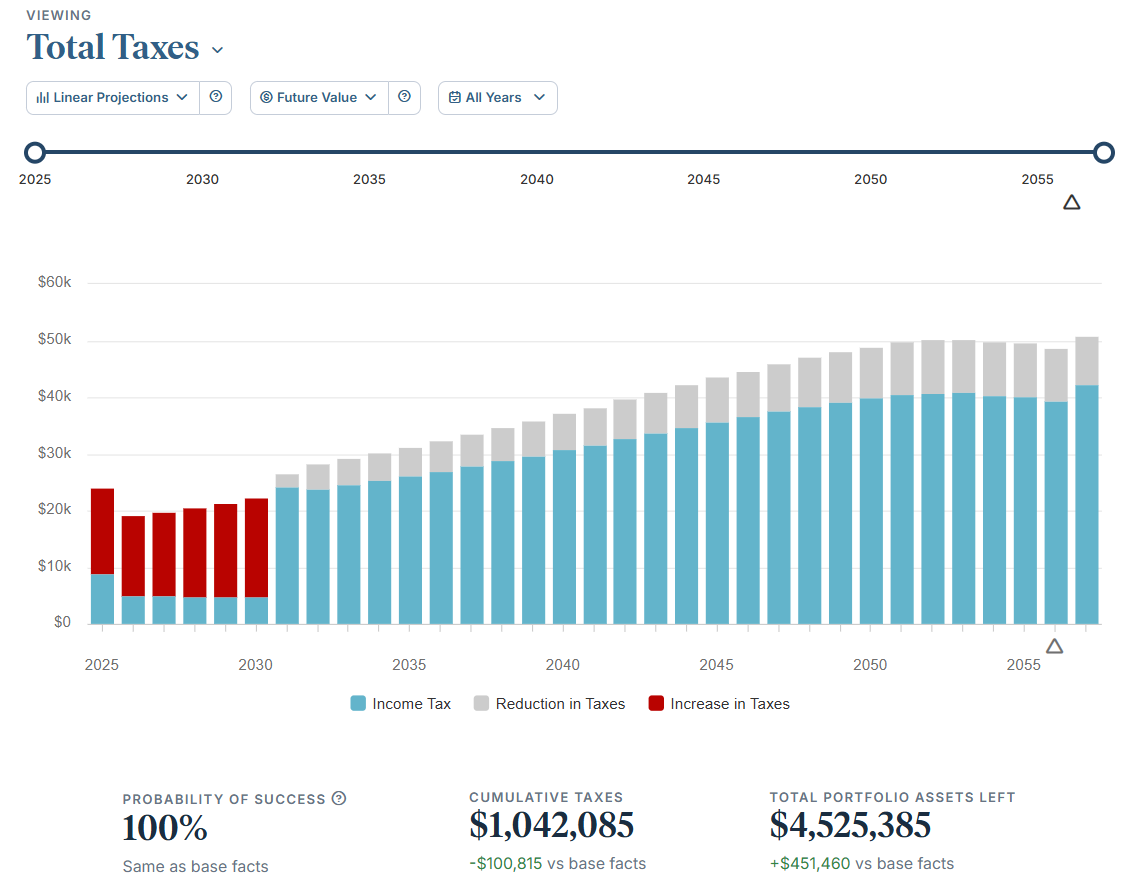

The graph above illustrates the potential tax impact of executing Roth conversions during the “income valley.” While taxes temporarily increase during the conversion years due to higher reported income, future tax liabilities are significantly reduced as a result of lower Required Minimum Distributions (RMDs). In this scenario, the client not only saves over $100,000 in taxes throughout their lifetime but also boosts their total asset base by more than $450,000—demonstrating the long-term benefits of strategic tax planning.

Understanding the Tax Implications of RMDs

RMDs are considered taxable income, which can impact your overall tax situation. When planning for RMDs, keep in mind:

- Income Tax Bracket: RMDs add to your taxable income, potentially pushing you into a higher tax bracket.

- Impact on Social Security: Increased income from RMDs can affect how much of your Social Security benefits are taxable.

- Medicare Premiums: Higher income may also lead to increased Medicare Part B and Part D premiums.

- Strategies to Reduce Tax Impact: Consider spreading withdrawals over multiple years or coordinating with Roth conversions to manage tax liability.

At Pure Portfolios, we believe in empowering our clients with transparent, evidence-based financial guidance. Our approach focuses on removing human bias and ‘gut feelings’, ensuring decisions are based on data and aligned with your financial goals. By understanding and planning for RMDs, you can navigate retirement with confidence and peace of mind.