“Life is really simple, but we insist on making it complicated.” – Confucius, Chinese philosopher

My morning inbox routine, delete, delete, delete…

“Boom in Securities-Based Lending Lifts Wire Houses”

Ok, you’ve got my attention. From the article…

“The results are also showing up in loan balances at bank-owned wirehouse firms, which have been pushing securities-based lending as a way to cross-sell wealthy retail customers and generate non-compensable revenue that isn’t shared with their advisors.”

Cliff notes: big banks and large Wall Street brokers are pushing clients to borrow against their portfolios because it generates juicy margin loan interest revenue.

We’ve covered the pros and cons of borrowing against an investment portfolio in a previous post. We are going to take this a step further, as borrowing against an investment portfolio (especially in retirement) could be a precursor to a bigger problem…

Making retirement more complicated than it needs to be.

In the spirit of simple beats complex, these are ways people make retirement more stressful, confusing, and chaotic.

Note: we aren’t saying that any of these are catastrophic in isolation, but jumble a few together and you have the potential for a mess.

Loaning Money to Friends and Family

It’s noble to help out those who need it. However, it’s not a good idea to put your own retirement plan in jeopardy. If your plan is marginally favorable, take care of yourself first.

Maintaining Two Homes

Double mortgages (potentially). Double property taxes. Double maintenance. It’s common for new retirees to purchase a second home, only to unload the property a few years later. In the era of Airbnb & VRBO, it can be practical to rent the second home experience without the headaches of ownership.

Accounts Scattered Everywhere

Old 401ks, 6 IRAs with three different financial institutions. Multiple required minimum distribution calculations. You get the picture. For convenience, consider rolling over old 401k(s) into IRAs. Consolidate your IRAs into one (or maybe two if you want to work with another advisor or manage an account yourself). Your CPA will thank you for it.

Leveraging Up

This doesn’t mean a retiree has to be debt free when they retire. It might make sense to carry a mortgage given the low rate environment. But in most cases, retirees should be focused on eliminating debt, not taking it on. Debt amplifies the range of outcomes, both good and bad.

Downshift from Wealth-Building Mode

The attributes that got you to retirement i.e. risk-taking, the pursuit of more, and calculated speculation, are a potential liability during retirement. It turns out that building wealth and keeping wealth require two entirely different mindsets. We call it finding your enough.

Not Letting Go of Investment Portfolio

Most people hire an advisor to focus on the things they enjoy in life. Others recognize they have emotional ties to their money and need an objective third-party to manage the funds. Whatever your reason for working with an investment professional, find a good one and let them do their job. If you find yourself meddling with your long-term portfolio, open up a fun account and scratch that degenerate itch.

Complicating your Taxes

Most of the above list will make your taxes a nightmare. Do you really want to be filing extensions while you wait for the K-1 of the oil & gas partnership you invested in?

Find a good CPA and do your part to simplify the process.

Not Having your Estate Plan Dialed In

What would happen if you lost your cognitive ability to function tomorrow? Would your spouse or kids know where the assets are? Do you own cryptocurrency? Do the assets flow to your ex-spouse?

Weird stuff happens. Make sure your assets flow the way you want them to upon your death.

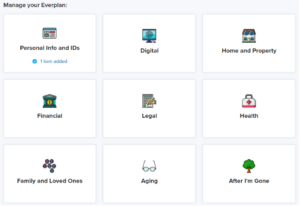

Pure clients have access to Everplans to organize their financial affairs…

Source: Everplans client portal

You’ve done a great job of building wealth. Now it’s time to enjoy the fruits of your hard work. When it comes to retirement (and most things), there’s beauty in simplicity.