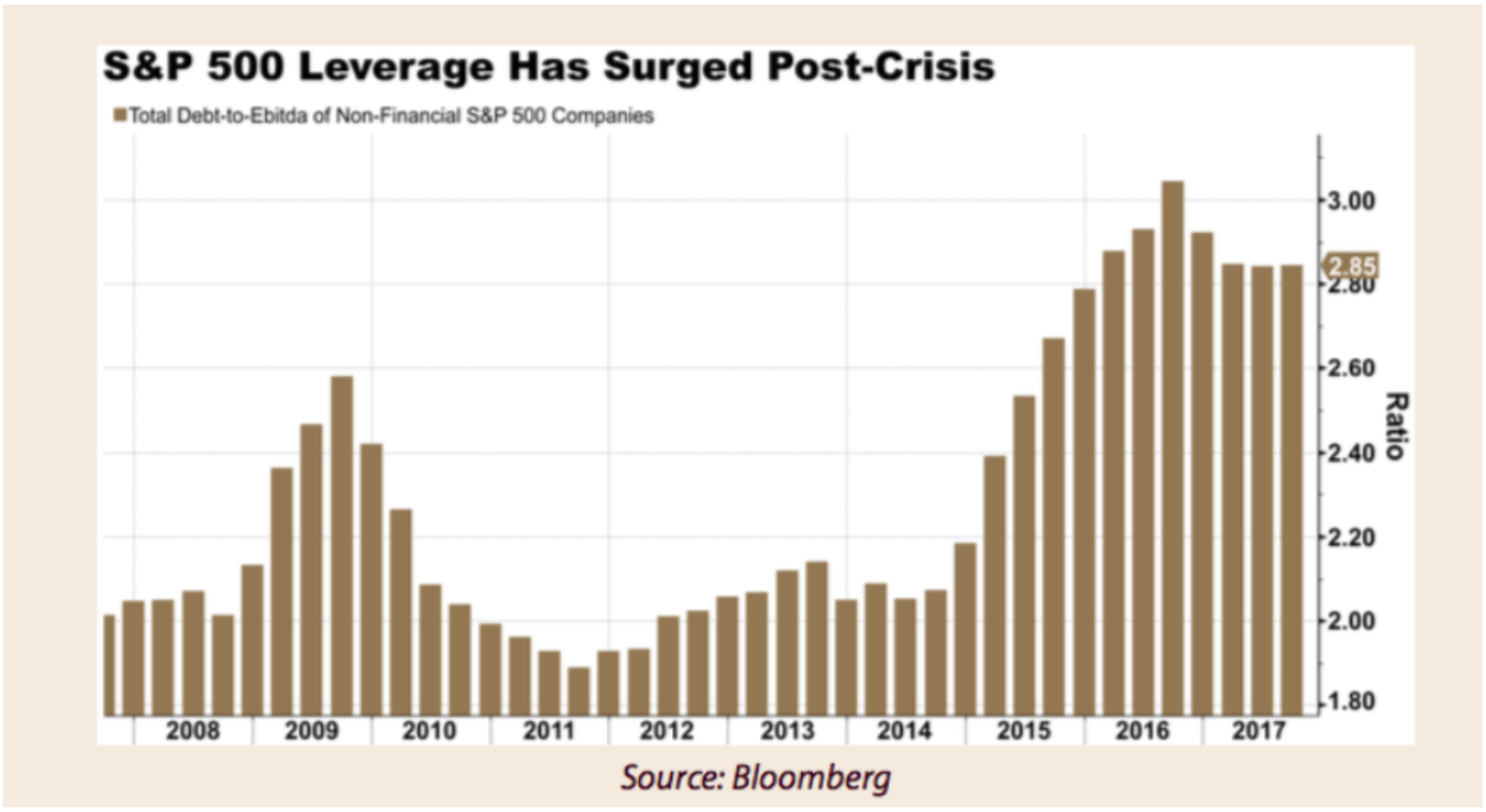

With corporate leverage continuing to surge—on record pace again in 2017—the threat of the “zombie” bubble popping appears increasingly real.– 13d Research

The absolute level of corporate debt, specifically among lower quality companies, is an understated risk. The International Monetary Fund’s annual Global Financial Stability Report included a stark warning about the health of the U.S. economy: 22% of U.S. corporations are at risk of default if interest rates rise (Source: 13d Research). In an era of low interest rates, are investors blindly reaching for income without appreciating the underlying ticking time bomb of lower quality debt?

High Yield Bond – A high paying bond with a lower credit rating than investment-grade corporate bonds, U.S. Treasury bonds, and municipal bonds. Because of the higher risk of default, these bonds pay a higher yield than investment-grade bonds (Source: Investopedia).

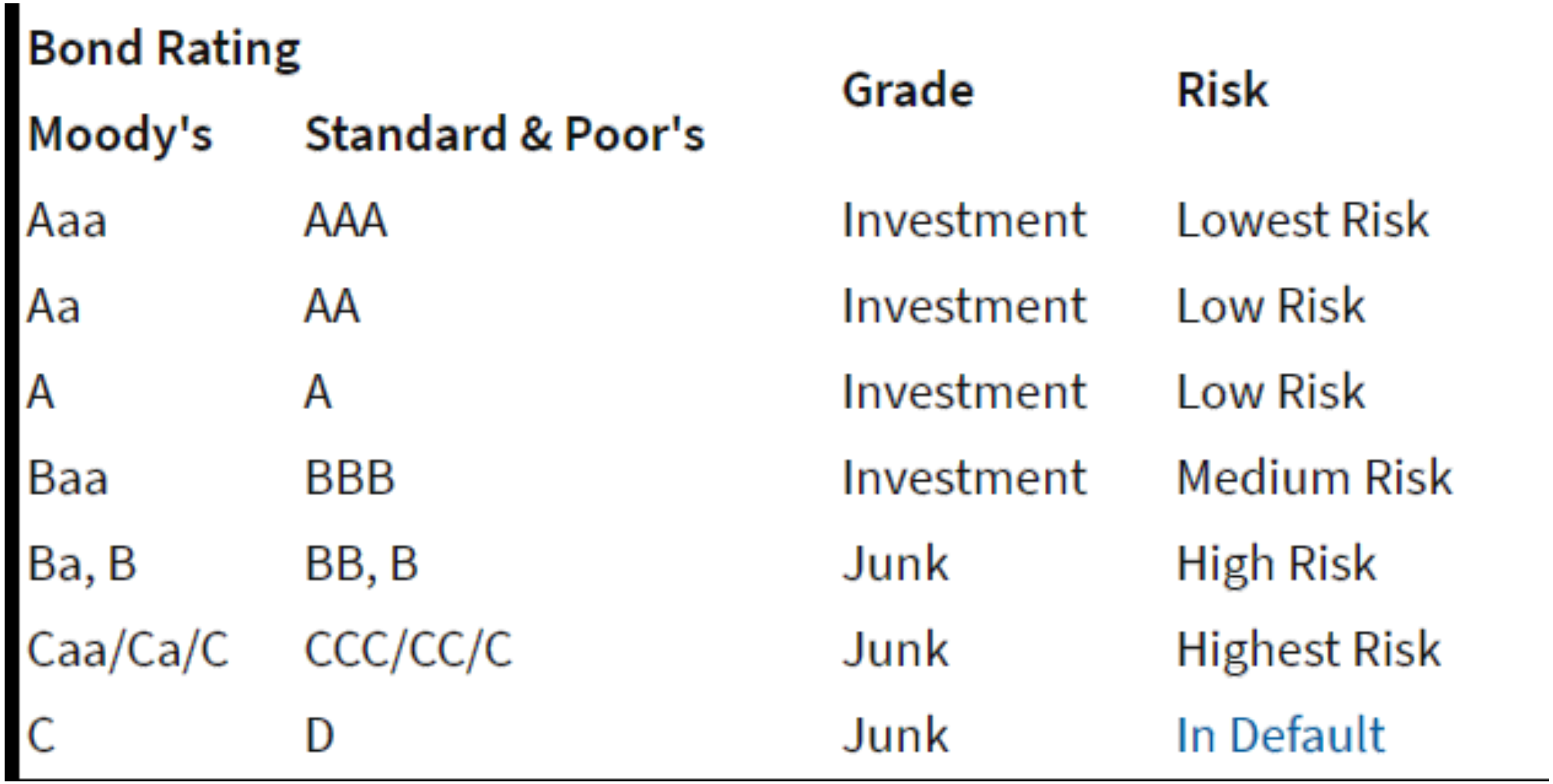

Both Moody’s and S&P define a bond as high yield or junk with a rating below BBB. Source: Investopedia

The myth of deleveraging post-crisis. Many companies have issued debt to take advantage of historically low interest rates.

Current high yield bond valuations are elevated by historical standards (blue bar on the left). This means investors are receiving less interest for holding lower quality companies. Perhaps the Fed isn’t talking about equity markets when they refer to elevated valuations? Are investors taking excessive risk within the corporate bond markets?

When does too much debt become a problem? As allocators of capital, these are the questions we ask ourselves:

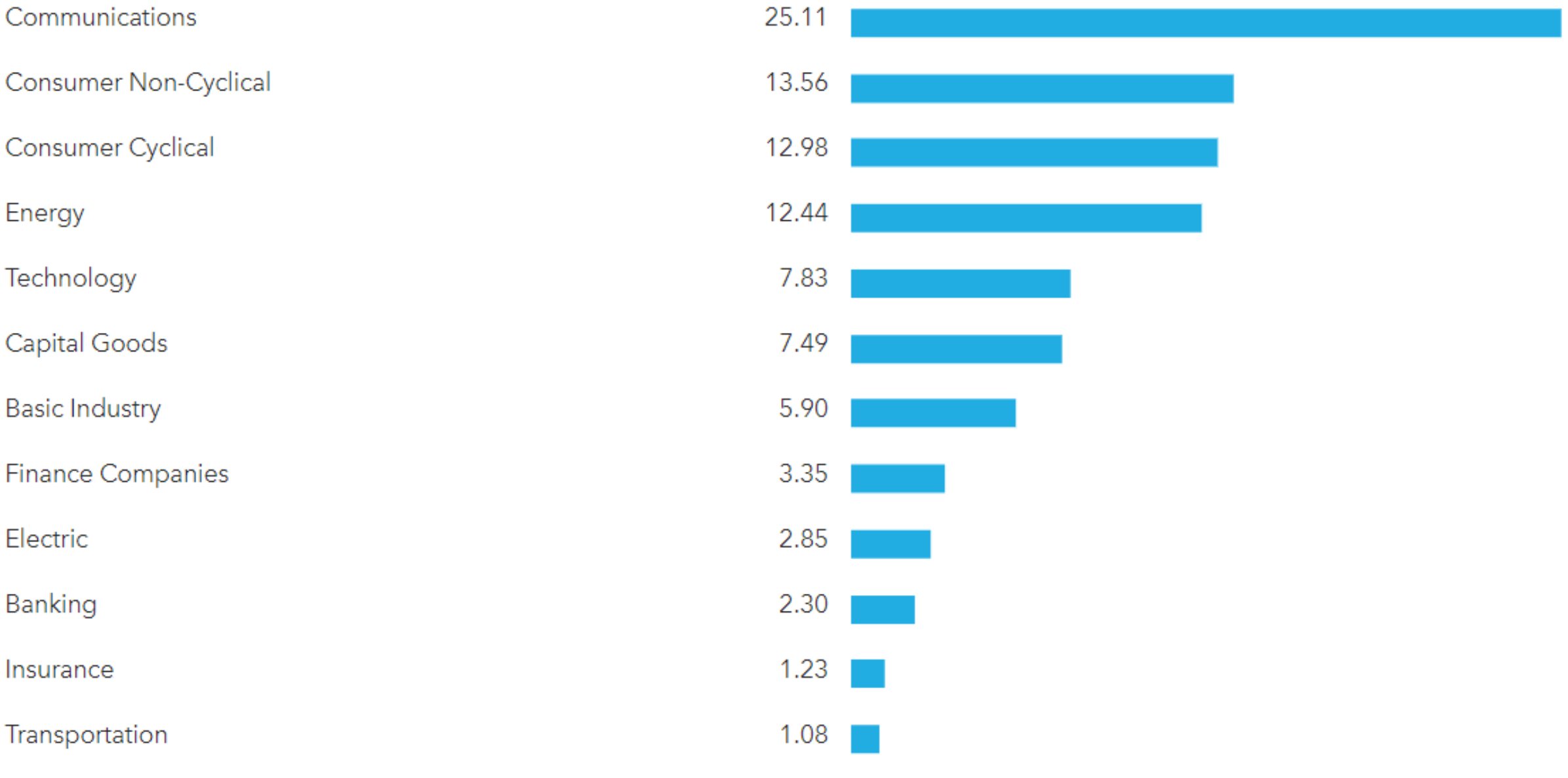

What effect does structurally lower oil prices have on lower quality energy companies? The energy sector makes up ~13% of the U.S. high yield benchmark.

What are the consequences of the retail apocalypse that has seen 5,300 stores shut their doors (as of 6/20/17), and companies wobble on the brink of insolvency?

Source: Visualcapitalist.com

What happens to marginal companies when their cost of capital goes up after years of taking on additional debt? From 2010-2016, the average US speculative default rate was 2.84%, well below the historical average of 4.22%. Long periods of debt issuance and investor complacency could be a recipe for pain.

At this stage in the cycle, we prefer quality over speculative high yield corporate bonds. We removed U.S. high yields bonds from portfolios in early 2017. We felt strongly that our clients were not being compensated (in the form of income) for the underlying risk. In our opinion, global short-term high yield is more attractive due to under-appreciated currencies and supportive monetary policy.

Know what you own and the drivers that influence the balance between risk and return.