“Bad bets sometimes pay off.” – Marty Rubin, Canadian Author

There’s been a stir in financial media about Robinhood traders bidding up bankrupt companies to turn a quick buck. Here’s a snippet from the Wall Street Journal making the rounds on Twitter:

“A 23-year-old salesman in San Francisco bought 35,000 Hertz shares on June 4 at $1.43, spending a little over $50,000. ‘It was my entire life savings,’ he said. ‘I decided, you know, if I’m gonna do it, I should do it big, and I’ll make a play and see what comes out of it.'”

Our young speculator is one of many examples of inexperienced traders (gamblers) that are whipsawing the share prices of companies that have declared for bankruptcy.

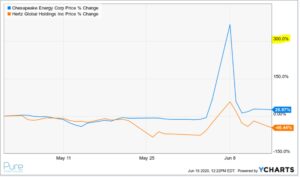

Source: Ycharts

The above chart shows the wild swings of Hertz and Chesapeake Energy, two companies that have declared for bankruptcy, since 5/1/2020. Notice the >300% move in Chesapeake Energy at the beginning of June. Crazy!

Source: Ycharts

The one year chart of Hertz and Chesapeake tells a more realistic story of the inevitable fate of the two companies. Bankruptcies typically wipe out equity holders completely.

The bonds of the underlying company are a good predictor to what comes next for equity holders.

The below note is from our friends at Verdad Capital regarding Chesapeake Energy:

The first-lien debt trades at 55 cents on the dollar, with the second-lien and unsecured bonds trading at between 2 and 8 cents on the dollar. But on June 8th, retail traders drove the price of the stock from $15 to $73 before it crashed back down to $24 on news coverage of the potential bankruptcy.

In general, betting your life savings on a bankrupt company isn’t a good idea, unless you enjoy lighting money on fire. However, can making degenerative bets with a very small slice of your investable assets be a good thing? Maybe so, especially if it saves you from making larger mistakes with your core investment portfolio.

Let’s face it. We bask in the glory of being right. We like instant payoffs. We anchor to weird beliefs and superstitions. We like to say “I told you so” to our friends. A stroll through any casino showcases a content trove of irrational human behavior.

That degenerate urge needs an outlet. We all need to get it out of our system, just do it with an infinitesimal percentage of your investable assets. Let your behavioral biases come out, market time every market ebb and flow on your smartphone, share your speculative bets with your friends. In other words, give your inner degenerate a moment in the sun.

In a recent post, we cautioned on the perils of having extreme opinions. What better way to capitalize on an extreme opinion than betting on it? Day trade, speculate, dabble in options, etc. People will be more likely to take your proclamations serious if you have the conviction to put money behind it. If you want to get serious about daily speculation, track your results, and jot down your rationale for each trade. Review your notes to hold yourself accountable.

You’re probably thinking, isn’t it irresponsible of a fiduciary investment professional to tell me to scratch my degenerate itch by speculating in financial markets? Not if it keeps you from tinkering with your core investment portfolio. Think of any speculative losses as tuition, insurance, or the cost of doing business as you leave your long-term assets alone.

Dice graphic was downloaded from depositphotos.com. The above post is not investment advice.