“I’d rather be partly great than entirely useless.” – Neal Shusterman, American author & writer.

Let’s face it, it’s fun to buy individual stocks. Maybe you like the company’s product. Or, your second cousin works as an executive. Perhaps your broker says the company is the next big thing. Potentially hitting a 10-bagger (10x return on investment) is alluring. There’s an unspoken intimacy with owning a company that you don’t get with a faceless ETF or mutual fund.

There’s one problem: S&P 500 companies are going away at a never seen before pace.

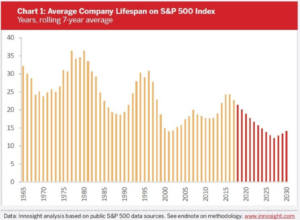

According to a McKinsey study, the average life-span of companies listed in Standard & Poor’s 500 was 61 years in 1958. Today, it’s about 16 years. McKinsey believes that by 2027, 75% of the companies currently in the S&P 500 index will have disappeared.

Source: Innosight.com

The above graph shows the average lifespan for an S&P 500 company since 1965. The staying power for large companies is getting smaller, as disruptive innovation, technology, and changing investor preferences shrink the average company’s runway. Note: the red bars indicate future estimates for a company’s lifespan.

Why are large companies going away?

You have the usual culprits: record private equity money chasing the next big thing, a robust merger and acquisition (M&A) market, and the growth of startups with billion-dollar valuations that are looking to disrupt virtually every business from retail to renewable energy.

You also have good ole fashioned bankruptcy. A good example is the seismic shift in brick and mortar retail, which was especially hit hard by creative destruction, think the shift from storefronts to online shopping.

I would expect the average shelf-life to condense even further. Technology is the biggest sector in the S&P. Today’s companies are less capital intensive, more intellectual-property heavy. Another way to put it, we are making less stuff and offering more services. Innovation, speed, and the fickle nature of investor preferences could leave today’s darlings in the dust.

What is the impact on portfolio construction decisions?

Let’s look at a hypothetical investor named Bill. Bill has dabbled in picking stocks throughout his career. He’s also worked with a few different brokers and financial advisors, each with their own philosophy on investing. Over the past 30 years, Bill has accumulated ~75 individual stocks through his own purchases and those of previous advisors.

Bill has a jumbled salad of random stocks. He has no idea of his sector exposures. He’s unable to track risk. Since he has four different brokerage account, total position sizes aren’t clear. Bill has no investment process or framework for buying and selling.

This is a common situation.

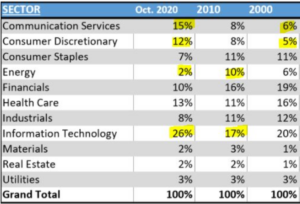

What ends up happening for Bill and many investors like him is massive drift. Consider how the S&P sector weightings have evolved over the past 20 years…

Source: einvestingforbeginners.com

The above chart shows S&P 500 sector weightings by decade (2000, 2010, Oct. 2020). We have highlighted some of the biggest changes in yellow. Tracking sector weights through time is a good proxy of how the underlying economy has evolved and investor preferences shifted.

Given Bill’s random accumulation of stocks over time and shifting sector weights, it’s likely he’s massively offsides and taking concentrated sector bets unknowingly.

In my opinion, a highly understated benefit of owning an index is that it evolves with the underlying economy. It’s impossible to know what the next big thing is. By capturing broad exposure via an index, an investor is more likely to participate.

Does this mean you shouldn’t own individual stocks? No. But you want your active individual stock bets to intentional, not random.

Here’s how you can have a sound portfolio that’s diversified, tax-efficient, intentional, and fits with your financial plan.

For your long-term monies earmarked for retirement (this is usually the biggest chunk of investable assets), build a diversified, multi-asset ETF portfolio. It might look something like this (just an example, not a recommended allocation)…

U.S. Large Cap ETF 25%

U.S. Small Cap ETF 15%

Foreign/Emerging Markets ETF 20%

U.S. Real Estate ETF 10%

Corporate Bond ETF 20%

U.S. Treasury ETF 10%

We would call the above a “core” portfolio.

The individual stocks, which can be thought of as a satellite portfolio, is a much smaller percentage of your investable assets, but probably more fun. This is where you can express your active views, invest in companies that interest you, and speculate. We call it scratching your degenerate itch.

By all means, dabble in buying and selling individual stocks. But, be mindful of collecting a mixed salad of random stocks. The core portfolio should be sound, diversified, tax-efficient, intentional, and should fit with your overall financial plan.