VR Research published a graphic on its Twitter account showing the characteristics of a “market top.” The summary is broken down by corporate, valuation, economic, market, and sentiment metrics. These are not hard and fast rules, rather a guidepost to help investors better understand where we’re at in the market cycle.

In the subsequent months, we will tackle each category and determine if the current environment is exhibiting signs of topping out. This week we break down investor sentiment.

Do the above sentiment characteristics exist today? We tackle each metric (bold) with our comments below.

Investors are momentum driven

Rules-based or quantitative strategies are gaining in popularity and often have momentum components. The investor would buy more of an appreciating stock and bet against a declining stock (read more about momentum investing).

Verdict: Inconclusive

Bears have given up

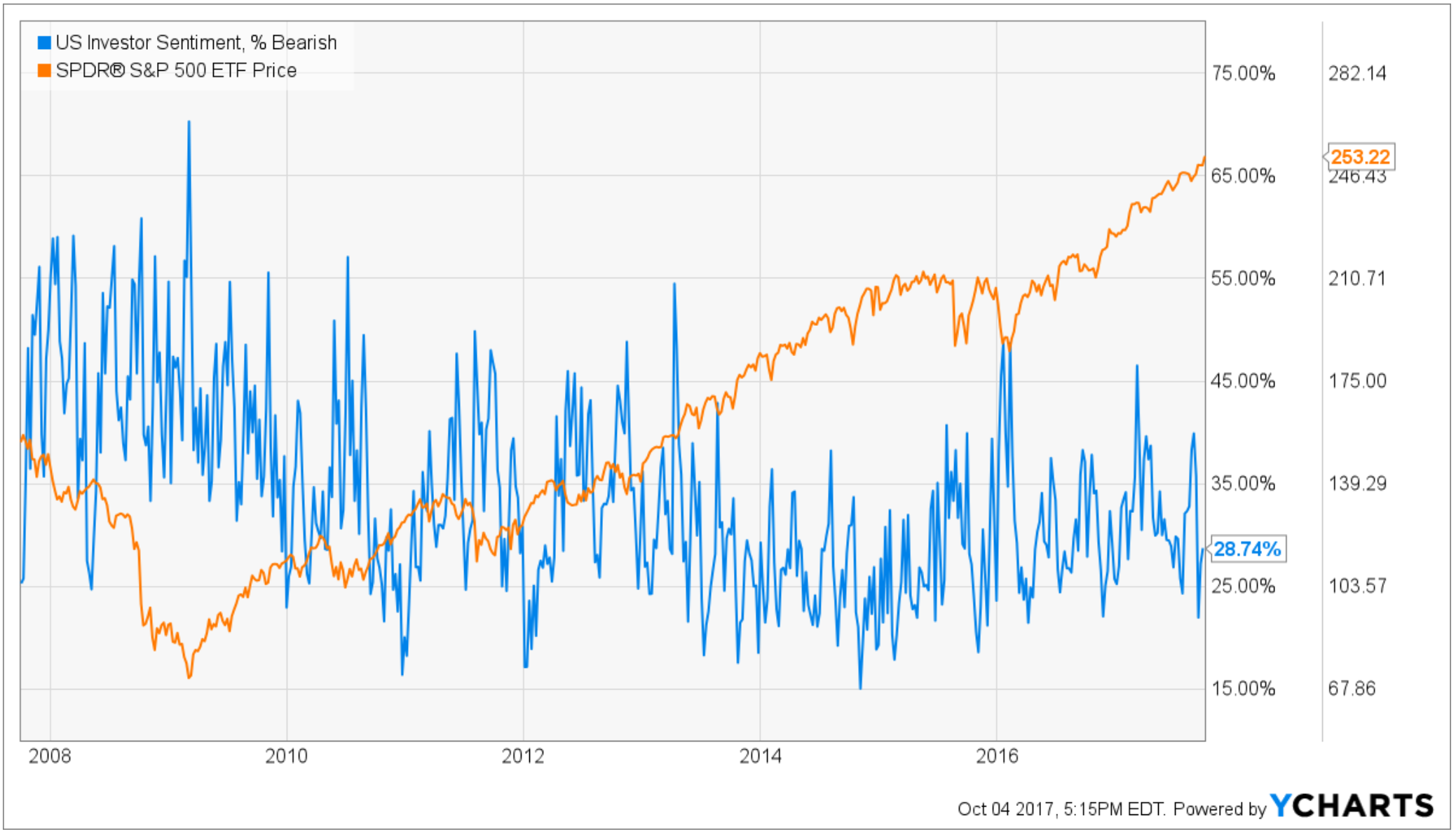

Higher levels of the blue line means investor sentiment is more bearish or pessimistic.

The blue line tracks bearish investor sentiment over the past 10 years (S&P 500 in orange). The level of optimism or pessimism amongst investors has little predictive power for determining stock prices. The current level of bearish sentiment is on the low side, but far from the trough in 2011, 2012, & 2015. Listening to doomsday predictions, financial media, and market participant attitudes of “we must have a pullback” indicate the bears are very much alive.

Verdict: Not a market top

Front covers of newspapers and magazines are euphoric

In 1929, the New York Times described “fantastic illusions” that fueled the most reckless stock market speculation. During the tech bubble of the late 90’s and early 2000’s, Alan Greenspan coined the term “irrational exuberance” to describe speculation that any stock with “.com” in the company name would lead to riches (see Mass Psychology Supports the Pricey Stock Market).

It’s safe to say the 2017 investor is not fist-pumping with euphoria. The financial media hates this bull market. In our opinion, CNBC would be more enthusiastic if the market rally wasn’t led by index funds. Their corporate sponsors i.e. active mutual funds have been crushed with perpetual underperformance and massive outflows. Also, the lack of volatility and a perpetually rising market doesn’t make for exciting news.

Verdict: Not a market top

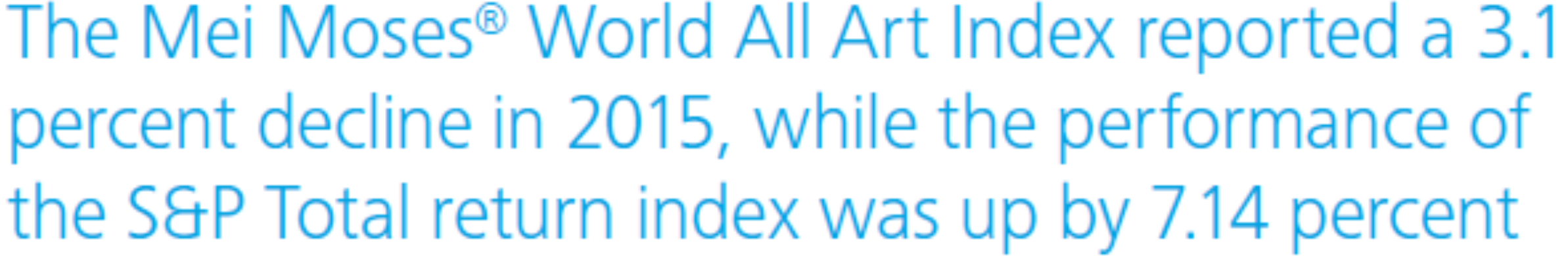

Art market and luxury goods market is booming

We found data from 2012, 2013, and 2015 via the Deloitte Art & Finance report. We are not art experts, but the below return numbers are hardly booming.

Verdict: Not a market top

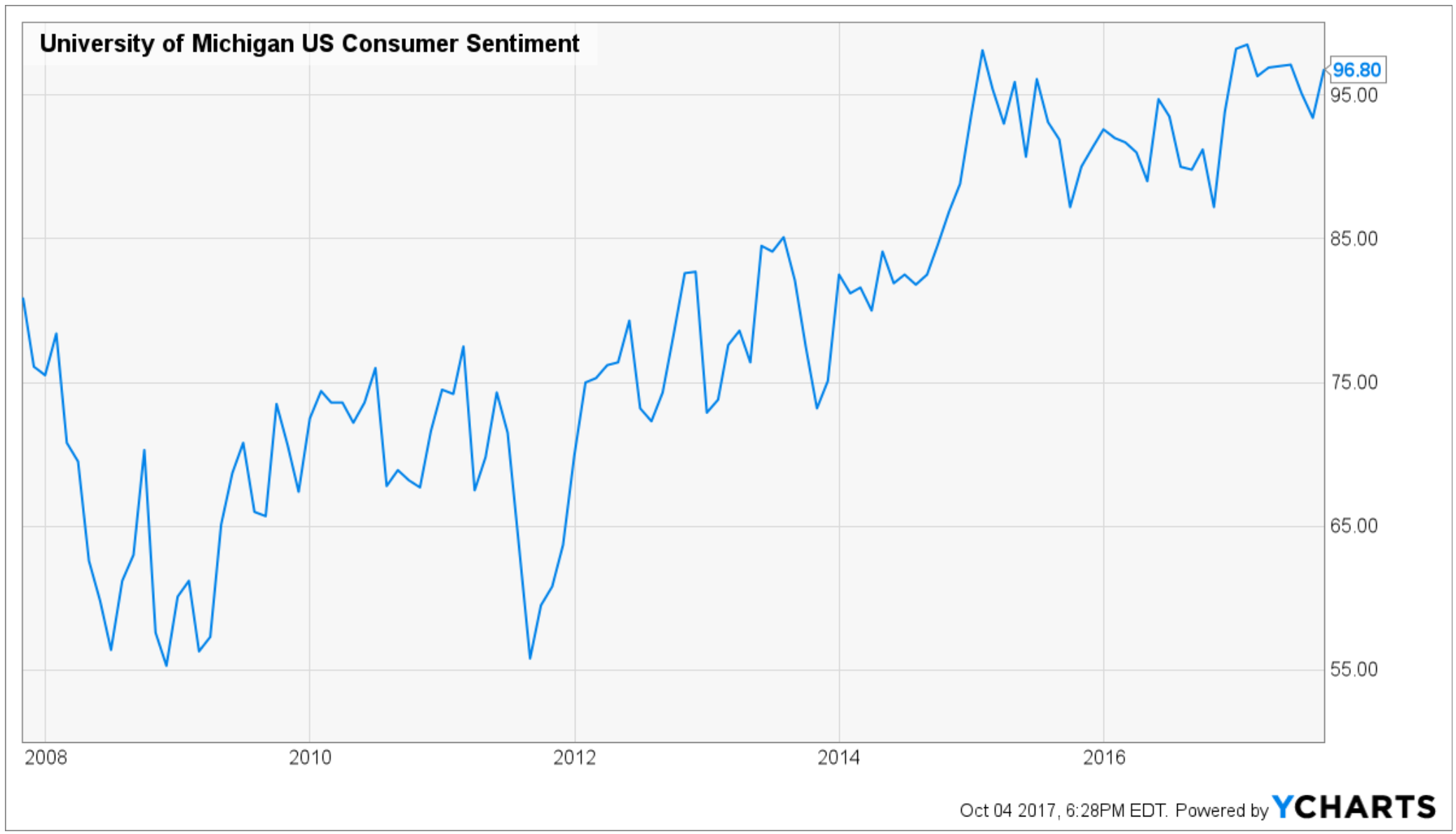

Consumer Sentiment is falling from a high level

Going back to 2008, consumer sentiment is at a high level, but is not falling.

Verdict: Not a market top

Financial Press and TV becomes more popular

A recent report shows CNBC ratings fell to a 22-year low. The WWE characteristics of financial media are no doubt a contributing factor. Programs such as Mad Money, Fast Money, Options Lunch, etc. have little benefit to the average investor. In fact, they can be detrimental to your wealth. The counterpoint is that investors are turning off the TV and consuming financial news via social media, blogs, smartphone apps, etc.

Verdict: Inconclusive

This is arguably the most unloved bull market in history. Investor sentiment is mixed. Financial media isn’t producing bubble mania warnings. The art market is healthy, but not booming. Consumer sentiment is strong. Financial TV (CNBC) viewership is down. We acknowledge sentiment is only one chapter in the book, but the story is not lining up with historical market top warning signs.