Perception exists within wealth management that complex equals smart and simplistic equals dull. This is especially evident in the hyper-competitive college endowment space. The largest college endowments have pioneered a culture of exotic hedge funds, private equity, venture capital and private real estate in the race to generate excess return. It’s smart people hiring other smart people to prove they’re the smartest.

Every year NACUBO-Commonfund Study of Endowments releases performance data for 800 college endowments representing $515 billion in assets. Being in the top quartile relative to peers is a badge of honor for the investment managers of the endowment (some receive compensation incentives for finishing in top percentiles).

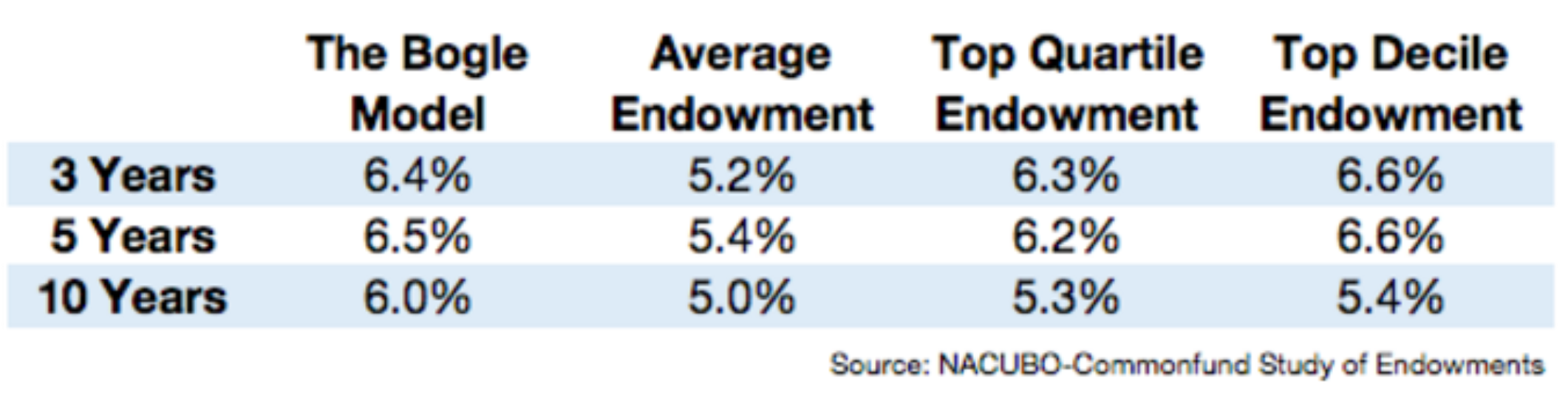

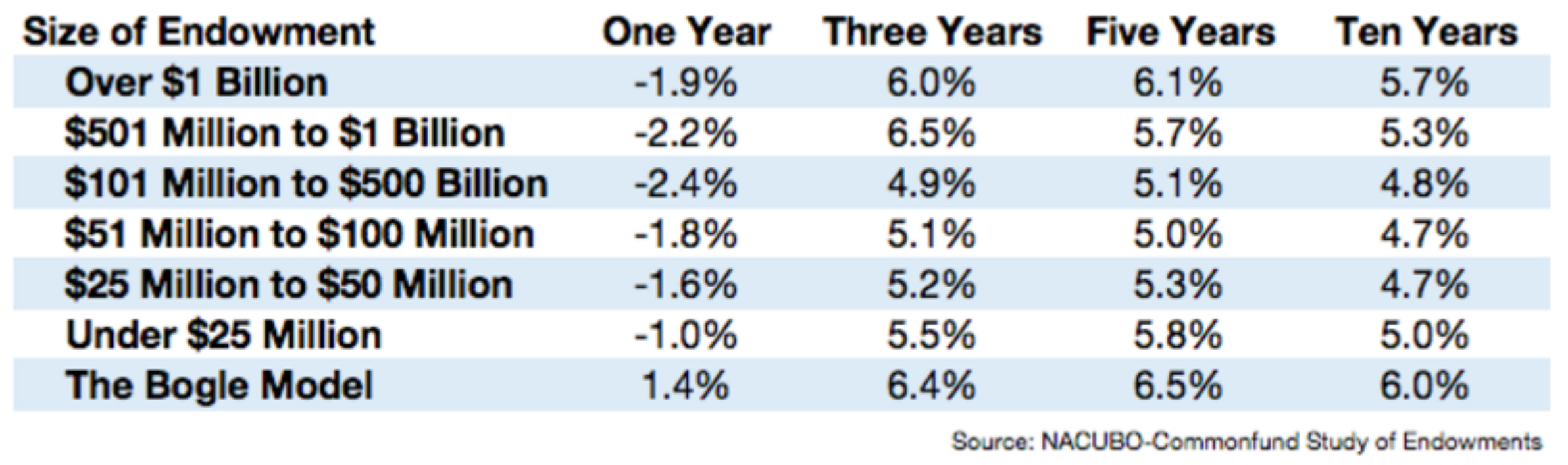

How do the endowment results stack up against a simplistic 3-fund Vanguard portfolio, aka the “Bogle Model”?*

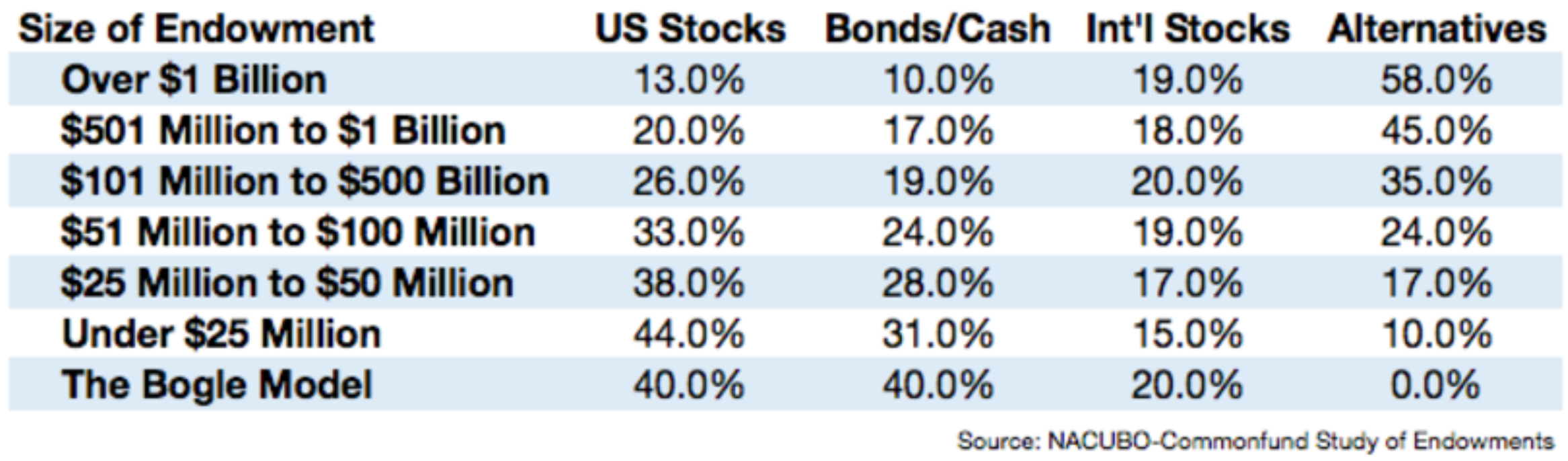

Charts courtesy of A Wealth of Common Sense**:

A few observations from the data set:

- The Bogle portfolio outperforms the top decile endowments over the past 10 years. This is interesting, considering the 10-year number includes the financial crisis, when you would expect hedge funds to add the most value.

- Endowments over $1 billion hold a whopping ~58% in alternative assets. The larger the pool of capital, the greater access to “elite” investment managers.

- The smaller the endowment, the more exposure to U.S. equities. This could be due to limited investment research budget or staff. A straightforward investment approach is likely more appealing to endowment boards due to operational efficiencies.

- The data omits portfolio risk metrics (i.e. risk-adjusted returns), which would likely favor alternative strategies.

- As Ben concludes, due diligence, evaluation, and vetting of complex alternative strategies is extremely time consuming and expensive. In our opinion, the beauty of the simple Bogle approach is the operational benefit and ease of use.

For retail investors, if your advisor is recommending a strategy you can’t explain to your golf buddy in less than 1 minute, there are cheaper and more efficient options. As we have previously stated, the most effective way to hedge total portfolio risk is fixed income & cash. We are paying particular attention to how cross-asset correlations evolve (how asset classes move in relation to one another) in the era of monetary intervention. It doesn’t do any good to own a multi-asset class portfolio if all the assets act the same during times of market stress.

*The Vanguard portfolio is made up of the Total U.S. Stock Market Index Fund (40%), the Total International Stock Market Index Fund (20%) and the Total Bond Market Index Fund (40%). The total cost of this portfolio is a rounding error at around 0.07% in the ETF versions of these funds.

**Endowment figures are net of fees