“One thing everyone should know about dividend yield is this: it doesn’t tell you much. It doesn’t give you clues about the valuation of a corporation, changes in corporate fundamentals, sustainability of the dividend or future returns.”– Scott Davis, Columbia Threadneedle Investments

There is a comfort in predictable income. Whether it’s stable employment, a dependable rent paying tenant, or a healthy dividend from a blue-chip company, the positive feeling we get from the safety and soundness of our income sources provides piece of mind.

In recent weeks, we’ve noticed more investors zeroing in on dividend yield as their paramount investment criteria. The thinking goes something like “the higher the dividend yield, the more income I receive, thus lowering the capital I have at risk.” The past nine years of low interest rates has put a premium on riskier, income producing assets. Like many other forms of investing, there are pitfalls to chasing high dividend paying stocks.

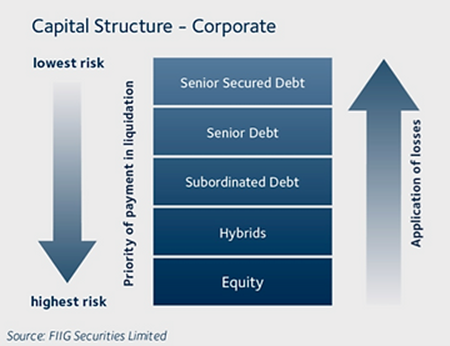

Capital Structure

It’s important to understand where the stock owner sits in the corporate pecking order. In other words, if the stuff hit the fan, how safe is your dividend?

The above graph shows equity holders sit at the bottom of the capital structure. This means they are likely to be wiped out completely in a bankruptcy or distressed situation.

Dividends Are Not Guaranteed

Dividends are a privilege, not a rite of passage. Look no further than the Great Financial Crisis. According to Dividend.com, a whopping 142 companies cut or eliminated their dividend in 2008. Banks, once sought for their stable dividend payments, still have not reached their pre-recession dividend payout levels.

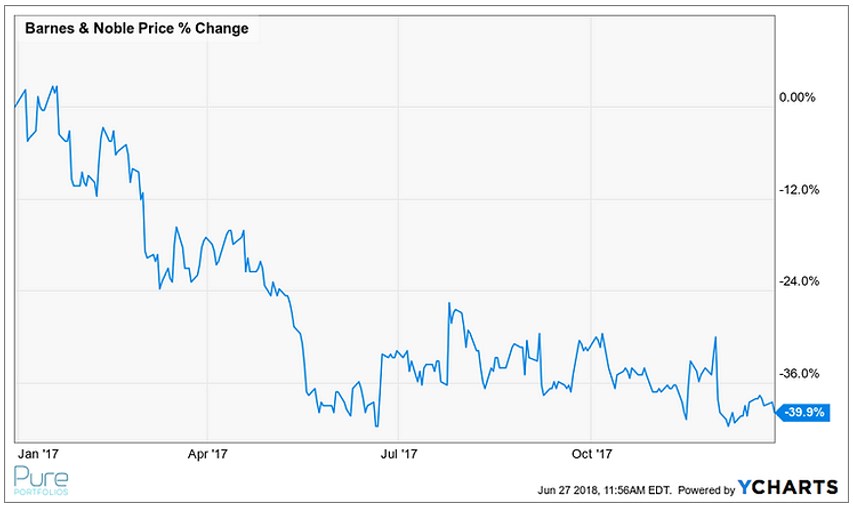

The Underlying Stock Can Move More Than A Paltry Yield

Dividend paying stocks are not a bond proxy. In other words, the underlying stock can move dramatically against you. Take the bookstore, Barnes & Noble (BKS); in 2017 the company sported a hefty dividend yield over 10%. The underlying stock proceeded to do this:

Don’t fall in love with dividend yield, you should focus on total return.

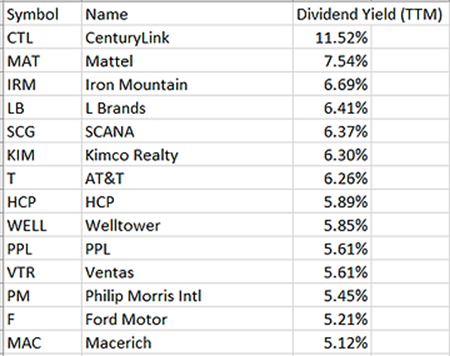

The Illusion of Safety

There’s a perception that dividend paying stocks are always safer than non-dividend paying stocks. We screened the top 15 dividend yielding stocks in the S&P 500 as of 6/27/18:

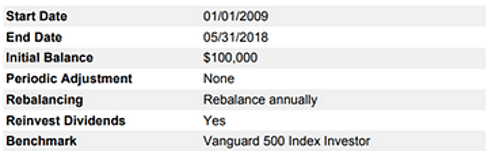

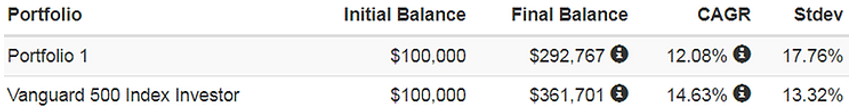

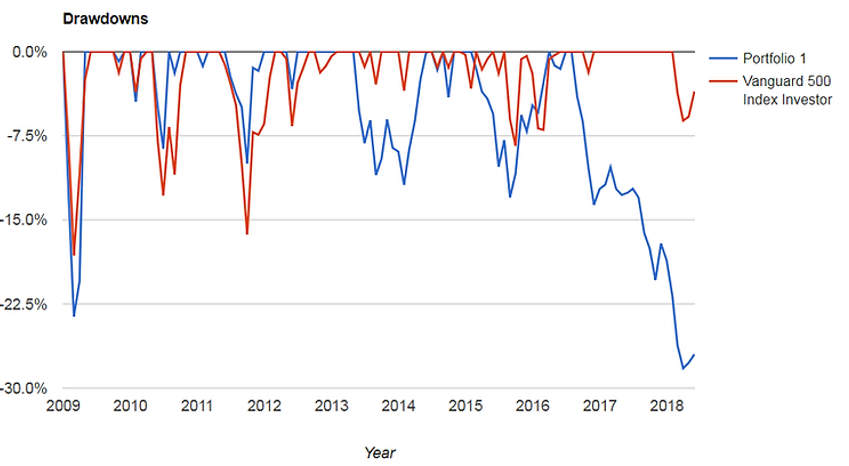

We back-tested* the above portfolio vs. the S&P 500 index under the following parameters:

The highest dividend payers had a lower final balance and more risk than the S&P 500.

The high dividend payers (portfolio 1, blue line) had a deeper drawdown than the S&P 500.

Reaching for high dividend paying stocks can result in the illusion of safety.

The Damage Happens Before You Realize What Hit You

You buy a stock for the dividend. You sense the underlying business is struggling. You decide to review the stock for potential sale from your portfolio.

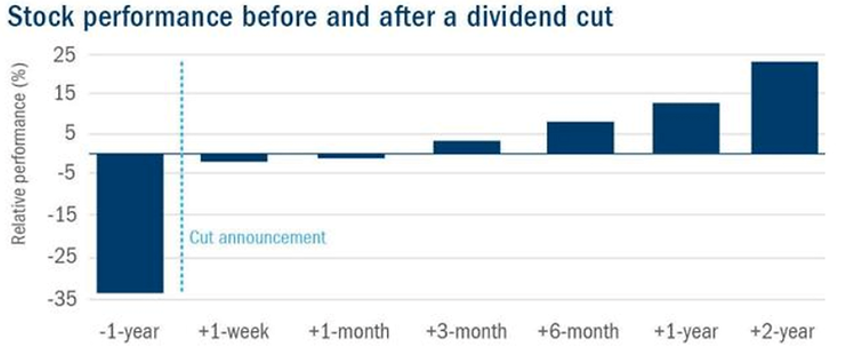

Source: FactSet, MSCI, Morgan Stanley Research

The market is a forward-looking entity and sniffs out the dividend cut one year before it’s announced. Your stock craters 35% and you are left wondering what happened to your safe, dividend paying investment.

Remember, dividends must be supported by cash flows. There are no free rides to investment prosperity, including investing in high dividend payers. Do not be blinded by lofty dividend yields, you should care about total returns.

*Backtested performance is NOT an indicator of future actual results. The results reflect performance of a strategy not offered to investors and do NOT represent returns that any investor actually attained. Back-tested results are calculated by the retroactive application of a model constructed on the basis of historical data and based on assumptions integral to the model which may or may not be testable and are subject to losses.