“The correct lesson to learn from surprises is that the world is surprising.” – Morgan Housel, The Collaborative Fund

Unprecedented.

Extraordinary.

Unexpected.

Once in a lifetime.

You don’t have to look far to find dramatic words to describe the financial markets in 2022.

Maybe we shouldn’t be so surprised by surprises?

Here are some things I’m surprised about in 2022.

Losing Money is a Potential Outcome

I’m surprised that some are surprised their portfolio is down.

Since 1928, there has been one year the S&P 500 and the U.S. 10-Year Treasury bond were down >10%.

Care to guess which year? 2022.

In this environment, most every investor is going to experience some level of pain.

It doesn’t mean you need to panic sell, abandon your investment strategy, or something is broken. Refusing losses is a disease that creates a trove of irrational behavior.

Accept that there will be difficult years. There will also be fruitful years. Your portfolio should reflect your acceptable range of outcomes.

For example, you might say, “I’m comfortable with a 15% drawdown in any calendar year.” A professional advisor should be able to build a portfolio that mirrors that outcome.

Emotions of a Market Cycle

I’m surprised that behavioral finance and human behavior is largely ignored.

Every market cycle has its own symptoms; mortgage crisis, inflation, war, pandemic, etc.

These are unpredictable.

Human behavior during a difficult market environment is predictable.

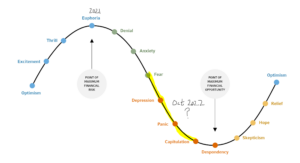

Source: Russell Investments

The above graph shows the euphoria of a bull market (blue) followed by the fear & panic of a difficult market (orange). Most investors embrace risk when sentiment is exuberant and shun risk during the point of maximum financial opportunity.

History would suggest the time to exercise prudence is when market participants are greedy. The time to get more aggressive is when you want to puke.

Investor sentiment backs this up…

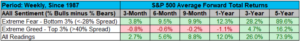

Source: Charlie Bilello, Twitter @ charliebilello

The above data set shows average forward S&P 500 returns (since 1987) when investors feel fearful (extreme fear, top row) and greedy (extreme greed, middle row). 5-year total returns are ~5.5x higher when investors are beaten down vs. greedy. Right now, investors are in the extreme fear camp.

Supreme Confidence

I’m surprised how many people continue to proclaim what happens next.

In your social circles, pay attention to how people use their personal experiences to interpret what comes next.

The restaurant owner is paying more for ingredients. Inflation is going to run hotter for years to come.

The gas station owner has seen his profits double over the last eight months. The economy is not that bad.

The retiree that lived through the roaring inflation of the late 1970s/early 1980s is convinced interest rates are going to the moon.

The last two years can be scripted straight out of a movie. Go read Wall Street predictions from fall 2019, 2020, and 2021. No one saw any of this coming.

What derails us is seldom what anyone is talking about (COVID, Ukraine/Russia, UK pension funds).

Hedge fund manager Stanley Druckenmiller stated, “What is obvious is obviously wrong.”

The message is that if everyone is talking about it, the market has priced in the information.

It’s okay to say “I don’t know.”

Be willing to change your mind when the facts change.

Have a plan for making allocation changes (reducing or adding risk).

Understand how your portfolio acts during times of stress. For example, when the S&P 500 is down 25%, how is your portfolio going to react?

Here’s a video explaining how Pure Portfolios measures risk using drawdown (fast forward to the 12-min mark).

The Fed Obsession

I’m surprised that the Fed still has so much influence.

Central bank credibility is everything. One can argue the last 18 months for the Fed haven’t been their best.

Here’s an open secret, the Fed doesn’t know what’s coming. They are making it up as they go.

Consider Fed Chairman Powell’s quotes from late 2021…

11/3/21: “Fed not behind the curve in addressing inflation.” (CNBC)

11/3/21: “We don’t think it’s time yet to raise interest rates.” (CNBC)

11/3/21: “Inflation is elevated, largely reflecting factors that are expected to be transitory.” (CNBC)

Almost a year later, the Fed is saying the extreme opposite…

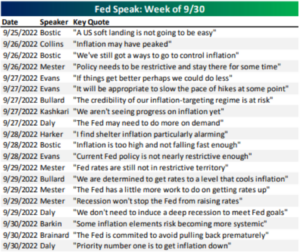

Source: Bespoke Investment Group

To be fair to the Fed, forecasting inflation & other economic trends in a normal environment is difficult. Coming out of a pandemic it’s darn near impossible.

The fear is that the Fed has potentially been on the wrong side twice in the past year.

Too late to hike interest rates in 2021. Too aggressive in hiking rates in 2022 in the face of an economic slowdown.

—————————————————————————————————————————-

It’s been said those who are surprised by everything haven’t engaged in history.

Would we all do better to not be so surprised by surprises?