Minimizing taxable income in retirement is an Olympic sport for financial advisors.

Roth conversions, charitable giving, asset location, tax-free bonds, being mindful of IRMAA brackets, etc.

These are all part of a sound, comprehensive financial plan.

There’s a lesser-known lever we can pull to potentially unlock $100,000 in tax-free retirement income.

The secret? Understanding capital gains brackets and utilizing different account types i.e. traditional IRA, Roth, taxable brokerage strategically.

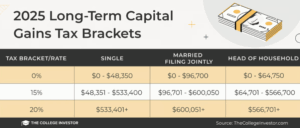

Capital Gains Brackets 101

Most retirees know that Traditional IRA withdrawals are taxed as ordinary income. What’s less understood is that long-term capital gains, or profits from investments held in taxable accounts for more than a year, are taxed differently.

Source: TheCollegeInvestor.com

The above graph shows long-term capital gains bracket by filing status and income thresholds. Retirees married filing jointly could pay 0% long-term capital gains if their income is under $96,700 in a calendar year.

In other words, if total taxable income stays under roughly $96,700 for 2025, a retiree could realize long-term gains tax-free.

Let’s see how this could work in practice…

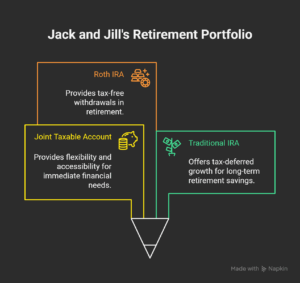

Meet Jack and Jill

Jack and Jill are married and retired. They file jointly and have three main accounts:

- Joint taxable account

- Traditional IRA

- Roth IRA

Source: Napkin

The above graphic shows the three account types (Roth, Traditional IRA, taxable) needed to unlock ~$100,000 in tax free retirement income.

Scenario 1: Withdraw from the IRA

Jack and Jill pull the entire $100,000 from their Traditional IRA.

- Every dollar is taxed as ordinary income

- They blow past the standard deduction and climb into the 22% federal bracket

- Their Social Security (if applicable) and Medicare premiums could also be impacted

Result: Higher taxes, less flexibility, and potentially higher monthly expenses.

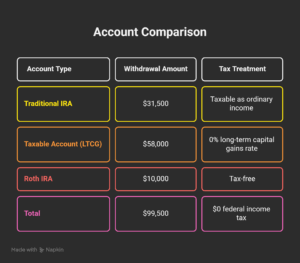

Scenario 2: Blend Withdrawals to Stay in the 0% Capital Gains Bracket

Source: Napkin

The above graphic shows how a retiree can tap distributions from each account type, while being mindful of thresholds that could trigger taxable income. Note: this tax strategy is only possible when a retiree has Roth, Traditional IRA, and a taxable account.

Here’s how it works:

- The $31,500 from their IRA is fully offset by the $31,500 standard deduction in 2025 (no tax owed). If married filing jointly and over 65, retirees are entitled to an additional $1,600 per spouse ($3,200 total)

- Because Jack and Jill are both over age 65, they also qualify for the “senior bonus” deduction introduced in the One Big Beautiful Bill. This deduction offers up to $6,000 per person (phase-outs apply for higher incomes) and is available for tax years 2025 through 2028, potentially boosting their total standard deduction.

- Their $58,000 in long-term capital gains stays below the $96,700 taxable-income threshold, keeping them in the 0% long term capital gain bracket

- The $10,000 Roth withdrawal doesn’t count toward taxable income at all

Result: Nearly $100,000 of spendable income with zero federal income tax.

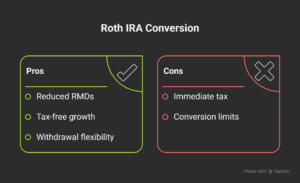

What if I’m Retired and Don’t Have a Roth IRA?

In lower-income years, retirees like Jack and Jill can use Roth conversions to shift money from their Traditional IRA to a Roth IRA while staying in a lower bracket.

Source: Napkin

By converting up to the top of the 12% bracket, they:

- Reduce future Required Minimum Distributions (RMDs)

- Build up tax-free money for later

- Gain flexibility in future withdrawal years

Result: Smoother tax exposure over time with additional flexibility. Not just for one year, but for their entire retirement.

Why This Matters

Source: Napkin

Owning various account types, i.e. taxable, IRA, and Roth accounts can help…

- Lower your lifetime tax bill

- Avoid Medicare IRMAA surcharges

- Extend portfolio longevity

- Prevent “tax surprises” when RMDs start

- Allow for strategic tax strategies

Taxes in retirement is not about how much you take out. Rather, which account the distributions come from. By understanding the 0% capital gains bracket and blending withdrawals wisely, you can fund your lifestyle and keep more of what you’ve worked so hard to build.

Ready To Get Started?

We’ve made it simple to see your own numbers.

Use our interactive planning tool to explore your personalized retirement income strategy.

If you want more personalized retirement planning guidance, shoot us a note at insight@pureportfolios.com.