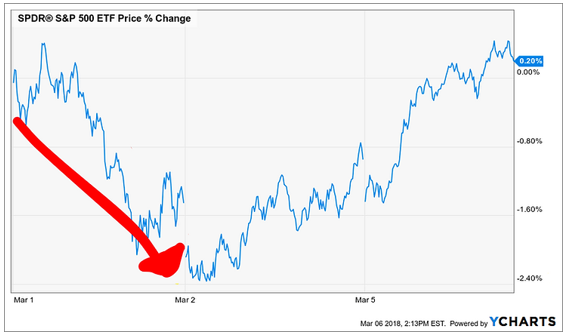

On March 1, 2018 President Trump unexpectedly announced tariffs on imported steel and aluminum. The threat of a global trade war sent the S&P 500 ~2.40% lower:

On March 1, 2018 President Trump unexpectedly announced tariffs on imported steel and aluminum. The threat of a global trade war sent the S&P 500 ~2.40% lower:

During the fallout, we’ve been asked how the Trump tariffs will impact global equity markets. While it’s impossible to predict how investors will react to trade war rhetoric, we can examine the traditional case for and against tariffs, recent history, and what (in our opinion) this is really about.

Tariff – Used to restrict imports by increasing the price of goods and services purchased from overseas, making them less attractive to consumers. Governments may impose tariffs to raise revenue or to protect domestic industries from foreign competition. Source: Investopedia

According to the National Bureau of Economic Research, the original purpose of tariffs was to generate revenue for the federal government. Up until income taxes were introduced in 1913, tariffs funded over 90% of the federal budget. Subsequently, tariff income has dramatically declined as a source of revenue. On occasion, tariffs can be used as a political tool to gain leverage, negotiate trade deals, or yield concessions from a foreign trade partner.

Supporters of tariffs claim:

- Tariffs protect American jobs

- Tariffs can be a matter of national security

- Tariffs protect American industries from unfair trade practices such as “foreign dumping” (selling goods below market rate to drive domestic producers out of business)

Opponents of tariffs claim:

- Tariffs will increase the price of goods, hurting American consumers

- Tariffs will destroy jobs in the long-term

- Tariffs hurt innovation and keep prices high due to decreased competition

- The government shouldn’t be subjectively choosing which industries to “protect”

Looking at recent history, this isn’t the first time a U.S. President has introduced tariffs on steel imports. On March 5, 2002, George W. Bush introduced an 8 – 30% tariff on steel imports (Canada & Mexico were exempt) citing foreign dumping endangering the future prosperity of the U.S. steel industry. Here’s how the S&P 500 reacted:

Under pressure from the World Trade Organization, President Bush scrapped the steel tariffs on 12/4/2003. The above graph shows a -6.67% S&P 500 price change from 3/5/2002 to 12/4/2003.

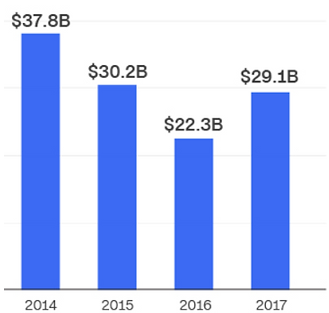

One might ask why President Trump is making a stand now? Has there been a fundamental change in U.S. steel imports?

Source: U.S. Census Bureau

The above bar graph shows the total U.S. steel imports since 2014. There was an increase from 2016 to 2017, however, the overall trendline is lower.

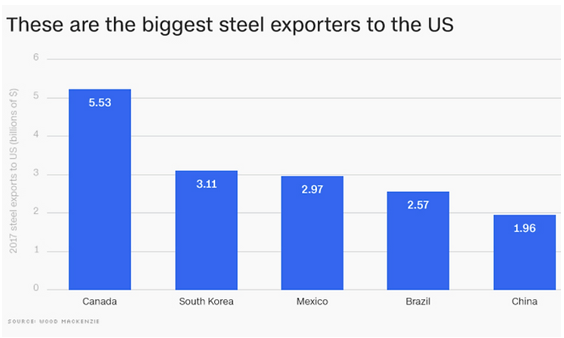

Source: Wood Mackenzie

In 2016, 88% of Canadian and 75% of Mexican steel exports found their way to the U.S.

Could this whole tariff tantrum be about gaining leverage for NAFTA negotiations?

Call it the “Art of the Deal”, gamesmanship, or whatever you want. In our opinion, President Trump is sending a shot across the bow to NAFTA constituents Canada and Mexico.

The political posturing could be effective or it could snowball into a full blown trade war. What we do know, is making investment decisions based on the impulses of big government is a loser’s game (see The Danger of Mixing Politics and Investing).

*After this writing, Gary Cohn resigned as President Trump’s Chief Economic Advisor. It seems the White House is doubling down on tariffs with rumors of China being the next target.