When it comes to retirement, few decisions feel as weighty as when to claim Social Security.

Do you take it early and lock in a smaller check for a longer time, or wait for a bigger benefit later?

It’s a choice that impacts not only your monthly income but also your long-term financial plan. While there’s no one-size-fits-all answer, evaluating your personal circumstances can help you understand the best age to start Social Security for maximum benefits.

Download our guide: 5 Key Factors to Consider Before Claiming Social Security

Understanding the Basics of Social Security Benefits

Social Security benefits are calculated based on your highest 35 years of earnings, adjusted for inflation. If you have fewer than 35 years of earnings—such as if you retire early—those missing years are counted as zero, which can lower your average.

You become eligible to start receiving Social Security retirement benefits at age 62. However, claiming benefits before reaching your Full Retirement Age (FRA) results in a permanent reduction of your monthly benefit amount.

For individuals born in 1960 or later, the FRA is 67. Conversely, delaying benefits beyond your FRA up to age 70 increases your monthly benefit through delayed retirement credits by approximately 8% per year (there is no benefit for delaying benefits beyond 70).

Social Security Claiming Strategies

-

Early Claiming (Age 62 to FRA)

- Pros: Provides income sooner, which may be beneficial if you retire early or need to minimize withdrawals from savings.

- Cons: Results in a reduced monthly benefit—about 30% less if claimed at 62 vs. waiting until FRA. (Source)

-

Claiming at Full Retirement Age (67 for Most)

- Pros: Entitles you to 100% of your calculated benefit.

- Cons: Does not maximize potential benefits compared to delaying until age 70.

-

Delayed Claiming (FRA to Age 70)

- Pros: Increases your benefit by approximately 8% for each year you delay past FRA, culminating in a 24% increase if you wait until age 70. (Source)

- Cons: While this strategy maximizes long-term Social Security benefits, it requires drawing from your investment portfolio or other sources to cover expenses in the meantime.

Key Factors to Consider Before Claiming Social Security

- Life Expectancy: If you anticipate a longer-than-average lifespan, delaying benefits can lead to higher lifetime payouts.

- Available Resources: Assess your immediate income requirements. If you have sufficient savings to cover your living expenses, delaying Social Security might be advantageous.

- Portfolio Sustainability: If delaying Social Security requires larger withdrawals from your investment portfolio, consider whether your assets can sustain this strategy. A high withdrawal rate over several years may reduce portfolio longevity, particularly in down markets.

- Employment Status: Continuing to work while claiming benefits before FRA can result in temporary benefit reductions due to the earnings test. However, these reductions are recalculated upon reaching FRA, potentially increasing future benefits.

- Spousal Considerations: Married couples should coordinate their claiming strategies to maximize combined benefits, considering factors like spousal and survivor benefits.

Case Study: John and Susan’s Social Security Strategy

Consider John, 63, and Susan, 60, a married couple contemplating when to claim their Social Security benefits. They both expect to live until 90. They face three primary options:

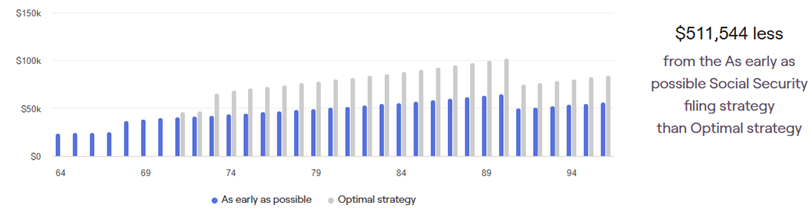

Scenario 1: Claiming Early (John at 63, Susan at 62)

Outcome: John receives $2,200 per month instead of the $2,571 he would receive at FRA. Susan receives about $900 instead of her FRA benefit of $1,200. This provides immediate income but significantly reduces their total lifetime benefits.

social security strategies

Source: RightCapital

The above chart is a Social Security scenario showing a comparison of claiming Social Security as early as possible (blue) against the optimal strategy (grey). The result is a significant reduction in lifetime benefits as compared to the optimal strategy.

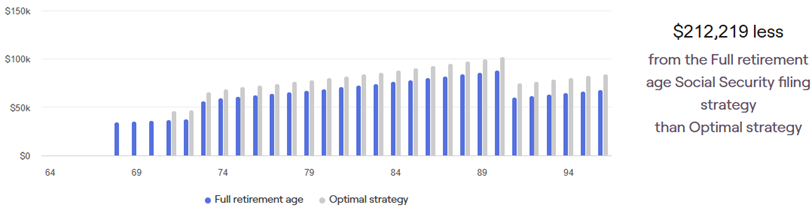

Scenario 2: Claiming at Full Retirement Age (67 for both)

Outcome: John receives his full benefit of $2,571 per month, while Susan receives $1,200. This option balances their total lifetime benefit with ensuring a higher monthly income. This also allows them to reduce their withdrawal rate earlier from their portfolio.

social security strategies

Source: RightCapital

The above chart is a Social Security scenario showing a comparison of claiming Social Security at Full Retirement Age (blue) against the optimal strategy (grey).

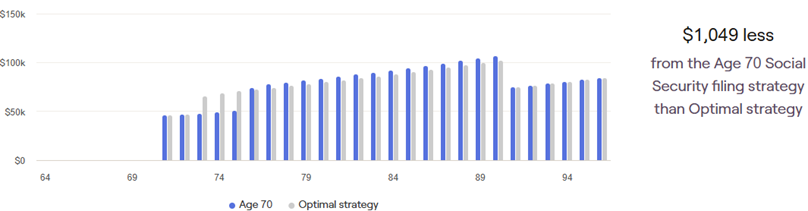

Scenario 3: Delaying Until Age 70

Outcome: John’s benefit grows to approximately $3,190 per month, maximizing his payout, while Susan maximizes her benefit at age 70 with approximately $1,488 per month. However, delaying benefits for both requires withdrawing funds from their portfolio to cover living expenses for seven years.

After evaluating their financial situation, they determine that while delaying benefits provides an additional lifetime Social Security income, it also results in higher risk of drawing down their investments, potentially impacting long-term portfolio sustainability.

social security strategies

Source: RightCapital

The above chart is a Social Security scenario showing a comparison of claiming Social Security at age 70 (blue, latest date) against the optimal strategy (grey).

Which Option Was Best?

After running these scenarios through their financial plan, John and Susan discovered that their optimal strategy would be to have John delay claiming until 70 and Susan claiming at 67.

alternative social security strategies

Source: RightCapital

This strategy allows Susan to claim her benefit earlier, while allowing John to maximize his benefits, balancing lifetime benefits with the long-term sustainability of their investment portfolio.

Making the Right Social Security Decision

Choosing when to take Social Security is a personal decision that should align with your overall retirement plan. Consulting with a financial advisor can help you analyze your specific circumstances and develop a strategy that optimizes your benefits while maintaining overall financial stability.

Understanding the implications of your Social Security claiming strategy is crucial to securing a comfortable and sustainable retirement.

Next Steps:

✔️ Assess your financial needs, portfolio sustainability, and expected lifespan.

✔️ Run different claiming scenarios with a financial professional.

✔️ Create a customized Social Security strategy that maximizes lifetime benefits without jeopardizing your investment portfolio.

📞 Contact us today to discuss your Social Security options and optimize your retirement plan!