“Everything I do in investing is just very different.” – Michael Burry, famous investor featured in “The Big Short”

Michael Burry predicted the 2008 housing crash. His fund made a boatload of money betting against the U.S. housing market. The quirky investor was made famous by the movie “The Big Short” (Mr. Burry was played by actor Christian Bale).

Recently, Mr. Burry caused a social media frenzy after he placed a $1.6 billion dollar bet U.S. equity markets would crash.

Source: X, Ash Crypto, @ashcryptoreal

The above tweet (and many like it) were trending all over X (formerly known as Twitter) on August 14th & 15th.

Mainstream media ran wild with the story. Headlines sensationalizing the trade were everywhere…

“Michael Burry, of ‘Big Short’ fame, just bet $1.6 billion on a stock market crash” – CNN Business, 8/16/23.

“Trader who predicted 2008 financial crisis bets $1.6bn on stock market crash by end of 2023” – Independent, 8/19/23.

Predictably, my phone starts to ping with questions of what to make of Burry’s dramatic trade. I received a text from a savvy, business owner friend…

“Michael Burry (Big Short Guy) just made two huge moves announcing the economy and stock market will drop. Might be an interesting thing for you to speak to should you not subscribe to his thesis.”

Seems like a big deal, maybe Mr. Burry is on to something?

Let’s unpack the trade, Mr. Burry’s track record, and what the rest of his portfolio looks like.

Mr. Burry’s Option Trade

What a clickbait headline, the trade wasn’t for $1.6 billion. Not even close.

Mr. Burry purchased put options on the S&P 500 (SPY) and the Nasdaq (QQQ). The options expire in mid-November 2023.

The trade would make money if the market falls below a predetermined level (strike price of the option contract).

The trade would lose money if the market rises above a predetermined level. The put option would finish out of the money and expire worthless.

Essentially, Burry is betting the S&P 500 and Nasdaq indices go down between now and mid-November.

The media reported the notional value of the trade, which is extremely misleading.

Notional value = number of options contracts * 100 * value of underlying security.

It’s not obvious what the out of pocket costs were for the trade, but we can say with confidence Mr. Burry spent much, much less than $1.6 billion to purchase the put options.

Even X (I still call it Twitter), flagged tweets sensationalizing Burry’s trade as misleading…

“This tweet is citing the notional value of the underlying ETF shares as is required by the 13f filing, not the value of the options purchased/held by Mr. Burry’s fund. This is a very misleading headline for the uninformed.”

Good for X!

Swing and Miss

Mr. Burry is a brilliant investor. He made one of the greatest trades of all-time by shorting the U.S. housing market.

Lately, not-so-much. He’s been wrong a lot…

Source: Piranha Profits

The above graphic highlights Mr. Burry’s public market calls (dark gray) and S&P 500 price action. Since 2015, Mr. Burry seems to carry a bearish outlook predicting crashes that never materialize.

This isn’t a knock-on Mr. Burry. Forecasting short-term market movements is impossible, even for the smartest investors on Earth.

Long U.S. Stocks

Mr. Burry is very much a net owner of U.S. stocks. The options trade is basically betting against big technology stocks.

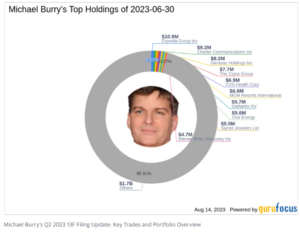

Here is Scion Asset Management (Burry’s investment company) latest holdings as of 6/30/23…

Source: Scion Asset Management 13F holdings, Yahoo! Finance

The above graphic shows Mr. Burry’s investment portfolio as of 6/30/23. Even considering the premium paid for the put options, Mr. Burry is a net owner of U.S. stocks. Keep in mind, the above shows the notional value of the options (others category, gray), not how much Mr. Burry paid for the position.

Instead of piling into perceived “overvalued” U.S. technology stocks, Mr. Burry has targeted companies and industries that are out of favor or trading at attractive valuations (in his view). It seems he is going back to his value investing roots.

In summary..

- Don’t believe everything you read on the internet. Media companies and influencers care about engagement rather than outcomes.

- Forecasting is a fool’s errand, yet so many fall into the trap of seeking opinions on what happens next. Perhaps Benjamin Graham said it best, “I am skeptical about stock market forecasting by anybody, and particularly by bankers.”

- Build an information filter. In the digital age, we are hit with a firehose of information. If you listen to everything, you’ll get a bunch of noise and miss what’s important.

Many people predict what will happen next for financial markets. Often, there is little personal consequence for being wrong. Kudos to Mr. Burry for putting his capital where his mouth is.