“Banks do not create money for the public good. They are businesses owned by shareholders. Their purpose is to make a profit.” – John Rogers, author of Local Money: What Difference Does it Make?

According to the Federal Reserve, the average interest rate on a credit card is ~20%.

Bankrate.com publishes daily mortgage rates for various terms. As of this writing (3/7/23), one can get a 30-year fixed for ~7%.

Depending on credit score, amount, and payoff terms, personal loan rates can go for 7-30%.

The above is great for lenders, many of which are large, public banks.

Higher rates make borrowing more expensive. Not-so-good for those taking on debt.

Surely, banks have programs in place to reward prudent savers with excess cash, right?

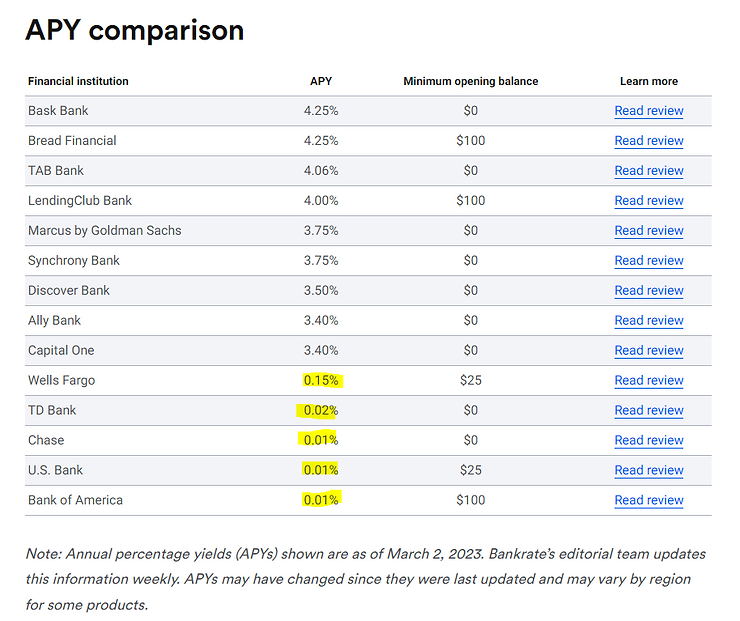

Source: Bankrate.com

The above graphic shows savings account rates for some of the largest banks in the U.S. Mega banks are paying peanuts to depositors & savers compared to market interest rates.

How can big banks get away with this?

- People don’t know any better. Your banker is not leading with the highest yielding products. You have to ask (and they still might not offer anything attractive).

- People think it’s difficult or daunting to change banks. There’s some truth to this, but we are talking about saving excess cash, not uprooting your day to day banking transactions.

- Public banks have a legal obligation to maximize shareholder profit. Incentives dictate how banks operate. Their duty is to maximize the bottom line, therefore, they will pay the least they can get away with. When banks lend money, they will charge the most they can get away with.

In my opinion, this is highway robbery in broad daylight.

Fortunately, consumers are starting to wise up to the fact big banks are not their friend.

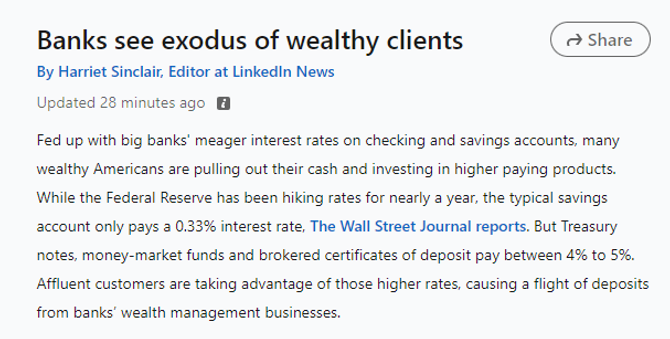

Harriet Sinclair, Editor at Linkedin News ran the following story…

Source: Linkedin News

Vote with your wallet and find a better place for your hard-earned capital. Banks are getting away with paying nothing to depositors because they can.

Here’s where we would look…

Internet Banks – Bankrate.com publishes a list of internet banks that are offering high-yield savings accounts.

Money Market Funds – investment companies offer money market funds that can be purchased with a few clicks. For example, we use Fidelity Market Cash Reserves (ticker: FDRXX) and Schwab Value Advantage Money (SWVXX). Both funds yield ~4-4.5%.

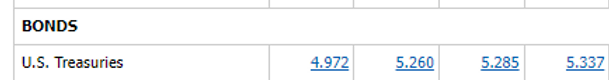

U.S. Treasuries – the best option in our humble opinion. U.S. Treasuries are liquid and backed by the full faith and credit of the United States. If you don’t want to lock up funds for a year, you can buy shorter-term maturities for flexibility.

Source: Charles Schwab

The above graphic shows annualized yield-to-maturity for short-term U.S. Treasuries (as of 3/8/23).

The good news is finding a friendly home for your capital doesn’t take any talent, skill, or insight about financial markets. It’s the definition of taking the low-hanging fruit.

For those that continue to do business (investments, loans, banking, etc.) with mega banks, if they’re fleecing you on cash, do you think the poor behavior stops there?

If you have idle cash, click here to learn about Pure Portfolios’ cash management offering.