““We are beginning to see trends that people tend to fear what they are exposed to in the media. Many of the top 10 fears this year can be directly correlated to the top media stories of the past year.” – Jefferson Bethke, author of “To Hell With the Hustle”

“I’ll tell you what Schuurmans. If the Democrats sweep Georgia I think the market is going to tank.”

“Ok. Why do you think that?”

“I just have a strong feeling. It’s coming.”

If my friend was looking for a reaction, I didn’t give him one.

The above warning came from the most conservative person I know. I took the dire warning with a grain of salt. However, it did get me thinking, how has the market performed under a so-called blue or red wave?

Blue wave is in reference to Democratic control of the White House, Senate, and House.

Red wave is in reference to Republican control of the White House, Senate, and House.

The consensus is that political gridlock or divided power is good for financial markets. Turns out a party sweep, either Democrat or Republican, hasn’t been too shabby either.

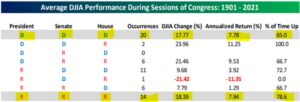

Source: Bespoke Investment Group

The above graph shows how the Dow Jones has performed during sessions of Congress (1901-2021). The blue wave has occurred 20 times (top row), while the red wave has occurred 14 times (bottom row). The annualized performance for both parties is ~8% while having control in Washington, Senate, and House.

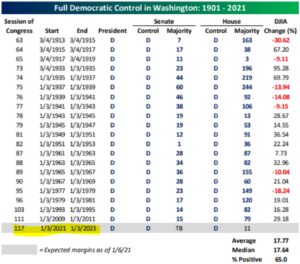

We can dig deeper on market returns during blue wave occurrences…

Source: Bespoke Investment Group

We’re not making an absolute claim on what the market does next based on which party is in power. Simply, the outlandish predictions of doom because a certain party has control is not supported by empirical evidence.

More interestingly, despite our political climate being more polarizing than ever, the market did not care about the dysfunction in Washington nor the too-close-to-call election.

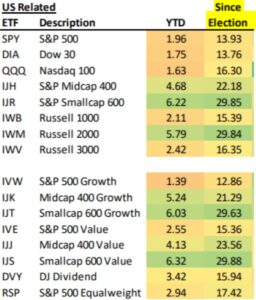

Source: Bespoke Investment Group

The above chart shows various U.S. equity ETFs with post election returns (as of 1/8/2021). If someone told you in September 2020 that we would not have a President a week after the election, it would be hard to fathom the above returns.

There’s a lesson here and it has nothing to do with politics, elections, or parties.

When one asks “what is the impact of the election on the market?,” they’re isolating one variable (the election) and assuming the millions of other variables in the global economy remain fixed.

That’s not how complex systems work.

Take chess for example, if I make a move, the rest of my pieces remain fixed. I can isolate the impact of every individual move. Clear cause and effect in a fixed system.

Global financial markets do not work that way. In complex systems, nothing remains fixed. Everything is changing. Asset prices, interest rates, capital flows, infection rates, vaccine timelines, I could go on and on.

It’s impossible to draw a cause and effect from one data variable, the election, and use it to explain what is going on in financial markets.

The post election market returns exhibit a complex system in action. There was no election result. The resulting uncertainty was deemed to be bad for financial markets, but there was progress on a vaccine, which was another variable in a complex system.

Be careful about making investment decisions based on one variable or event, even if it seems like a big deal. Failure to recognize the complexity and ever-changing nature of the global financial system can lead to incorrect cause and effect conclusions.