“Just remember that 10 of the last 13 Fed hiking cycles have been miscalculations that ended in recession.”– David Rosenberg, Chief Strategist at Gluskin Sheff.

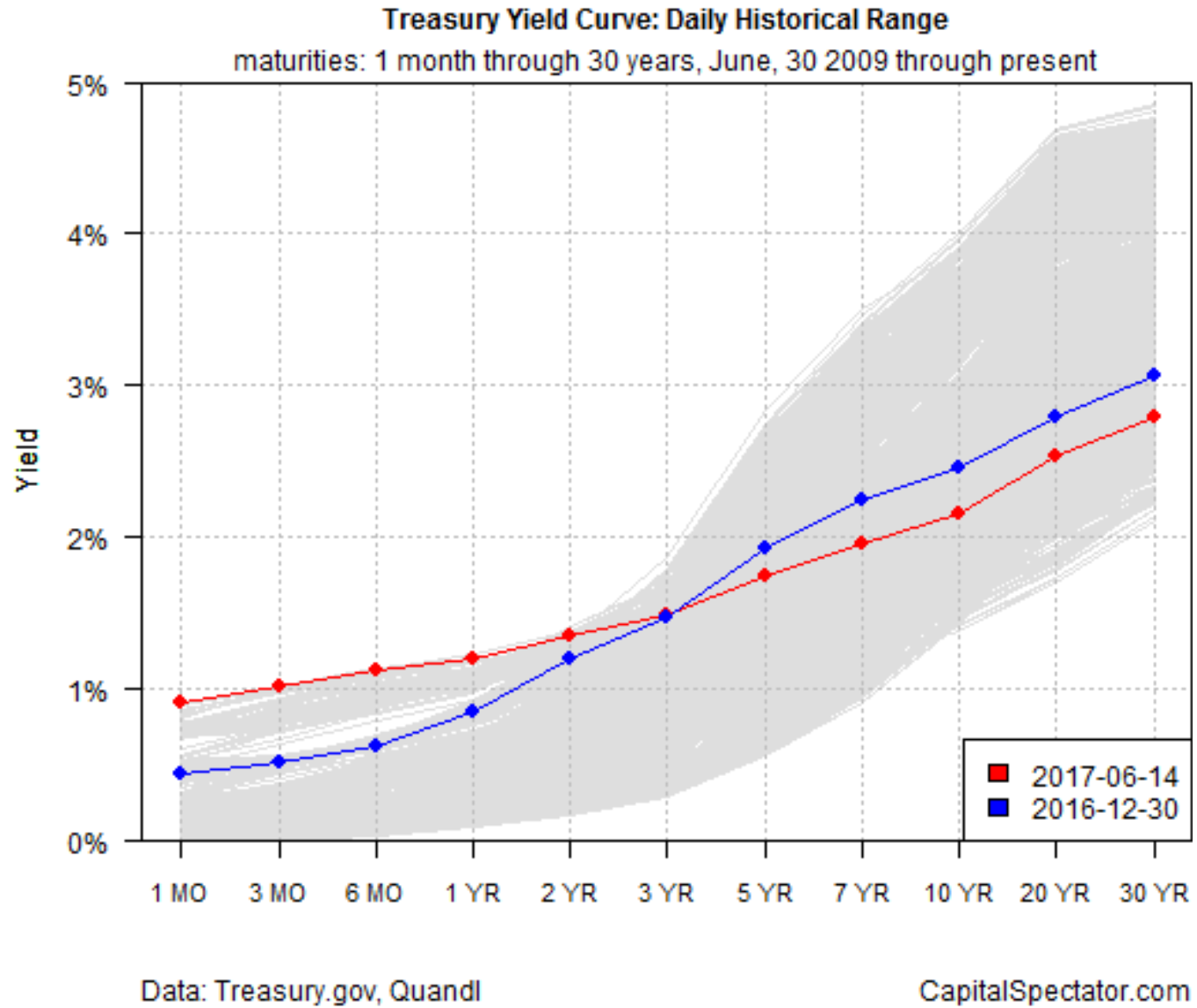

Fed has raised short term interest rates twice in 2017. Long term bond yields haven’t budged in a show of defiance. The bond market isn’t buying what the Fed is selling i.e. improved economic fundamentals.

Who should you believe? We’ll take bond investors for $500 Alex.

The Fed has been abysmal at projecting growth habitually being perma-optimistic (The Fed is Bad at Predicting the Future). Furthermore, long term bond yields have moved lower despite a mainstream belief that we are in a “rising rate environment.” Long story short, the bond market is extending a giant foam finger to the Fed.

The red line shows long term bond yields have moved lower since end of 2016 (blue line).

Let’s back up for a minute. The Fed has a dual mandate for price stability (managing inflation) and full employment. You can argue the box can be checked for employment, although we would argue wage growth and quality job creation leave much to be desired. On the inflation side of the ledger, results are more complicated. Rising home prices and an appreciating stock market favor raising interest rates to prevent excessive risk seeking. The collapse in oil prices and uneven/sluggish GDP growth favor a more patient approach from the Fed. Historically, the Fed raises short term interest rates to pump the brakes on an overheating economy.

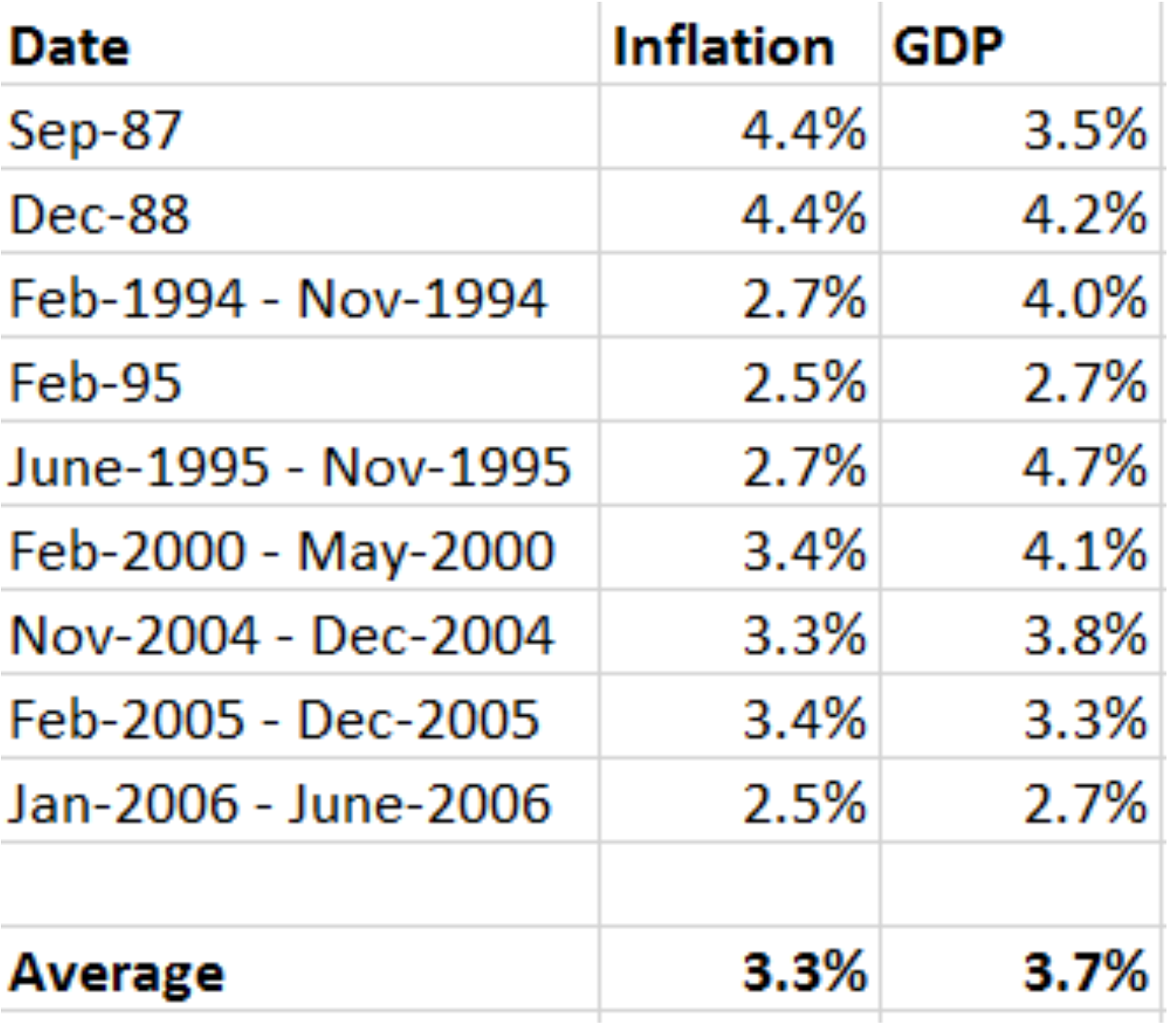

Let’s look at inflation and GDP growth from past Fed tightening cycles for context*:

Source: New York Federal Reserve.

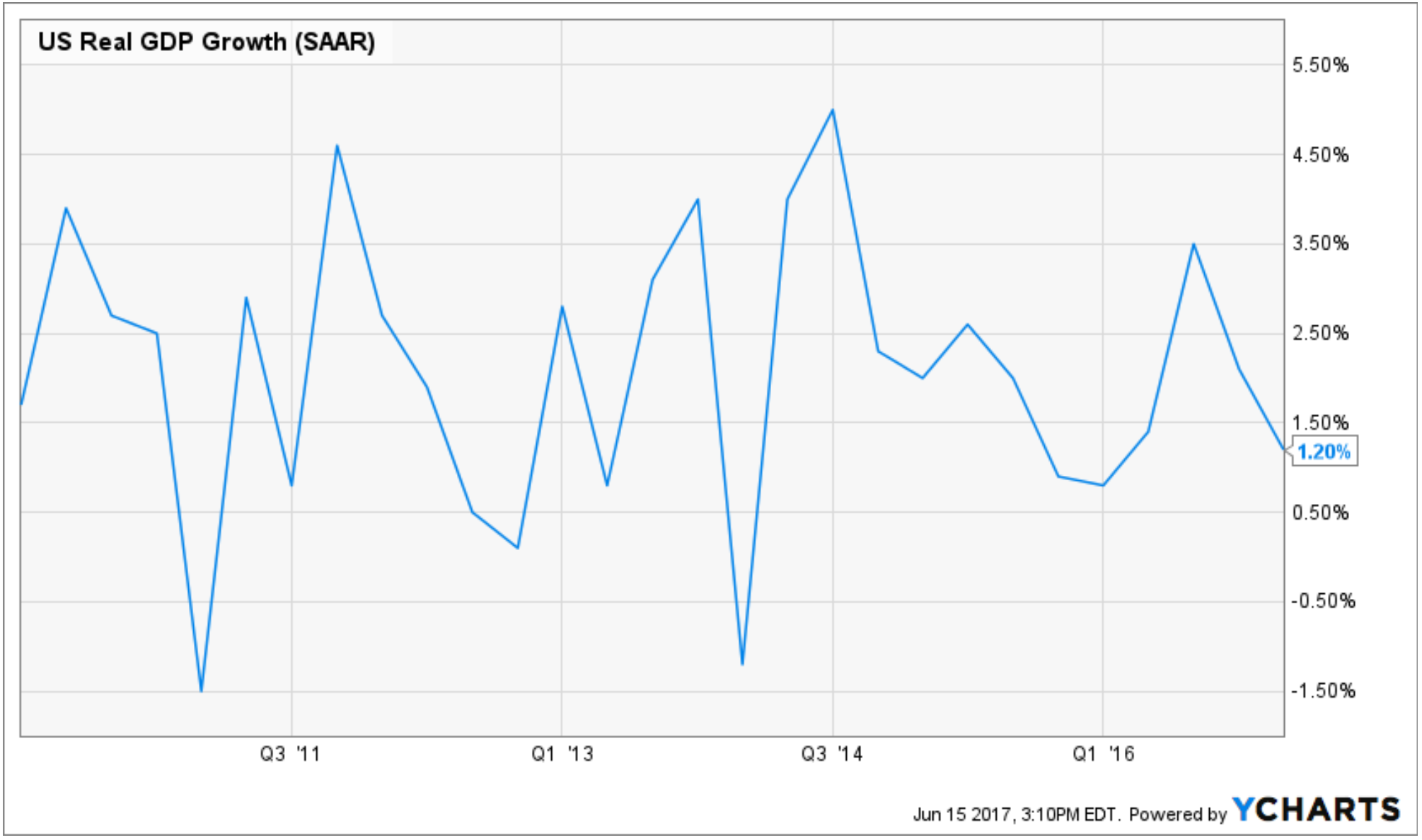

Now let’s look at GDP and inflation trends currently:

U.S. GDP growth well below historical averages during Fed tightening.

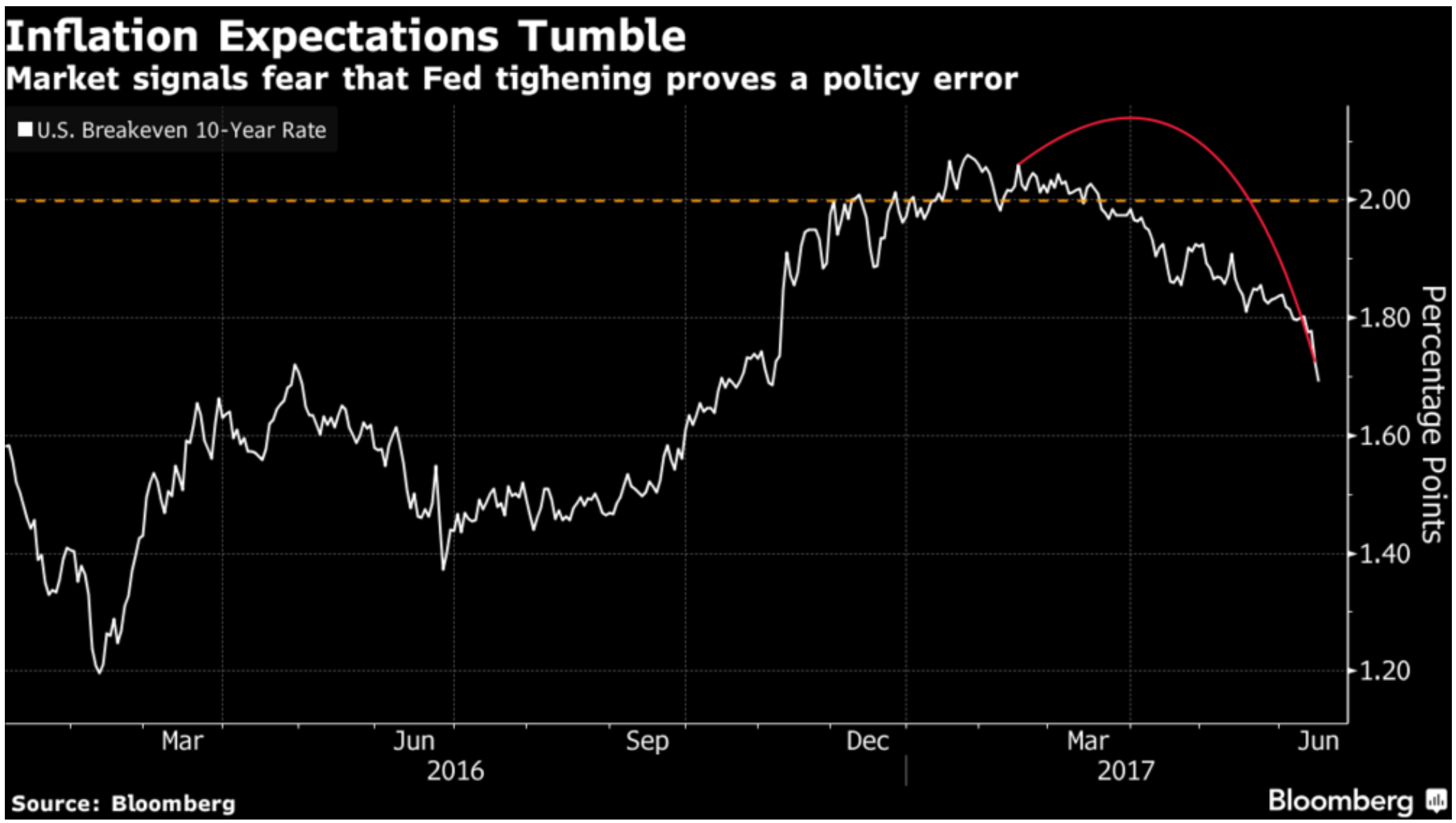

Inflation expectations trending down. Source: Bloomberg.

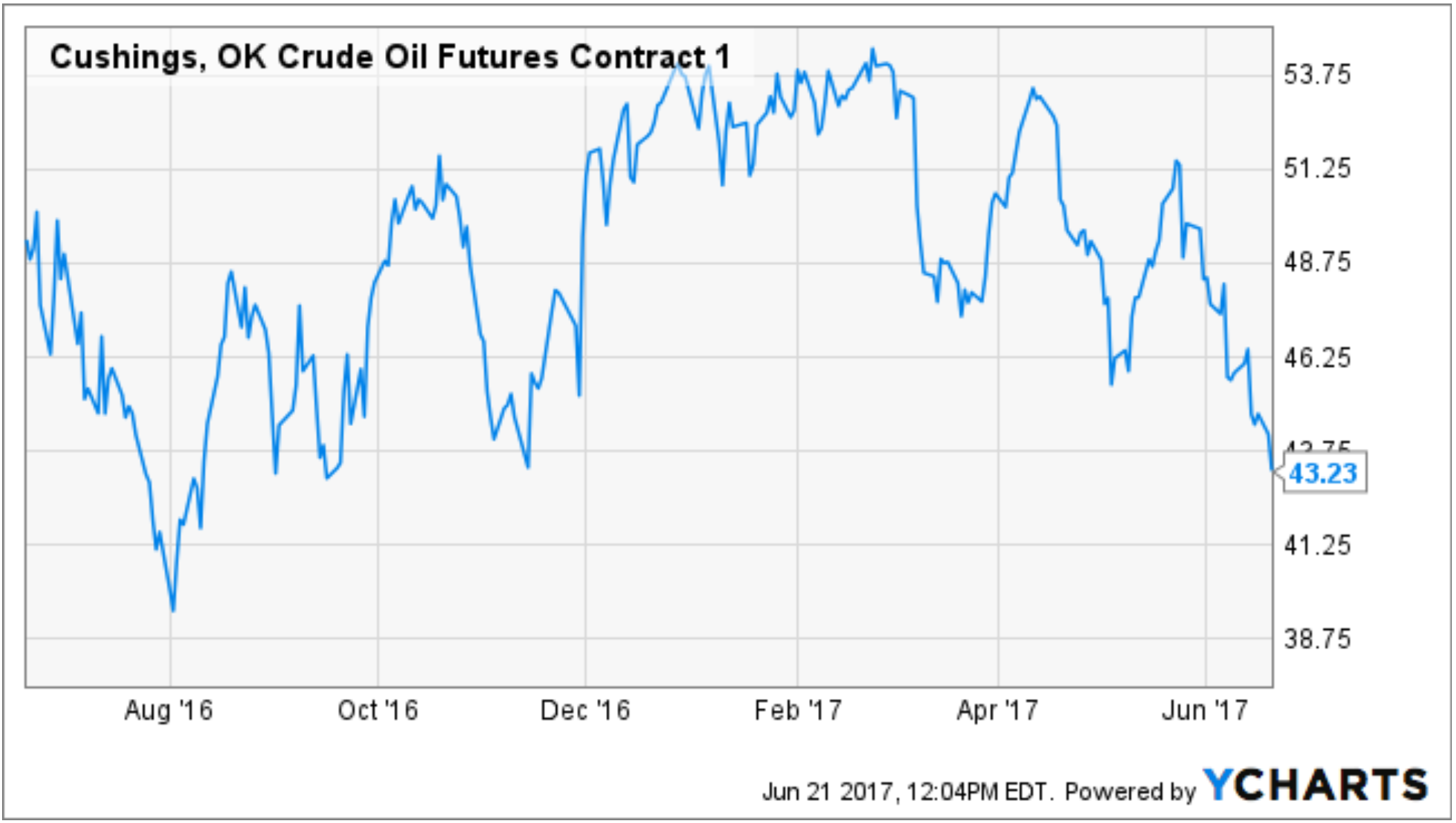

The cratering of oil prices isn’t inflationary.

Is the Fed hiking into economic weakness? It looks that way.

We have been on record stating monetary policy error is the biggest risk for financial markets. The Fed is betting the recent softer data is transitory and rate increases are justified. Bond investors aren’t buying it and neither are we. In our opinion, we would be shocked if the Fed increased rates again in 2017.

*Data from 1987 which marked the start of Alan Greenspan’s tenure as Fed Chairman (August 1987-January 2006).