“There’s nothing people love more than a Federal Reserve joke.” – Adam McKay, American screenwriter

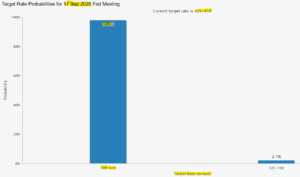

After months of speculation, markets have fully priced in a September rate cut. CME FedWatch puts the odds at nearly 100%.

Beyond the soaring stock market, there’s an uneasy undercurrent — the Fed’s timing, political pressure, and the resilience of the economy make this a potentially odd rate cut.

Source: CME Group

The above chart shows the odds of a 0.25% rate cut near 100% during the September Fed meeting.

Inflation is still above the Fed’s 2% target. The job market isn’t flashing recessionary signals. The S&P 500, Nasdaq, Bitcoin, Gold, real estate, and pretty much every other asset class is at or near all-time highs. It all adds up to one of the oddest rate cuts in history.

Pressure from the Top

The noise isn’t new, but it’s louder. President Trump has been leaning on Fed Chair Jerome Powell to cut rates, framing it as a necessary step for economic momentum. Powell insists the Fed is “data-dependent,” but political pressure adds a layer of skepticism to any policy shift. Whether Powell admits it or not, markets know the political optics are impossible to ignore.

While the Fed is independent, President’s publicly angling for lower rates is nothing new.

George H.W. Bush (1991–1992) criticized Fed Chair Alan Greenspan for not cutting rates fast enough. Bush even said he blamed Greenspan for his 1992 election loss.

Lyndon B. Johnson (1960s) summoned Fed Chair William McChesney Martin to his Texas ranch in 1965, reportedly pushing him against the wall to argue for lower rates to fund the Vietnam War and Great Society programs.

The Taylor Rule

The Taylor Rule was introduced by economist John B. Taylor in 1993 and is often used as a benchmark to judge whether Fed policy is “too loose” or “too tight.”

The two main inputs of the Taylor Rule are inflation and economic output.

If inflation and economic activity are running hot, the Fed would raise rates.

If inflation and economic activity are below capacity, the Fed would cut rates.

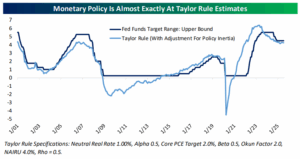

Source: Bespoke Investment Group

The above chart shows the Fed Funds Target Rate (dark blue) vs. the Taylor Rule’s neutral rate (light blue). The current Fed Funds is right in-line with the Taylor Rule indicating a cut might be premature.

According to the Taylor Rule, the current federal funds rate sits near neutral, neither overly restrictive nor overly stimulative. Inflation is cooling but still above the Fed’s 2% target, and growth metrics remain resilient. Cutting now raises two questions…

- Is the Fed signaling that inflation is beaten?

- Is the Fed quietly acknowledging a softer labor market and downside economic risks ahead?

If the goal is to preempt an economic slowdown, the Fed risks sending mixed messages, especially when consumer spending, corporate earnings, and asset prices remain healthy.

Inflection Points Breed Confusion

The Fed was too late increasing rates coming out of the pandemic.

Some say the Fed is too late cutting rates in 2025.

We’ve seen this movie before. Every time the Fed moves from a hiking cycle to a pause—or from a pause to cuts—folks tend to get worked up. Short term economic, employment, & inflation data is noisy. Investor positioning becomes a game of “obsess over every monthly report.”

The September pivot is no different, and history suggests volatility will rise as investors debate whether this is the start of a sustained easing cycle, one-off trim, or (gulp) a policy mistake.

Cutting Into Strength

Equities are at all-time highs. Credit spreads remain tight. Corporate earnings are robust. The consumer is still spending. Economic data—while mixed—is far from recessionary.

Cutting rates into asset price strength and broad economic resilience is quite rare. The market likes it (of course), but it raises the risk of feeding asset bubbles rather than providing genuine economic insurance.

Historically, the Fed would cut interest rates to boost economic activity and/or stimulate the job market. If the Fed cuts during a non-crisis time, does it have the ammunition to handle a real economic slowdown?

Market Implications

Asset prices have sniffed the rate cut out and have been going gang busters.

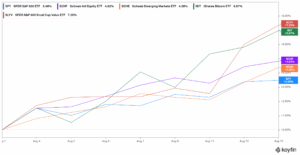

Source: Koyfin

Source: Koyfin

The above graph shows several equity asset classes from 8/1 – 8/13. The “softish” job report on 8/1 combined with in-line July inflation have boosted most every risky asset. Could equities, especially overvalued U.S. large caps, be getting a bit frothy?

If the Fed cuts with inflation still above target, it will be a communications challenge. The message could be a victory lap over inflation—or a subtle admission that employment and growth are weakening faster than they appear in headline numbers. Either way, the Chairman Powell’s commentary during the September meeting will be as important as the move itself.

The September cut may look like a gift to markets, but history shows that Fed pivots are rarely as simple as they seem. The bigger question isn’t if the Fed cuts—it’s what the cut says about what’s coming next.

If you have questions about what interest rates cuts could mean for your portfolio, shoot us a note insight@pureportfolios.com