“Self-control is a key to investing success, but so is fending off self-delusion.” – Jason Zweig, Wall Street Journal & financial author

I tend to ask non-traditional questions to potential job candidates. I have little interest in the technical knowledge of the answer. I’m very interested in the process and delivery of the answer.

I asked a potential candidate about their sales goals and prospecting requirements at their current firm.

They answered along the lines of, “I’m very good at closing business.”

Most employers would like that answer. I hated it.

I would have preferred, “I’ve had some success at bringing in new clients, but I’m eager to improve and refine my approach.”

The first answer represents a fixed mindset. The candidate had good intentions (and might excel at bringing in new clients), but it gives off a “I’m a finished product,” type of vibe.

The second answer represents a growth mindset. The candidate has a decent track record and is open to feedback and improvement.

You might call me crazy, but the subtle difference can be potentially huge in life and investing.

Here’s how a fixed and growth mindset might affect the behavior of an investor.

First a disclosure: A growth mindset doesn’t mean someone is always right. It doesn’t mean generating the best returns. It doesn’t mean an investor is the smartest person in the room.

In my opinion, the mindset of a growth investor reflects the humility to admit you don’t know anything.

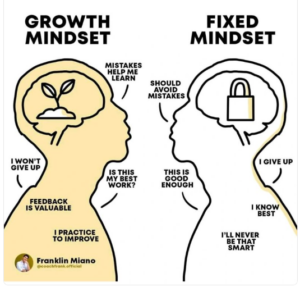

Source: Franklin Miano @coachfrank.official

The above graphic shows the difference between a growth mindset and fixed mindset. It’s been said that those with a fixed mindset believe they are a finished product. Those with a growth mindset seek continuous improvement.

How can we apply a growth mindset to make better investment decisions?

Let’s look at a few scenarios and how a person with a fixed vs. growth mindset might respond.

Outcomes vs. Process

Fixed: I’m down for the year. What the heck happened? I’m not very good at investing.

Growth: Although the results aren’t what I wanted, I’ll continue to refine my investment process and look for opportunities to improve.

Inability to Change One’s Mind

Fixed: The market is going to tank next quarter. I’m 100% sure of it.

Growth: The world is a complex system with thousands of variables. It would be foolish to think anyone can predict what happens next. I can assign a probability to several different outcomes with the understanding that I’m probably going to be wrong.

Focus on the Non-Essential

Fixed: Watches CNBC every day. Scrolls phone seeking out market narratives that jive with personal views. Curates like-minded individuals on social media.

Growth: Has developed a solid information filter over the years. Consumes financial news from trusted or independent sources. Will seek opinions that challenge personal views. Will focus on the things that are within their control i.e. risk exposures, asset allocation, taxes, behaviors, financial planning process.

Blame External Factors for Failures

Fixed: I predicted a market crash, and it would have happened if the Fed hadn’t come to the rescue. I’m still going to sit in cash and wait for a better entry point.

Growth: What can I learn from previous cycles of Fed intervention and the markets potential response?

Take Credit for Successes

Fixed: I had great results this year. I knew the market was going to crash. I’m an investment savant. I’m going to tell all my friends about my investment expertise.

Growth: I was positioned correctly for the current market environment. However, I know that the lines are blurry between luck & skill, especially in the short-term. The market has a way of humbling over-confident investors.

Here are a few characteristics of an investor with a growth mindset…

- Embrace humility. Markets have a way of making every investor look foolish from time to time

- Focus on the process rather than the outcome

- Understand there is a fine line between luck and skill

- Be open to constructive feedback

- Think in probabilities rather than absolute outcomes (avoid narratives and predictions)

- Be able to change one’s mind

- Understand how your investment thesis could break down

- Seek continuous improvement

I often tell people the longer I work within investment management, the less I know. Some might take that the wrong way, but it’s an acknowledgement that randomness does happen. Look no further than the past 3+ years.

In my opinion, we would all do better to adopt the growth mindset for life & investing.

Have questions or feedback? Shoot us a note at insight@pureportfolios.com