“It’s OK to not have an opinion on topics you don’t know anything about. And I don’t know anything about coronaviruses. But I have a few thoughts about how people think about risk.” – Morgan Housel, The Collaborative Fund.

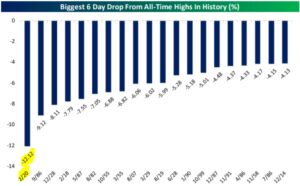

The past few weeks have been quite the adventure. The S&P 500 had its worst six-day decline in the history of the index. Fears of a global pandemic due to the COVID-19 virus threatened global supply chains and the flow of goods and services. Central banks around the world, including the Fed, have cut interest rates and pledged future monetary policy support to stabilize financial markets.

We are not experts on virology nor qualified to give opinions on the future prospects of the COVID-19 virus. However, the market has had much to say the last few weeks. Here’s what we’re watching…

Source: Bespoke Investment Group

The above chart shows the biggest six day market declines from all-time highs in history. The recent swoon was unprecedented in its intensity and swiftness. If an investor was taking outsized risk, the market let you hear about it.

Conversely, traditional safe haven assets i.e. Gold, U.S. Treasuries, held up quite nicely. It turns out our recent post about the merits of investing in quality bonds at low yields was well-timed!

Source: Ycharts

The above graph shows price action for short (orange) & intermediate term U.S. Treasuries (blue). Gold (red) has also provided stability to portfolios. The current environment is precisely why risk-sensitive investors should own boring, safe-haven assets.

Despite China being the epicenter of the COVID-19 outbreak, its stock market has been one of the best global performers (see below). Go figure. Another prime example of the unpredictability of financial markets.

Source: Ycharts

The above chart shows equity market performance for several countries in 2020. It’s tough to reconcile how China has outperformed its global peers by a considerable margin.

To start the year, the Fed was supposed to be on cruise control holding interest rates steady. How quickly things have changed. Not only did the Fed cut rates by 0.50% in-between meetings, but the futures market is now predicting four interest rate cuts by year-end. Historically, emergency Fed interest rate cuts have not been a good thing for stock returns.

Source: Bespoke Investment Group

The above chart shows S&P 500 forward performance after an intermeeting Fed interest rate cut. The average return for the following 12 months is -8.86%. No one can tell if the previous relationship will hold, but one could make a strong case that caution is warranted.

The wild swings of the past couple weeks are reminiscent of a darker time. Volatility tends to cluster during difficult periods.

Source: Ben Carlson, Ycharts, Fortune

The above chart shows volatility clusters during 2008-2009 & the end of 2018. The recent action hasn’t been quite as wild, but some of the daily intraday swings have been pronounced.

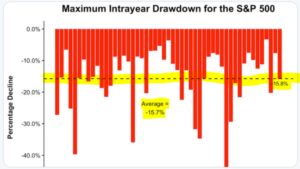

Despite the recent market action, we are still in-line with historical intra-year drawdowns ~15.7% for the past 50 years.

Source: Bespoke Investment Group

Despite virtually every CEO citing that coronavirus will affect their business in 2020, analyst earnings estimates haven’t budged (yet).

Source: Bespoke Investment Group

The above chart shows analysts’ 12-month forward earnings estimates. Could there be more stress ahead once the impact of the coronavirus on earnings becomes more clear?

The collection of charts isn’t meant to spread fear or predict doom. Rather, it’s a reminder that the range of potential outcomes, especially in the short-term, is extremely wide. We were surprised at the number of folks who were certain the recent market action signaled a buying opportunity. That position might have merit if the investment horizon is 20 years, but could be met with disappointment over the short-term. The last 11 years have programmed U.S. investors to believe any market dip will snap back immediately. There are enough yellow lights to ask, “but what if it doesn’t?”

In our opinion, it’s arrogant and reckless to pretend to know how trillions of dollars of global capital is going to respond to an unquantifiable virus. We encourage investors to proceed with caution, tighten up risk exposures, and optimize what they can control.

The market is talking, are you listening?

To find out how Pure Portfolios navigated the recent drawdown, please click here or respond to the Sunday Coffee Reads email.