“Nobody likes high interest rates.” – Chanda Kochhar, CEO of ICICI Bank

Interest rate prognostications have taken on a life of their own. Like a doomsday prepper, it’s not unusual to hear “if interest rates go up, then (insert asset) will get crushed.”

“Bonds will get crushed”

“Stocks will get crushed”

“The U.S. will go into a recession”

Why do we have such strong feelings about rising interest rates?

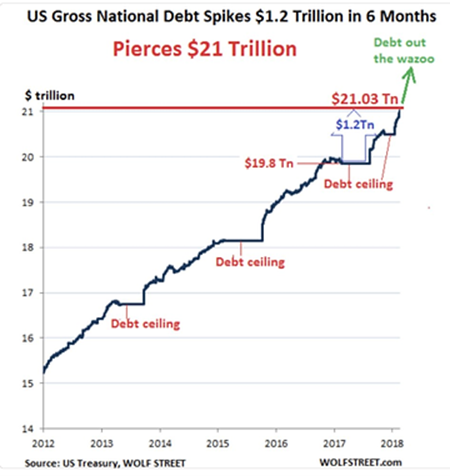

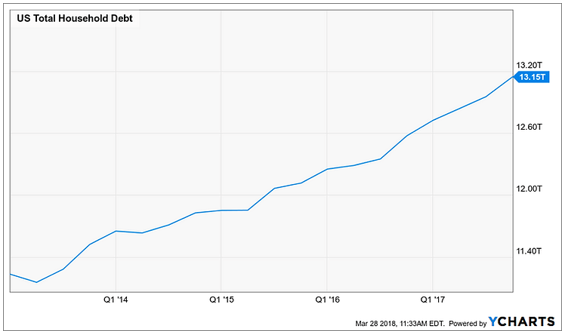

The most obvious is we are a nation of indebted consumers from the federal government on down to the household level. Higher interest rates mean borrowing costs go up.

More intimately, the cost of money affects our mortgage payment, car payment, credit cards, and student loans. In addition, some of us might work in a profession that’s heavily influenced by the cost of money. Think mortgage lenders, real estate agents, bankers, car salesperson, etc. People have strong feelings about interest rates because the impact is felt in our everyday lives.

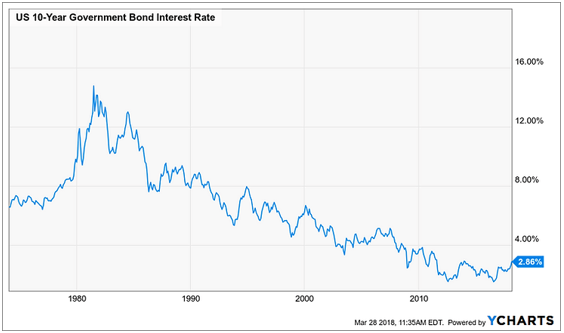

From an economic perspective, a prolonged period of rising interest rates hasn’t happened in the past 30 years. It’s been so long we don’t remember what actually happened or we weren’t old enough to understand. The result? We fill our knowledge gap with nonsensical information that can lead to destructive decisions.

You can barely notice the recent uptick in U.S. Treasury yields.

The financial media does their part to stoke our fears…

What’s the point? Our aim is to provide an evidence-based look at what’s happened during past tightening cycles and how we position ourselves to benefit from increased interest rates.

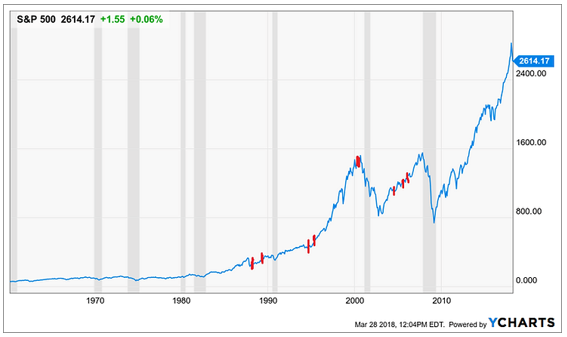

S&P 500 performance:

The mini-red lines mark Fed tightening cycles. My artistic ability is admittedly terrible, but the point of interest rate increases doesn’t always equal lower stock prices stands.

Since 1971, the S&P 500 has advanced in eight of the past nine rising rate periods, according to S&P Dow Jones Indices. Total returns, including dividends, have averaged 20%, during these times.

Bond performance:

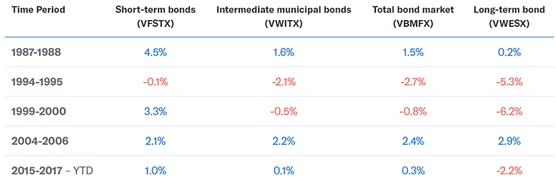

Despite several time periods of rising rates, bonds still posted positive returns over half the time. Source: Betterment

The above chart shows the last five hiking cycles of the Federal Reserve (time period). The chart shows the worst calendar year performance for different bond maturities. If you piled into long-term bonds in 1999-2000, the worst outcome was a -6.2% loss.

It seems rising interest rates can be a positive for bond investors as we reinvest the coupon payments at higher yields. The biggest risk for bond investors is inflation or the loss of purchasing power.

How can we benefit or position ourselves for higher interest rates?

- Live within your means – I have yet to meet a person with zero debt go broke.

- Get rid of high interest rate debt

- Get rid of variable rate debt – this is usually tied to LIBOR and will adjust your payments higher as rates increase

- Have a mix of bond maturities in your fixed income portfolio.

- Find a better home for your cash (see Want More Yield on Cash?)

To summarize, if you’re a saver or investor rising interest rates are a positive. If you’re a borrower or indebted rising interest rates are a negative. Your personal narrative will be different depending on what your balance sheet look like.