We recently came across a do-it-yourself (DIY) investor, let’s call him Cecil. Cecil firmly proclaims he hates technology stocks and doesn’t feel comfortable owning Tesla, Facebook, Apple, Amazon, Neflix, or any other high flying tech stock. Fair enough.

Cecil goes on to say that he owns a substantial percentage of his investable assets through an S&P 500 index fund.

My internal radar begins to flash red.

For the record, there is nothing wrong with Cecil’s position in the S&P 500. However, owning the S&P 500 as your biggest position is not consistent with hating technology stocks. In fact, it’s the opposite:

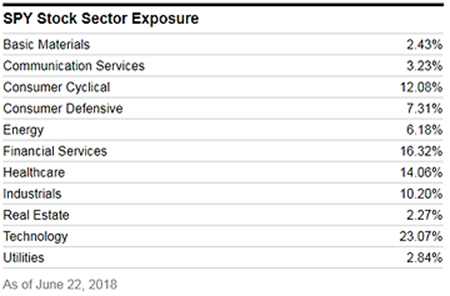

The above chart shows the sector weights for the S&P 500. Technology is by far the biggest sector at over 23% of the index.

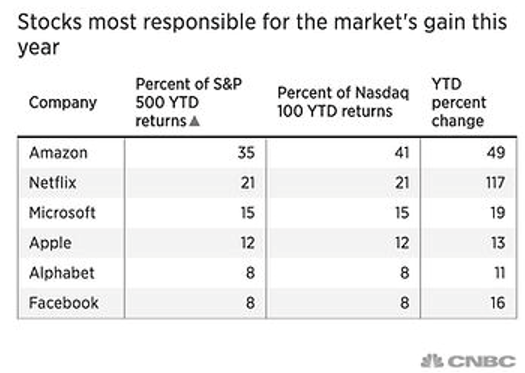

The S&P 500 is a market-cap weighted index. In other words, the biggest companies by market cap (share price * shares outstanding) comprise a greater percentage of the index. Another way of saying this, is that a handful of stocks “explain” a good chunk of the S&P 500’s performance. In fact, many of these stocks are large tech companies.

To simplify the above chart, if the S&P was up 10% this year, Amazon would “explain” 35%, or 3.5%, of return.

To summarize, Cecil owns a great deal in a sector he absolutely doesn’t want to own: technology. Even more dangerous, it seems likely Cecil is unaware of his “indirect” tech exposure.

How does this happen?

In short, the underlying composition of an index evolves over time. The S&P Dow Jones Indices (division of S&P Global) investment committee decides which companies are included in the index every quarter to proxy the U.S. equity market (some argue the process is subjective and the “passive” index is very much active in its construction and ongoing management).

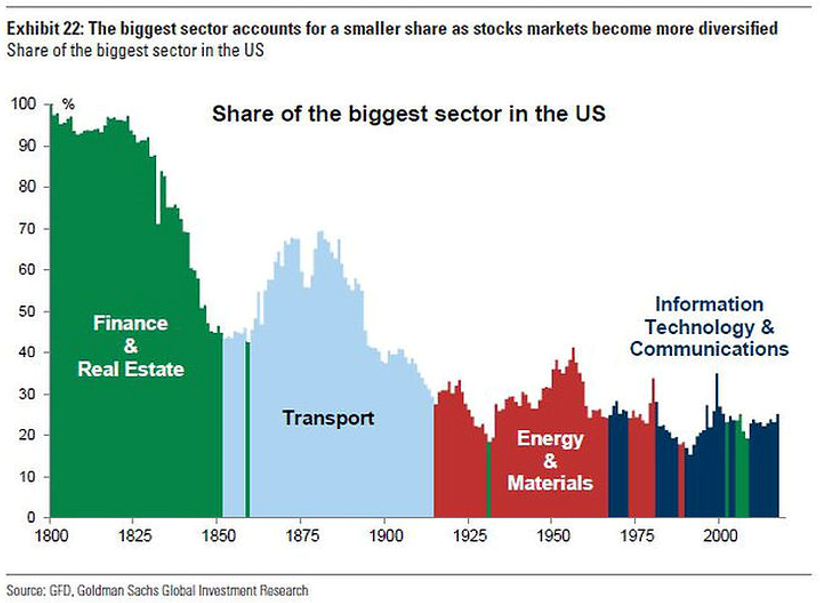

Furthermore, a broad index (like the S&P 500) will mirror the underlying economic progression of a country, in this case, the United States.

The above graph shows the biggest U.S. sectors through time. You can see the shift in the dominant sectors as the nation matured and evolved. Despite the technology sector’s 23% weight, it seems the U.S. economy is more diverse than at any point in our history.

Before taking a large position, it’s imperative to know what you own and if it fits within your investment personality. This sounds ridiculously easy, but good market environments can mask all sorts of garbage.

As evidence-based investors, we understand index composition can change over time. The good news is the transparent structure of index funds are relatively easy to track. You might have a more difficult time if you own active mutual funds or alternative strategies (hedge funds, private equity, SMAs).

Our friend Cecil still hates technology stocks, but now he has a portfolio that reflects his investment principles.