“The stock market is the story of cycles and of the human behaviour that is responsible for overreactions in both directions.” – Seth Klarman, CEO Baupost Group

After being left for dead during the Great Recession, the 100% stock investor has been brazenly strutting around for 11 years. It didn’t matter which pitch they took a mighty hack at, it usually ended up being a hit. As my uncle would say after a string of good luck, “you could fall in a pile of dog crap and come out smelling like a rose.”

Source: Novel Investor

The above asset quilt shows a relatively uninterrupted streak of impressive gains for the riskiest corners of the market.

The all-equity investor just experienced a golden decade. Confidence was sky-high and previously acceptable return figures of 6-8% suddenly weren’t good enough. We actually had a client close their “boring” balanced portfolio to focus on their best performing investments (I actually took the intended slight as a compliment, good investing is supposed to be boring).

Then a global pandemic erased three years of gains overnight…

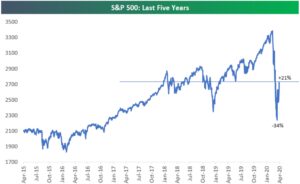

Source: Bespoke Investment Group

The above chart shows the S&P 500 over the past five years. Notice the -34% free fall on the S&P is consistent with January 2017 levels.

Suddenly, nothing worked. Good companies were being sold off with the bad. Solid dividend payers were getting crushed. There were talks of defaults, mass layoffs, dividend cuts, banks failing, government bailouts, and the “D” word was being thrown around.

Welcome to the plight of an all-equity investor.

One minute, you are printing money. Investing seems easy. Just pick a ticker symbol and watch the gains accumulate. The next minute, you are getting hit with deep paper losses with no end in sight.

If you stuck it out without a second thought, you are equipped to handle the volatility of being an equity owner. You understand that investing in stocks is risky, with outcomes both good and bad. You feel confident that over time your patience will be rewarded. If you hold idle cash, you move quickly to invest in areas you liked before, but are now getting shares at a lower price. You don’t try and time the bottom. You’re in this for the long haul and realized trying to predict short-term moves in the market is a loser’s game.

Congratulations, you are truly an all-equity investor.

If on the other hand, you are shocked that your all stock portfolio is down -35% in 30 days. You are completely caught off-guard by what’s going on. You have a strong urge to sell-out to minimize losses. Your gut instinct is fairly certain things will get worse before they get better. The articles you’re reading on the internet confirm your pessimistic views. For now, you will park money in cash and bonds. You feel confident about buying back in when things calm down.

We hate to be the bearer of bad news, but you are not equipped to have 100% of your portfolio in stocks.

For Pure’s 100% stock portfolios, we do not hedge nor raise cash when things get tough. We don’t buy bonds or any other risk-reducing asset classes (just like we wouldn’t buy equities in a 100% bond portfolio). Why? In short, this is precisely what all-equity investors signed up for. The true equity investor understands the rollercoaster isn’t a bug in the system, but rather the cost of admission.

Embracing risk during good times and shunning risk during bad times isn’t an investment strategy, it’s market timing. The sell part of timing is easy. You click sell and the pain stops. The losses can’t get any worse. You instantly feel relief. The part investors get wrong virtually 99% of the time is when to buy back in. There isn’t an “all-clear” bell that rings at the bottom. Furthermore, the greater number of market-timing decisions one makes (jumping in and out of stocks), the higher likelihood of making a grave error.

“What you do over the next few months will likely decide the next 5-10 years of returns. Everyone looks back and wants a shot at buying in 2008-09. You might get it now. Do you have the stomach for it?” – Ian Cassel, Microcap investor.

The COVID sell-off was unpleasant, but the damage wasn’t an outlier by historical standards.

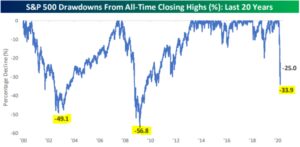

Source: Bespoke Investment Group

The above graph shows S&P 500 drawdowns for the past 20 years. The sell-off was swift, but not out of the ordinary for stocks.

Just when you felt the absolute worst, the S&P did this…

Source: Ycharts

The above graph shows the massive ~23% rally from the end of March to April 20th. The violent moves of the past couple months are a case study on why market timing is so hard. The market beats you down with a ~-35% hit, you throw in the towel, and stocks explode higher in a logic defying rally.

If you stayed the course or saw opportunity, you passed the test. You are well-suited to the plight of the all equity investor.

If you panic-sold or were baffled by the steep losses, it’s okay to admit defeat and rebuild your portfolio with your newfound knowledge.

The best investment plan is one that doesn’t come off the rails when things get hard.