“I’ve found that investors who rely on crystal balls frequently wind up with crushed glass.” – Martin Zweig, famous investor

I haven’t seen anything like it in my ~20-year investing career. This period includes the Great Financial Crisis, several wars, the U.S. losing its AAA credit rating, and COVID.

The last 18 months topped ’em all.

The number of doomsday investors coming out of the woodwork is off the charts.

I have theories on why this is so, but I needed to dig deeper.

I’m not the only one who has noticed entrenched pessimism.

Michael Antonelli, Market Strategist at R.W. Baird, wrote…

“We are running a great behavioral experiment where we pump negativity into humans 24/7. News. Socials, etc.”

Mr. Antonelli’s comments are not anecdotal. There is evidence to back it up.

Mainstream media has figured out stories that elicit fear, anger, and disgust sell.

Source: George Mack, Twitter @george__mack

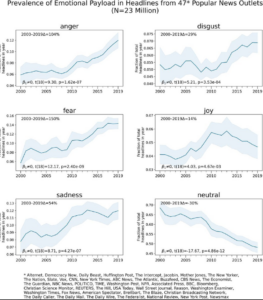

The above graphic shows the emotional payload in headlines from 47 popular news outlets from 2000 -2019. Since 2010, the media has figured out anger, fear, disgust, and sadness drive more clicks, opens, and eyeballs (which leads to more ad revenue). Stories that are neutral or joyful are less interesting thus drive lower engagement.

It’s not just mainstream news outlets who sell fear. There’s a huge faction of authors, experts, bloggers, and influencers that have created successful businesses (subscriptions, newsletters, investment clubs, YouTube channels, etc.) selling fear. The below graphic is one example from Robert Kiyosaki , author of Rich Dad, Poor Dad (in fairness to Mr. Kiyosaki, there are thousands of doomsdayers that have created online businesses selling fear).

Source: Robert Kiyosaki, Twitter @therealkiyosaki

The above graph show Mr. Kiyosaki’s tweets, which proclaim dire warnings about market crashes, real estate crisis’, economic depressions, and bubbles. The dark line is the S&P 500’s price level since 2009. It turns out, Mr. Kiyosaki is very good at selling books and seminars, but not-so-good at providing investment advice.

“But Nik, I need to know what’s going on in the world.”

Fair enough.

You need to be aware that you are the product. Networks, media, social platforms, and influencers get paid when you engage.

How do they keep you engaged?

By spinning up controversy after controversy. Eliciting fear. Making every problem, your problem.

In our July 22, 2021 post, Intoxicated by Pessimism post, we highlighted how the media keeps you hooked…

Positive scenarios delivered by optimists are shrugged off as aloof and mundane.

Negative scenarios delivered by pessimists are given a microphone.

“Tell someone that everything will be ok and they’ll shrug you off. Tell someone they’re in danger and they’ll hang on your every word.” Morgan Housel

The result is a parade of people, often smart and credentialed, proclaiming how the world gets worse, not better.

What does this have to do with my retirement?

The Wall Street Journal ran a story about how retirees are spending their time. Sahil Bloom, author & influencer, broke down the article on his Twitter feed…

The WSJ released a breakdown of how people spend their time in retirement. It was horrifying.

4.5 hours of TV.

0.5 hours of socializing.

0.3 hours exercising.

The study didn’t break down what the retirees were watching, but it wouldn’t be a stretch to assume it’s a heavy dose of network news.

Men are particularly at-risk of “doom scrolling”.

From Michael Finke, professor at the American College…

“There seems to be an epidemic of men watching hate news all day in retirement according to social media groups of retirees. Men seem to be at risk of addictive antisocial behaviors, making everyone (including themselves) miserable.”

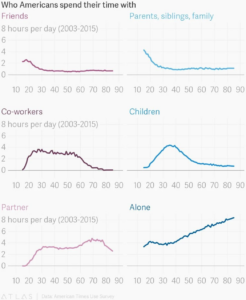

According to Atlas & American Times Use Survey, as Americans age, we spend more time alone (bottom right)…

Source: Atlas, American Times Use Survey

That’s a lot to take in. Let’s recap…

- Retirees spend 4.5 hours per day of TV. We can assume much of this is the daily news cycle.

- The media is ramping up coverage of topics that make people feel worse.

- There’s an army of bloggers, social media influencers, and “market experts” selling doomsday newsletters and seminars.

- Older Americans spend more time alone.

- Men are more prone to consuming “hate news all day” making themselves and those around them miserable.

This might explain why investor sentiment was worse the last 18 months than it was during the Great Financial Crisis. Keep in mind, the market sell-off during the Financial Crisis was steep, falling over 50% from peak (Oct. 2007) to trough (March 2009).

The difference? Back in 2008, most people weren’t glued to their phone, tablet, TV, and laptop 24/7 doom scrolling.

Not surprisingly, the dark disposition is leaking into investment portfolios. According to CNBC, high-net worth investors with more than $1 million have their highest allocation to cash…

Source: Unusual Whales, Twitter @unusual_whales

How can you balance out the “world is going to hell in a hand basket” propaganda machine?

- Understand that fear sells

- You are the product, engagement is the holy grail for news networks & influencers, not favorable viewer outcomes

- Turn off the TV and take a walk

- Accept negative investment outcomes as the cost of admission

- Realistic and likely outcomes are boring and come off as unintelligent, even if they’re the most likely outcome

- Be intentional about the information you consume. If you watch & read everything, you’ll be unable to filter out what’s useful vs. useless.

Imagine your 85-year-old self, sitting on the porch reflecting on your life. Are you going to look back and wish you watched more depressing news?

Probably not.

For more Pure Portfolios content on the negative news cycle, check out our podcast, “Are You a Doom Scroller?“