My Uncle Joe is absolutely convinced the market is going to crash.

He’ll seek me out at family gatherings and say things like;

“Washington is a mess.”

“Government spending is out of control.”

“The Republicans/Democrats will win the next election.”

“The Fed has lost control.”

“Stocks, real estate, bonds, etc. are in a frothy bubble.”

Usually, I’ll just listen. He’s not looking for affirmation or a debate. From a behavioral standpoint, I find Uncle Joe’s unwavering confidence in his beliefs fascinating.

Now, Uncle Joe could be right… eventually. But the real problem is that he’s been saying this stuff since 2015 and his extreme viewpoints have crept into his investment strategy. Having strong opinions and being wrong can be costly. We highlight the understated opportunity cost of being a doomsayer.

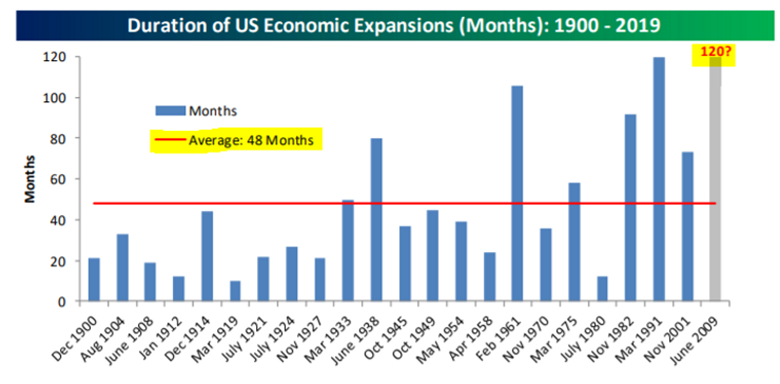

To start, we won’t pretend there aren’t a myriad of legitimate concerns out there (see Uncle Joe’s list). Even the most optimistic investor must acknowledge the sheer length of the current economic expansion.

Source: Bespoke Investment Group

The above graph shows the duration of U.S. economic expansions (in months). The average cycle lasts for 48 months. The current cycle is 120 months and counting!

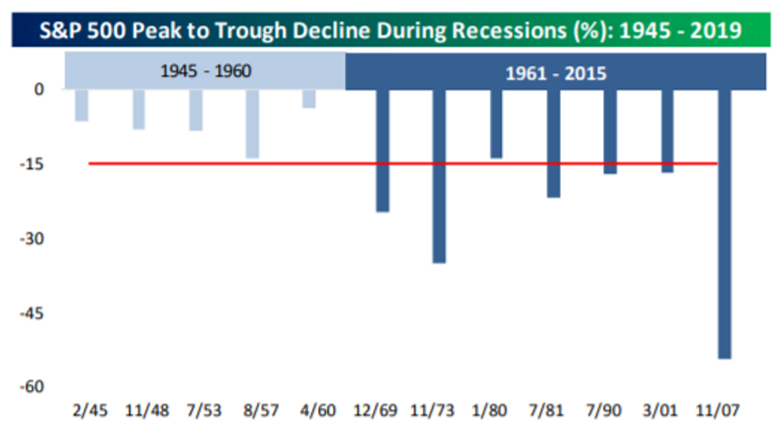

Also, market declines during recessionary periods are getting more intense.

Source: Bespoke Investment Group

The above graph shows S&P 500 peak to trough declines during U.S. recessions. In fairness to Uncle Joe, the most recent recessions have seen the largest stock market declines (1961-2015). Many market observers blame the Fed for creating more violent market cycles.

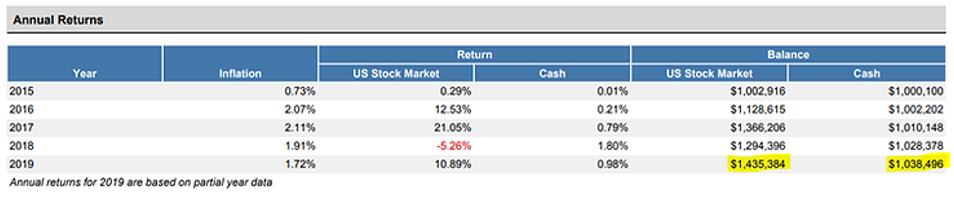

Back to Uncle Joe… I don’t know his exact asset allocation, but he’s shared his affinity for Certificate’s of Deposit (CD’s), money market funds, and holding cash in his bank account. For this exercise, let’s assume he holds 100% cash. Let’s see how he’s done since 2015 vs. the U.S. stock market (remember, that’s when he really became a stock market skeptic).

Source: Portfoliovisualizer.com

The above graphic shows Uncle Joe’s fictitious starting balance of $1,000,000 beginning in 2015. If he invested all of the funds in U.S. equities, he would have a balance of $1,435,384. As it stands, Uncle Joe’s cash has grown to $1,038,496.

It wasn’t all bad for Uncle Joe. He made a little money and avoided some bumps along the way.

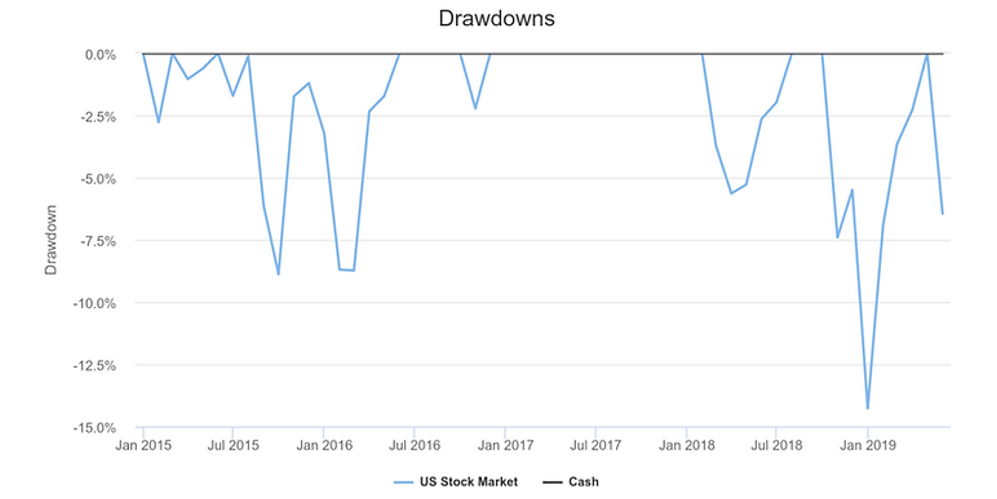

Source: Portfoliovisualizer.com

The above graph shows U.S. stock market drawdowns from 2015 through May 2019 (blue line). Uncle Joe would have avoided a few ~8% declines in 2015 & 2016. He also would have dodged the ugly ~14% decline at the end of 2018.

Let’s look at the final tally for Uncle Joe’s hypothetical investing:

Scenario #1: 100% invested in the U.S. Stock Market Jan. 2015 – May 2019: $1,435,384

Scenario #2: 100% invested in Cash Jan. 2015 – May 2019: $1,038,496

Hindsight 20/20, we can easily see that Uncle Joe would have been better off by $396,888 investing 100% in U.S. equities, but that’s not the point. Let’s dig a bit deeper.

Let’s say Uncle Joe, against his better judgement, decided to invest in 100% equities in 2015. Heading into the 4th quarter of 2018, everything was going swimmingly as the portfolio had grown virtually uninterrupted. Then his worst fear was realized. Uncle Joe’s balance of $1,400,000 suffered a 14% loss or $196,000. His post drawdown balance was ~$1,200,000.

You’ll notice even after the large market drawdown, he was still ahead of his doomsday cash allocation (scenario #2) of $1,038,496.

What can we learn from Uncle Joe?

Being invested doesn’t mean 100% equities. Find a portfolio that provides a happy medium. Stay away from outlier portfolios based on extreme viewpoints i.e. 100% cash or 100% Biotech stocks.

Have a risk management process in place before a market event occurs. Recognize your blind spots as an investor. Document your decision-making process.

Stocks are more risky in the short-term, but historically have been superior in protecting purchasing power over time. Cash is the opposite, much safer in the short-term, but you are almost guaranteed to lose purchasing power in the long run.

Poor Uncle Joe learned that preparing for the next big market crash can often be more penalizing than the actual event itself.

Share your questions and feedback on Twitter @pureportfolios or insight@pureportfolios.com