“Diversification means always have to say you’re sorry.” – Brian Portnoy, founder of Shaping Wealth

“Why do we own these bond ETFs? They haven’t done very well.”

“REITs have stunk. We should just sell them.”

“I’m thinking about putting all my money into the S&P 500. It has done the best.”

Every year, there’s an urge to sell what’s not working and buy more of what is working. This is a common human tendency known as recency bias. We tend to put more weight into what just happened and extrapolate the positive or negative results into the immediate future.

If stocks are up, we assume the good times will continue.

If stocks are down, we assume things must get worse.

In a diversified portfolio, it’s almost a certainty something is not going to work in any given year. In our opinion, that’s a good thing.

Sounds crazy, right? Let us explain…

Why do investors diversify?

It’s the old mental shortcut, “we don’t want to put all our eggs in one basket,” story. Allocating to one stock or asset class can be risky. Most people aren’t willing to bear that risk, hence, taking bets on other asset classes with different risk/return profiles is deemed prudent.

The idea of diversification is to smooth out the ride, decrease an investor’s risk of going broke, and hedge your bets.

It sounds good in theory, but it practice we get two common responses…

1. “Why do I own an underperforming asset?”

It doesn’t do any good to own eight different asset classes if they all behave the same. Something not working over a period means the investor is truly diversified. It might seem like the portfolio is broken, but we would claim an asset not working is a healthy function of a diversified portfolio rather than a sign something is amiss.

It’s darn near impossible to predict which asset class is going to do well, hence, it makes sense to make calculated allocations across various asset classes.

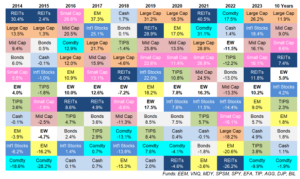

Source: Ben Carlson, A Wealth of Common Sense Blog

The above graph is a color-coded quilt showing the best performing asset classes from 2014 – 2023 and annualized returns over the past 10 years (far right, best performers are at the top). There are several examples of the best performing asset in one year being down in the dumps the following year (REITs 2021-2022, Emerging Markets EM 2017-2018, Cash 2018-2019). In our opinion, that’s why performance chasing is dangerous!

2. “Why is the NASDAQ up 30%, but my portfolio is up 13%?”

There is a price to diversification, which is not maxing out returns. A diversified investor is likely to trail the best performing index or asset class. The flip side is a diversified investor is going to live to fight another day during difficult years.

Most investors, especially retirees or pre-retirees, shouldn’t be looking to swing for the fences every year. A more prudent approach is trying to generate reasonable returns over the longest period of time, while being mindful of risk. That’s why diversification has stood the test of time.

In summary…

- Diversification means something in your portfolio is probably going to be out of favor. This is normal.

- Investors diversify to smooth out returns and mitigate risk.

- It’s nearly impossible to predict which asset class is going to be the best performer in a given year.

- The best performing asset class can find it difficult to sustain gains year over year. This is why performance chasing is dangerous.

- Sound investing is generating reasonable returns over a long period of time, while being mindful of risk.

Have questions? Shoot us an email at insight@pureportfolios.com.