“Never make predictions, especially about the future.” – Casey Stengel, Legendary Baseball Manager.

This might be my favorite topic to write about. In fact, it’s going to be an annual stroll down memory lane to check the accuracy of this year’s market forecasts. We will also look ahead to what our Wall St. friends are predicting for 2019. You can check out our original post from last year here.

We find the exercise of forecasting intriguing, especially when it comes to something as deep, complex, and random as the financial markets. It’s part narrative, hubris, charade, and a drunken uncle spouting nonsense all rolled into one.

Can you imagine how audacious it is to pretend to know what algorithms, computers, artificial intelligence, and human market participants are going to do in a short period of time?

We can’t either.

To be fair, the fact there is an audience for market forecasts says more about us than the forecaster. Wall Street is giving the people what they want. Humans thirst to make sense of an uncertain world. Forecasting offers a sense of control, especially when markets are acting squirrely.

Going back to our original “Tis the Season for Wall St. Forecasting” post, our beef with the prediction game hasn’t really changed. To recap:

Optimistic predictions encourage wealth management clients to stay invested

There is no penalty for being wrong

Story-based advisors can spin anything

Given the rough ending to 2018, we were curious to see how the tone of Wall St. forecasts would change. Surely, the negative market sentiment would temper the return expectations for 2019, right? Wrong.

According to Bloomberg, 2019 market predictions are the most optimistic since 2009. In our opinion, this is nothing short of astonishing with a healthy dose of recklessness.

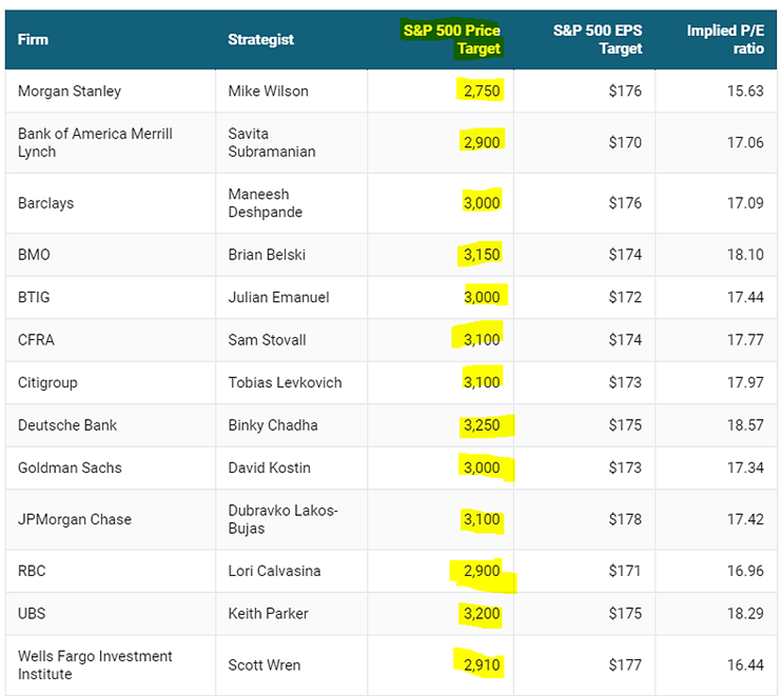

Source: CNBC

According to CNBC, the median strategist see the S&P 500 climbing to 3,000 by the end of 2019. That’s approximately 15% higher than current levels.

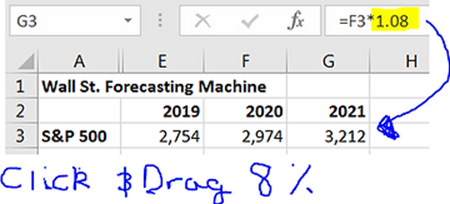

The tidiness of the above forecasts (all hovering around 3,000) has me envisioning massive group-think and wide spread use of the point and drag function in Excel:

The Wall Street forecasting machine = find year end index value, assign an 8% return, point & drag for a perpetually rising market. Give it to client facing associates and have them act like they know what’s going to happen. Easy game.

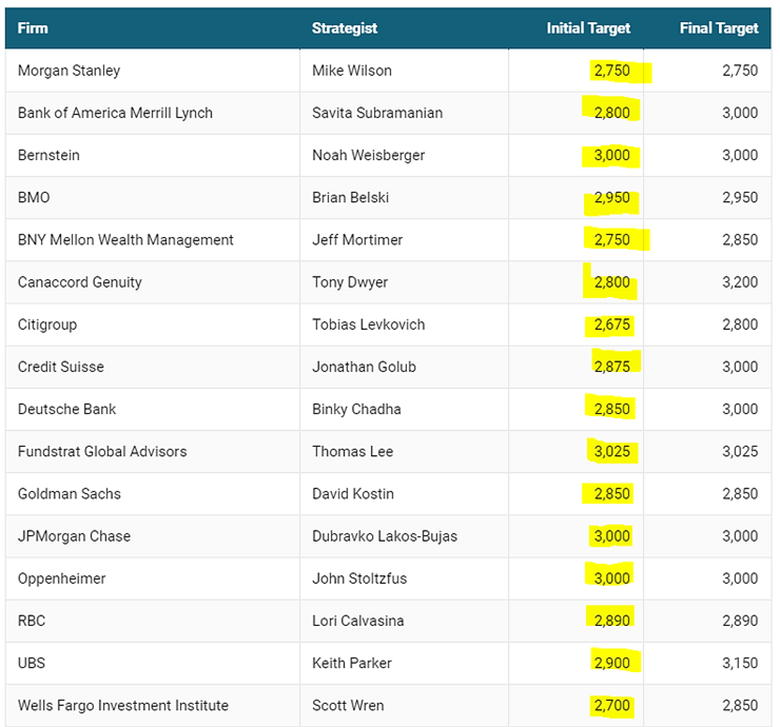

What about 2018 forecasts? Not surprisingly, the predictions seem to be on the optimistic side:

Source: CNBC

As of this writing, the S&P 500 sits at 2,546. Unless there is a ravenous rally Christmas week, it looks like both the initial forecasts and final target revisions will miss on the upside.

In summary:

- Forecasts exist because we crave a sense of comfort & control.

- Wall Street will always err on the side of optimism. They do not want to scare or depress their fee paying clients.

- Don’t make investment decisions based on a forecast. If you must indulge, think of market forecasts as a source of entertainment.

- Pure Portfolios has been forecast free since 2016.

Happy Holidays!