“Those who have knowledge, don’t predict. Those who predict, don’t have knowledge.”

– Lao Tzu

The annual charade of Wall Street sages predicting what will happen in 2020 is upon us. After a dismal forecasting result in 2018, the equity market predictions for 2019 were pretty decent. If you recall, 2019 predictions were the most optimistic since 2009. It turns out, Wall Street was not optimistic enough. As of 12/18/19, the S&P 500 is trading around 3193.

Source: CNBC

The above chart shows various S&P 500 predictions for 2019. UBS, BMO, Deutsche Bank are in the neighborhood. Admittedly, it’s tough to give Wall Street firms credit even when they get it correct. Their predictions year after year are a variation of, “we expect the market to rise 10-12% from current levels.”

For 2020, we noticed something that virtually never happens, multiple firms predicting negative market returns. These perma-optimistic firms have been predicting market gains in unison every year since 2000 (it’s better to be wrong with the crowd than wrong all alone).

Source: MarketWatch

The above graph shows the 2020 price targets for several Wall Street firms. The consensus projection would be ~4-5% increase from today’s market levels. Notice Invesco, Morgan Stanley, and UBS going out on a limb predicting negative market returns. This is a fireable offense at most big Wall Street firms (I’m not joking).

Predicting positive, but more muted market gains seems like a reasonable guess given our lofty starting point. We wonder, how common are single digit positive return years?

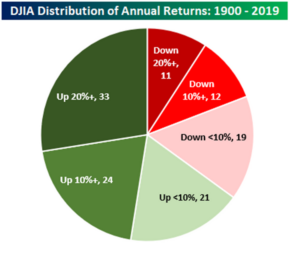

Source: Bespoke Investment Group

The above pie chart shows the distribution of annual returns for the Dow Jones Industrial Average. Over the past 120 years, there have been only 21 instances where the market has been positive and up <10% (light green slice). In other words, modest single digit gains are more uncommon than you might think.

Alas, tis the season for the 2020 market prediction blitzkrieg. It can come from all angles – your financial advisor to cousin Lenny at the family holiday party. Here are a few mental shortcuts to help get you through the forecasting season.

The more specific the forecast, the more you should ignore it

For example, “we expect S&P 500 upside to 3,950 is possible if Brexit comes to a seamless resolution, the 10-year U.S. Treasury yield remains around 2%, the Fed stays the course, and the Patriots repeat as Super Bowl champion. If not, we feel strongly the S&P 500 will hover around 3,650.” Wait, what!?!?

Watch out for the cop-out forecast

This goes something like, “we predict a year-end target for the S&P 500 between 3000-3900 for 2020.” A weatherman who predicts the temperature on Christmas Day to be between 20-60 degrees would be unemployable. Translation: we have no clue what’s going happen, but this sounds better than “I don’t know.”

The goalpost mover is an old Wall Street trick

As the name implies, they “revise” their prediction to jive with current market movements. If the market goes up, the year-end forecast moves higher (and vice versa for lower market movements). This type is good for telling us what just happened, but offers little in the way of true forecasting.

Beware the illusion of safety or false confidence forecast

The art of forecasting is akin to waging psychological warfare against clients. The dog and pony show is designed to portray a sense of comfort. In essence, forecasters are telling investors “trust us, we got you.” The reality is if the market takes a dump, they’re going to get their 1% fee regardless (that’s why we tie our fees to investment outcomes).

Pure Portfolios is proud to be forecast free since 2016. Happy Holidays!