“We’ve extended the analysis to every asset class where we could get our hands on the numbers and investigated the results. Same conclusion: trend-following minimizes tail risk.” – Wesley Gray, PhD Alpha Architects

We have touched on our rules-based investment approach during past blog entries. One of our clients recently took an interest and asked us to define our framework. Before we get into the nuts and bolts of quantitative investing, it’s important to understand why we do it.

The simple answer is, to reduce portfolio drawdowns (steep losses). We aren’t talking about all-equity investors that are actively seeking risk, or have 40 years left to work & invest. Rather, pre-retirees, retirees, and risk-averse investors that can’t stomach the thought of another 2008 market decline.

Currently, investors and advisors generally accept asset allocation (diversification) as a way to reduce portfolio risk. This is a sound principle and has worked nicely throughout history. However, diversification can break down during periods of market stress. A recent example would be 2018, where every major asset class (except for cash) posted negative returns.

We can keep our asset allocation principles, and add trend & momentum rules to help us manage risk and avoid massive drawdowns.

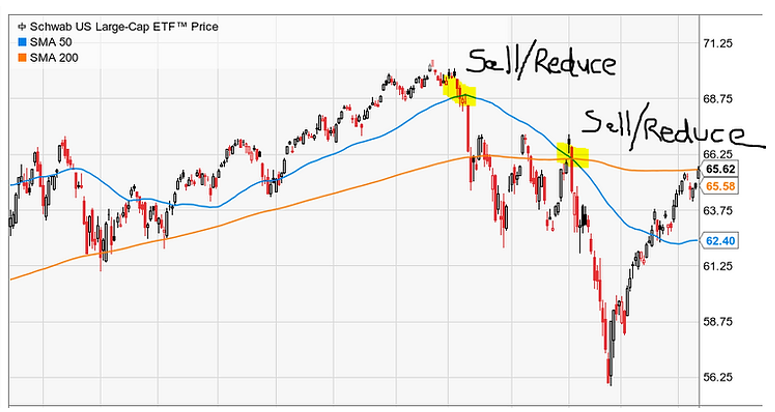

Trend Rule* – if the asset is above the moving average then buy. If the asset is below the moving average then sell or reduce the position and hold cash or U.S. Treasuries.

Source: YCharts

The above chart shows the Schwab US Large-Cap ETF (SCHX) during 4Q 2018. The trend rule would have signaled paring back U.S. stocks (yellow highlights).

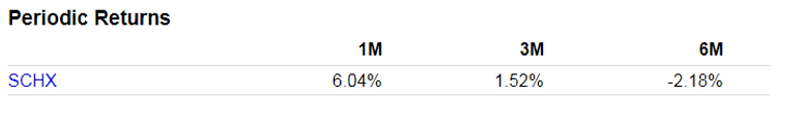

Momentum Rule* – if the assets return is positive over the past x months, then buy. If the assets return is negative, then sell or reduce position and hold cash or U.S. Treasuries.

Source: YCharts

Continuing with the Schwab US Large-Cap ETF (SCHX), the above table shows returns for one month (1M), three month (3M), and six month (6M) time periods. In this example, the 1M and 3M returns are positive so we would buy SCHX. Conversely, if we were going off 6M returns which are negative, we would sell or reduce our position in SCHX.

On the surface, our explanation might seem complex, but it’s actually very simple.

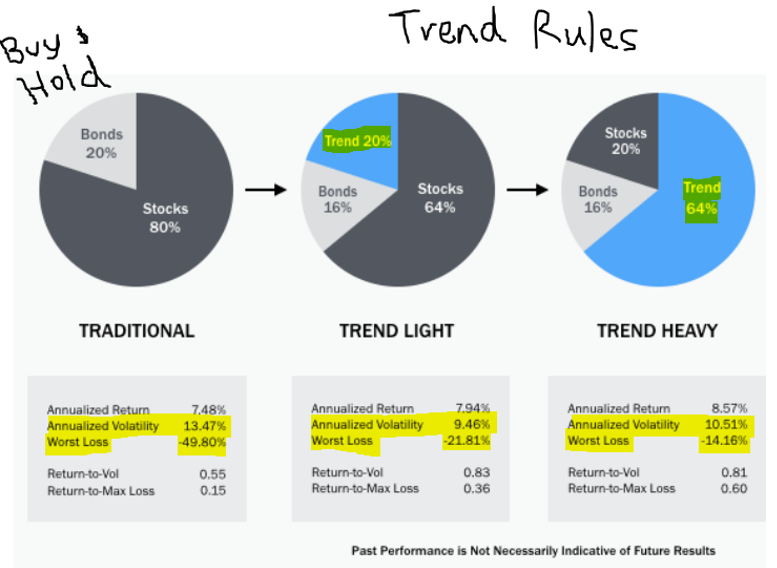

The key takeaway is through asset allocation, trend, and momentum, we can create a similar return profile as buy & hold investing, but avoid major portfolio drawdowns.

Source: Intrepid Wealth Partners, LLC

Source: Intrepid Wealth Partners, LLC

The above graphic shows risk & return metrics over the last 30 years (as of 12/31/2018). The traditional portfolio (left) shows a simple buy & hold approach. Notice the elevated volatility and Worst Loss figures compared to the Trend Light and Trend Heavy portfolios. The evidence would suggest introducing trend rules within an asset allocation framework can generate similar returns as buy & hold, but greatly reduce drawdowns and risk.

Benefits of introducing trend & momentum rules to complement your asset allocation:

- Piece of mind for pre-retirees, retirees, or risk averse investors.

- We can maintain the return profile of buy and hold, but greatly reduce risk and major drawdowns.

- Take human emotion and bias out of the investment process. You have biases, we have biases, and your financial advisor has biases. We can mitigate their destructive nature by relying on rules to make portfolio adjustments.

- If the market goes haywire, you have a plan. There’s nothing worse than hearing “stay the course” from your advisor when the market is cratering.

You might say rules-based investing sounds pretty good, what’s the downside?

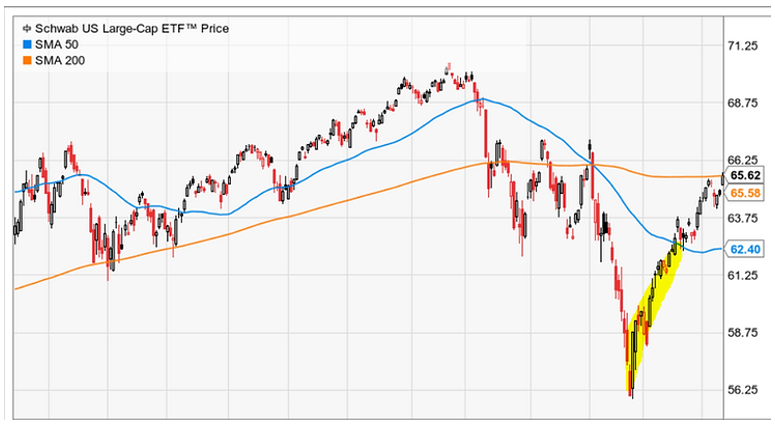

Good question. There is no free lunch in investing. In market environments with steep losses, you won’t participate fully in the downside, but it’s likely you won’t participate fully in the recovery either.

Going back to our SCHX graph, we would have missed the uptick off the bottom (yellow). If we were going off of the 50 day moving average (blue line), our reinvestment point would have been around $62.40. Likewise, we would have avoided the steep drawdown prior.

Source: YCharts

There are other nuances and approaches to rules-based investing, and every firm in the space does it a little bit differently. Regardless of what you believe, the overarching theme is you must have a plan in place to mitigate risk, especially if you are about to retire, retired, or can’t stomach steep portfolio losses.

*For illustrative purposes only. There are many ways to implement trend & momentum rules. Past results not a promise of future performance.