“The more expensive debt becomes, the less weak corporations will be able to maintain the illusion of health.” Trevor Noren, 13D Research

There seems to be a perpetual belief that corporate America is flush with cash. The below headline from Bloomberg has become commonplace:

The “flush with cash” story is only part of the equation. If I max out my credit card with a cash advance and transfer to my checking account, am I flush with cash? If you’re looking at my bank balance you might answer yes, however, the liability side of my personal balance sheet would show an equivalent amount of high interest debt. Our example is simplified, but a similar phenomenon is shaping up in corporate debt markets, especially among lower quality borrowers.

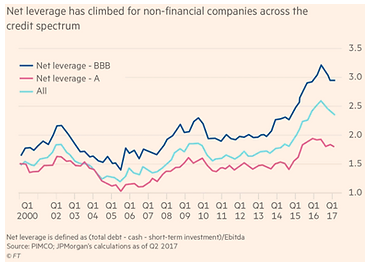

The above shows Net Leverage for non-financial companies (total debt – cash – short-term investment) for the past 17 years. You can see the lowest quality borrowers, BBB (blue line) have outpaced broader corporate issuance (light blue line).

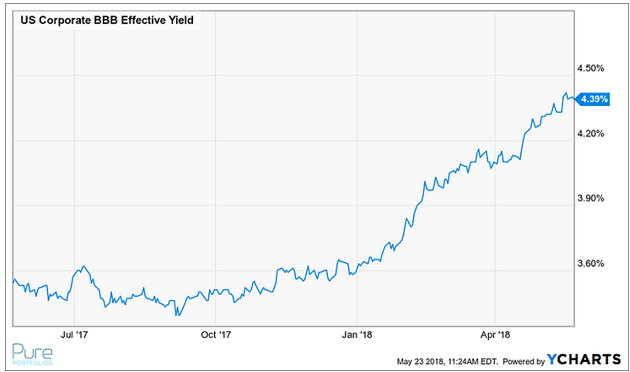

Meanwhile, the cost of borrowing has been rising:

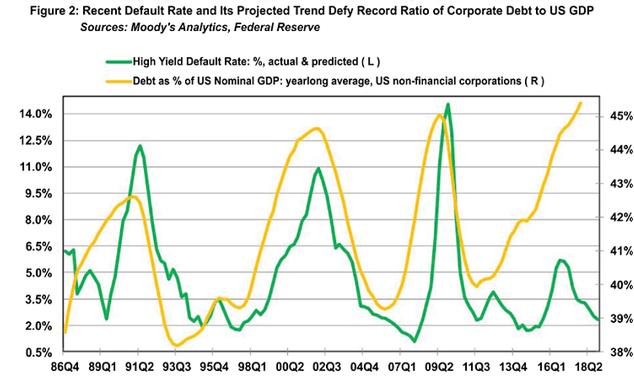

Historically, high levels of debt with increasing cost of borrowing equals elevated levels of defaults. However, a prolonged period of record low interest rates has disrupted an important relationship.

The yellow line shows non-financial corporate debt as a percentage of US GDP. The green line shows the historical high yield default rate. For the past ~30 years, the relationship of high debt and elevated defaults has held true (conceptually this makes sense). Notice the dramatic divergence post financial crisis? Low interest rates have offered marginal companies a lifeline of cheap capital, but this could be changing as the Fed increases short-term borrowing costs.

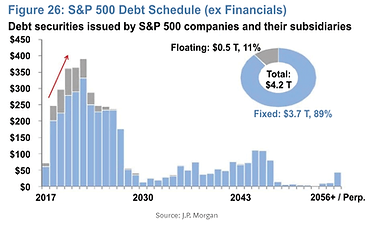

Lurking around the corner, ~$2 trillion of corporate debt is coming due over the next three years:

The above graph shows S&P 500 companies’ debt maturation schedule. You can see a large swath of corporate debt is coming due. Can lower quality companies withstand a dramatic increase in borrowing costs? We would prefer not to hang around this space to find out.

What does it all mean?

Record debt + rising borrowing costs + record low defaults + large amount of debt coming due = shoring up your fixed income portfolio and understanding how much credit risk you are taking. If you own a fund with “high yield, leveraged loan, or floating-rate” in the title, you could be unknowingly walking into a buzz saw.

Now is not the time to reach for yield or speculate within the corporate debt markets. Fixed income (bonds) are supposed to provide income and a shock absorber for your riskier stock holdings. Don’t turn a safe asset class into a risky one.