“Playing political football with a vote to raise the nation’s debt ceiling has become as predictable as a Twitter rant from Charlie Sheen.” – Peter Welch, U.S. Senator

On January 19th, the United States reached its debt ceiling limit of $31 trillion. Investor reactions have ranged from panic to non-event.

We examine possible debt ceiling outcomes and what the drama could mean for financial markets.

Unfortunately, the debt ceiling circus is nothing new. Since 1960, this is the 79th time the U.S. government has reached (and potentially raised) the debt limit.

Most of the time, Congress comes to an agreement with little fan fare. The debt ceiling is raised and we kick the debt can down the road for another day.

On rare occasions, things get ugly. Look no further than 2011, which carries some striking similarities to what is happening in 2023.

-

Shortly after a mid-term election year

-

Split Congress

-

Democratic president takes over from Republican president

On the last bullet, this isn’t a Democrat or Republican issue. The debt mess has been a team effort…

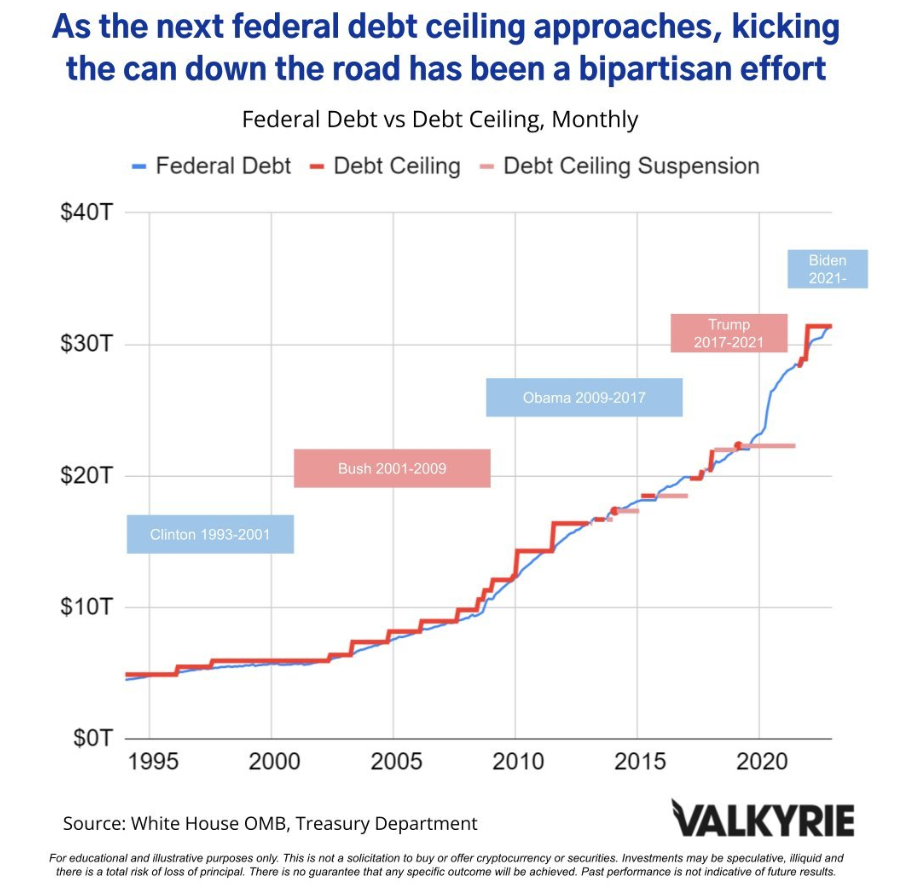

Source: White House OMB, U.S. Treasury, Valkyrie

The above graph shows federal debt (blue) and the debt ceiling (red) going back to 1995. The 2000’s started a parabolic rise in U.S. debt levels. It’s not a secret the country is on a perilous fiscal path. Spending is out of control and unsustainable. The lack of fiscal discipline has been a D & R problem.

Back to 2011, the debt ceiling gridlock lasted until early August when a deal was struck.

The collateral damage was significant…

- The U.S. credit rating was downgraded by Standard & Poor’s from AAA to AA-.

- The political dysfunction was a global embarrassment.

- The S&P 500 cratered almost 15% on the political drama.

Currently, Democrats and Republicans are talking tough and a drawn out stalemate seems more likely by the day.

Many are comparing 2023 to the 2011 debt ceiling standoff…

How did markets react in 2011?

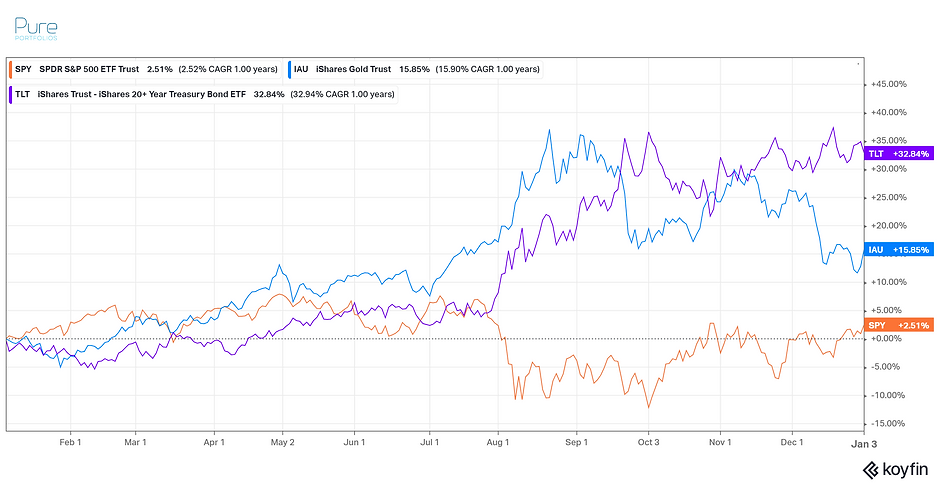

Source: Koyfin, Pure Portfolios

The above graph shows 2011 calendar year performance for the S&P 500 (SPY, orange), Gold (IAU, blue), and Long-Term U.S. Treasury bonds (TLT, purple). The S&P suffered a ~15% drawdown due to the debt ceiling theatrics and credit rating downgrade. Not surprisingly, investors flocked to Gold, which tends to do well during times of uncertainty. Ironically, long-term debt of the U.S. Government was deemed a safe haven (go figure).

Based on recent history, it would be naïve to think debt ceiling politics do not matter.

In our opinion, here’s how this likely plays out…

- Politicians are going to politic

- The headlines from financial media will sensationalize the event

- Stocks could react negatively to the Washington D.C. drama

- Some investors will panic and make emotional allocation decisions

- Congress will raise the debt ceiling, tout it as a political victory, and hurl insults at the other party

- The United States will continue to kick the debt can down the road

We should note the U.S. has never defaulted on its debt. The “full faith and credit” of the U.S. government still means something.

However, the privilege of being the world’s reserve currency, and the livelihoods of American citizens, should not be jeopardized by playing politics.

To reduce the deficit we have two choices, either cut spending and/or raise taxes. The current fiscal path is unsustainable.

Let us know what you think about the debt ceiling at insight@pureportfolios.com.