Free from pretense or deceit

Easily detected or seen through

Readily understood

Characterized by visibility or accessibility of information especially concerning business practices

Source: Merriam-Webster

According to a CFA Institute study, “From Trust to Loyalty: What Investors Want,” transparency rated near the top of desired financial advisor attributes. Furthermore, a quick peruse of random advisor websites and chances are there will be some reference to transparency. At minimum, an advisory client should have a general understanding of what they own, how much it costs, and how they’re doing. Unfortunately, many advisors talk the transparency game better than they play it.

We hope to provide a transparency reference point with a showcase of our client portal. After reading this, you’ll be able to decide how transparent your advisor actually is.

The below examples are from the actual Pure Portfolios client portal and smartphone app.

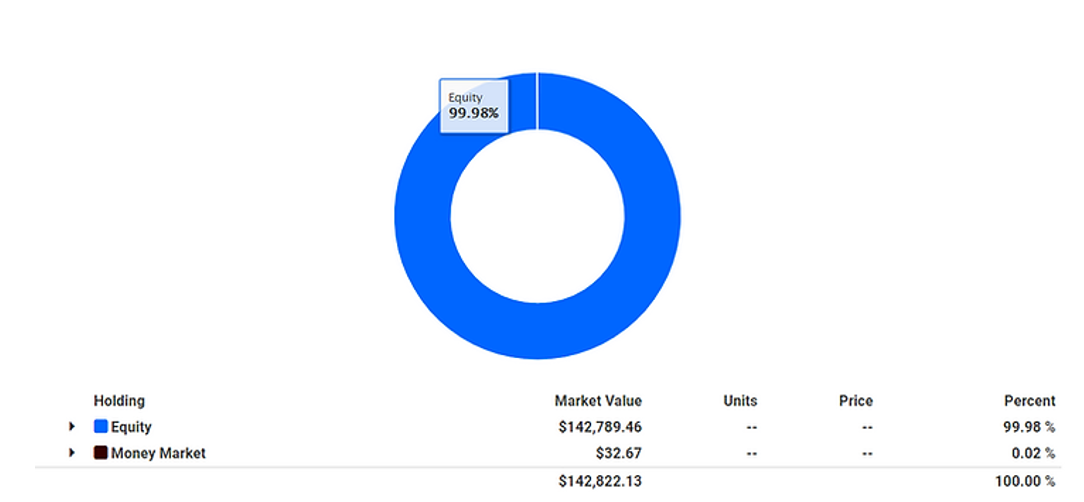

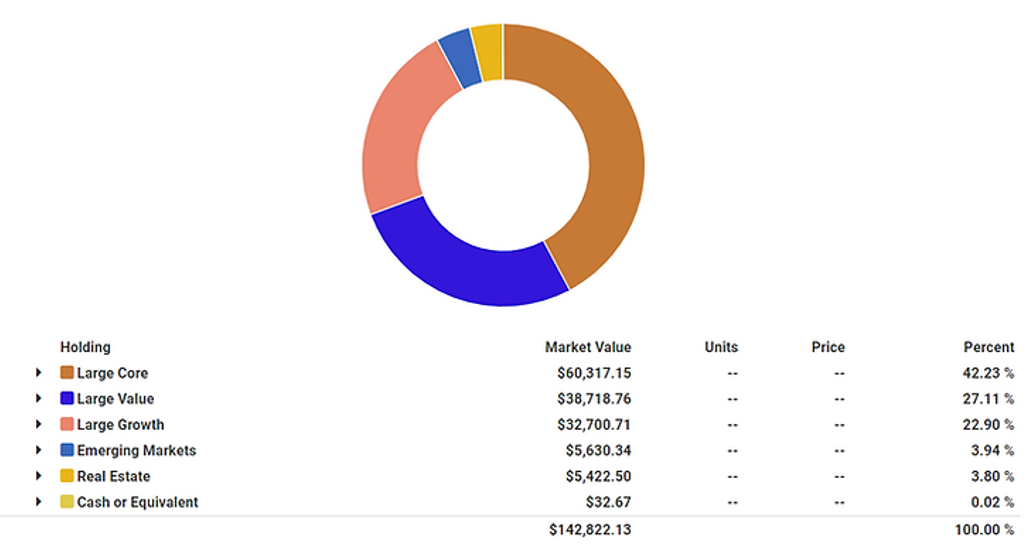

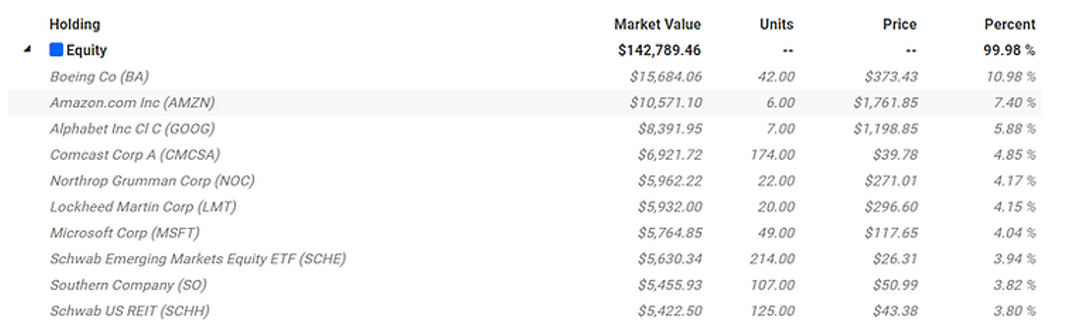

What You Own

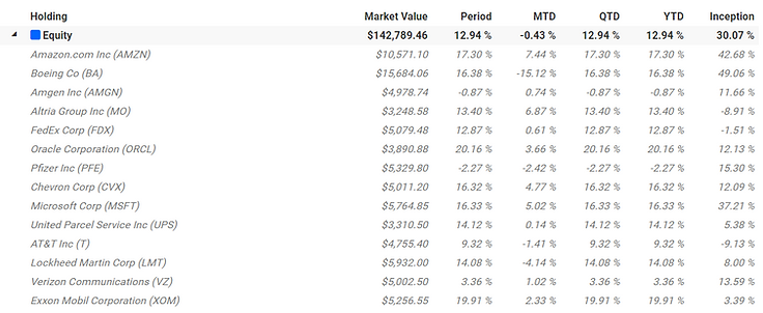

The above graphics show the sample portfolio at the broadest asset level (top), sub-asset level (middle), and individual holding level.

The above graphics show the sample portfolio at the broadest asset level (top), sub-asset level (middle), and individual holding level.

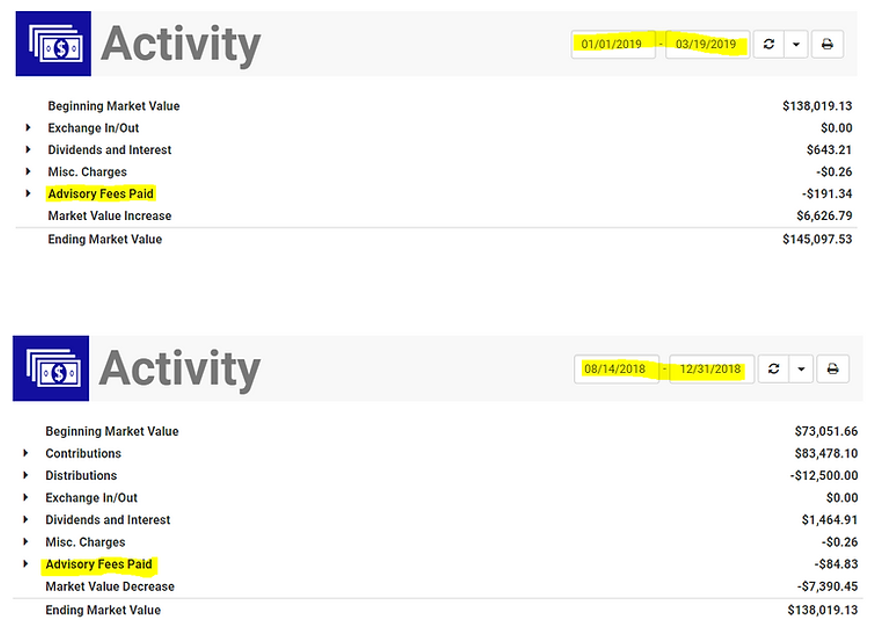

What You’re Paying

The above graphics shows every single dime that flows in and out of the account. From contributions, dividends & interest, advisory fees paid, misc. expenses, and changes in account value (our custodian Schwab charges $4.95 per individual equity trade. Depending on origin of the trade, Pure Portfolios will credit client accounts for certain ind. equity trades). Notice the highlighted date range box (top right of each graphic), the client can toggle the dates to show any time period.

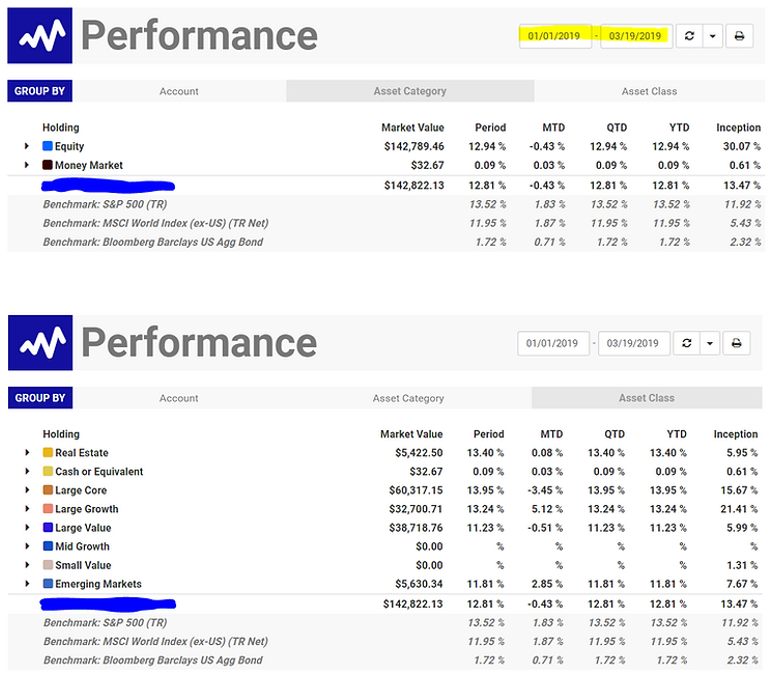

How You’re Doing

The above graphics show NET of fee performance from the broad asset class level (top), sub-asset class (middle), and at the individual holding level. Performance shouldn’t be hidden, nor should it require a special request to obtain, or be made available only at month end. It should be available 24/7 and presented net of your advisor’s fee.

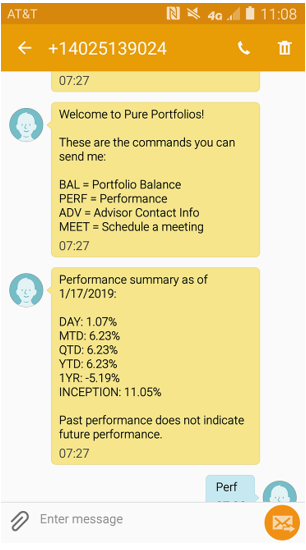

For those who prefer using a smartphone, all of the above information is available via the Pure Portfolios app (Apple Store or Google Play). We also offer an automated text feature which allows clients to text commands to Pure Portfolios and get instant responses:

The above graphic shows all of the prompts a client could text Pure Portfolios and receive an instant response, including performance and balance info. You can even schedule a meeting with us or bring up our contact info. How cool is that?

Regardless of how you prefer to consume information, it’s up to the advisor to set expectations and deliver on their promise of transparency. At the minimum, you should have 24/7 access to what you own, how much it costs, and how you’re doing. If your current advisor falls short, chances are there’s something they don’t want you to see.

The information contained herein is for illustrative purposes only. Performance is never guaranteed and past performance is not necessarily indicative of future returns. Pure Portfolios retains the discretion to change portfolio allocations at any time.