“As far as dividend yields go, the UK, Italy, Spain, and Singapore all offer dividend yields north of 4%, while US markets have the lowest dividend yields in the world.” – Bespoke Investment Group.

The cash in your savings account yields next to nothing. Bonds serve a purpose to reduce portfolio risk, but bond yields are still stubbornly low. There are more enterprising approaches to generate income i.e. preferred stocks, REITs, high-yield bonds, closed-end funds (essentially levered up bond or stock funds), etc., but those are fraught with risks.

Dividend investing is another approach, but a U.S. centric playbook might not be optimal.

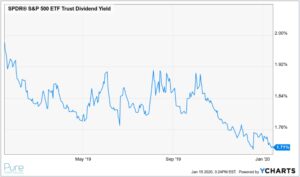

The above graph shows the dividend yield of SPY (S&P 500) ETF. Price appreciation and emergence of stock buybacks have driven the dividend yield of the S&P down, down, down.

Even historically high dividend paying sectors have sub 3% yields.

The above graph shows ETF proxies for historically good dividend paying U.S. sectors: utilities (blue), consumer staples (orange), and telecommunications (red). All three sectors used to sport dividend yields well above 4%, not so much anymore.

The good news is you don’t need to put in much effort to start generating more dividend income. You just need to know where to look.

We suggest expanding your investment universe to include foreign equities.

Source: Bespoke Investment Group

The above chart shows country specific indexes in the left two columns. We have highlighted the “div. yield” column to show the countries with the highest dividend yields. The UK, Italy, Spain , and Singapore indexes all have dividend yields north of 4%. Keep in mind, this is just the passive index. An enterprising investor can do a bit better with a more intentional strategy.

Pure Portfolios has developed its own rules and screening criteria to create a global dividend index. Here are a few of the things we pay attention to…

- Payout Ratio – The percentage of earnings a company pays out in dividends. Too high of a percentage might jeopardize the sustainability of the dividend if revenue or earnings take a hit. Remember, dividends are paid from after-tax earnings.

- Coverage Ratio – The company’s ability to meet its immediate financial obligations. The higher the coverage ratio, the easier it should be to make interest payments on its debt, or to pay dividends.

- Revenue/Earnings Growth – Projecting revenue or earnings growth is an inexact science, especially for more volatile sectors. A history of stable earnings growth is often supportive of a safe & sound dividend. On the flip side, it helps to understand how management navigated economic downturns; were they quick to cut the dividend?

- Debt & Capital Structure – A company with growing debt burden could have a negative impact on the dividend. Remember, equity owners are further down the capital structure than debt holders. Dividends are not contractual right and are often the first thing cut when trouble arises.

- Sustainable Yields – We believe the sweet spot for a sustainable dividend yield is between 4-5% (there are exceptions). Often times, a fast rising dividend yield can indicate trouble in the underlying business (dividend yield = dividend/price). There’s a major difference between a cratering stock price (and subsequent rise in yield) and a dividend increasing from strong earnings.

Perhaps most importantly, it’s better to own dividend-centric strategies in retirement accounts. Owning dividend paying stocks in a taxable account is tax-inefficient (check out your 1099 this tax season if you are unsure how much drag dividends are costing you).

Let us know if you would like to learn more about our Global Dividend Strategy. We can also create a customized dividend strategies by tweaking our screening criteria.