The most common question we have received in the past nine years goes something like this;

“How can I generate more interest on cash?”

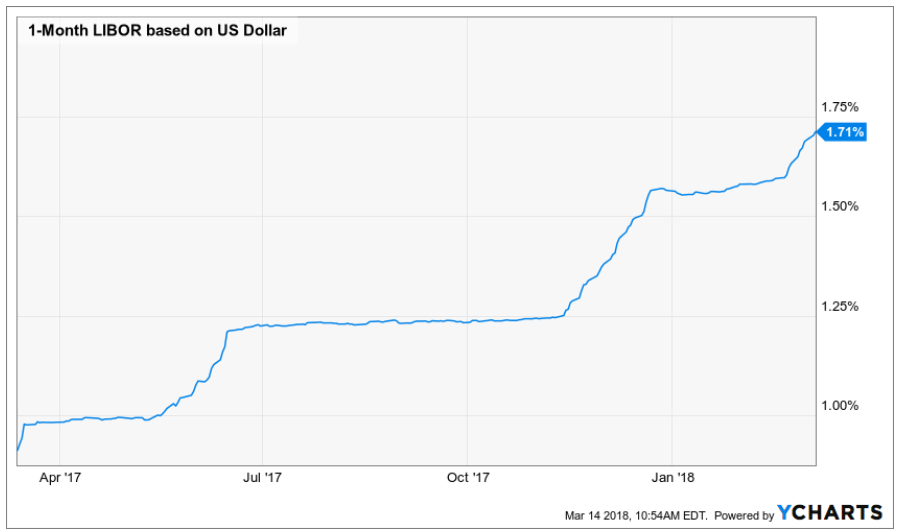

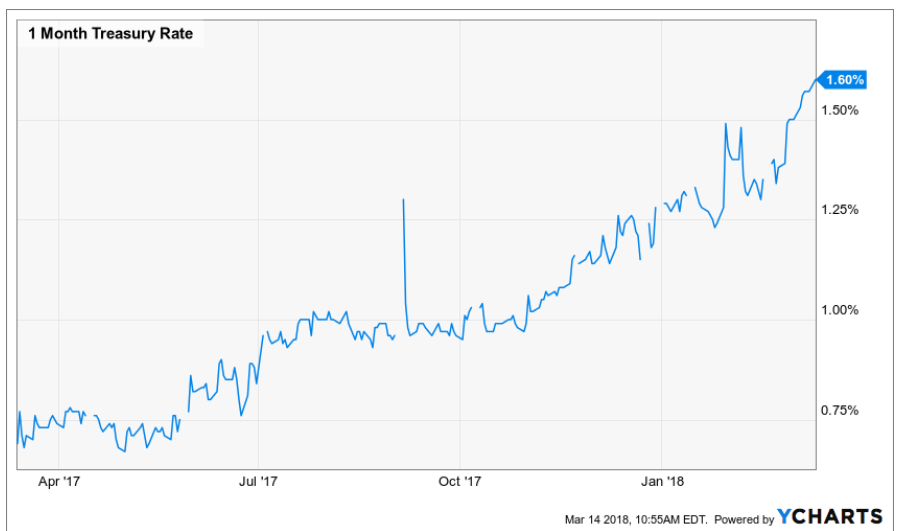

Up until the Fed started increasing interest rates, there wasn’t an attractive or viable solution. The recent uptick in LIBOR, short-term bond yields, and money market fund yields have changed that. It’s now worth a conversation and there are modest income generating options for idle cash.

No matter where you look, short-term yields have ticked higher. However, most investors are not reaping the benefits.

Award winning Wall Street Journal columnist Jason Zweig recently published “Broker to Investors: Your Cash Ain’t Nothin’ But Trash”. The story makes the case that although interest rates have increased, major brokerage firms aren’t passing along the higher interest income to their clients.

It works like this: your broker “sweeps” your idle cash and pools it with other brokerage clients’ idle cash. The larger pool of money is invested in safe, short-term instruments to generate interest income for the broker. They pay you a small percentage in the form of credited income to your account. They keep the rest.

Seems reasonable, right?

The problem is they’re giving you below market rate (often well below market rate on your money). For example, a 1-month U.S. Treasury yields ~1.60%. Meanwhile, your brokerage sweep account yields a paltry .01% – .027%. The spread of 1.30% – 1.50% is kept by your broker as a stealthy, low-risk profit. Doesn’t seem like much, but multiply the spread by billions of dollars and you’re talking real money. Money that could have gone to investors.

“Brokerage firms have basically been betting on the laziness of their investors.” – Peter Crane, President of Crane Data.

What’s a better approach?

-

Understand what rate your current sweep or money market account is paying

-

Ask your advisor if you pay an investment management fee on cash

-

Find out what other cash solutions or money market funds are available (your advisor or broker will likely make the information difficult to find or make it a pain to access better yielding funds)

-

Get cash you don’t plan to invest out of your brokerage account. Banks and credit unions often have plenty of flexible, low fee cash solutions

For full disclosure, Pure Portfolios’ approach to cash is simple. We keep clients fully invested. If a client needs cash for a future expenditure, we send it to them ASAP.

For some reason if we need to hold cash, we exclude it from investment management fees. Through Schwab, we have access to their suite of money market solutions. They trade just like a mutual fund (one-day settlement) and have zero transaction fees. The money market yield goes to the investor and is representative of a true market rate.