Time and again I speak with investors who have no clue what their advisor is charging them. CFA Institute published a report (February 2016) “From Trust to Loyalty: What Investors Want” stating investment costs are the most important factor when choosing a wealth manager.

Why the disconnect?

I have mentioned countless times (see here & here) the tricks the industry plays to hide investment fees and make performance impossible to find. If you do inquire about fees, you will likely be quoted a fixed fee as a percentage of assets, but that is NOT the total cost of investing.

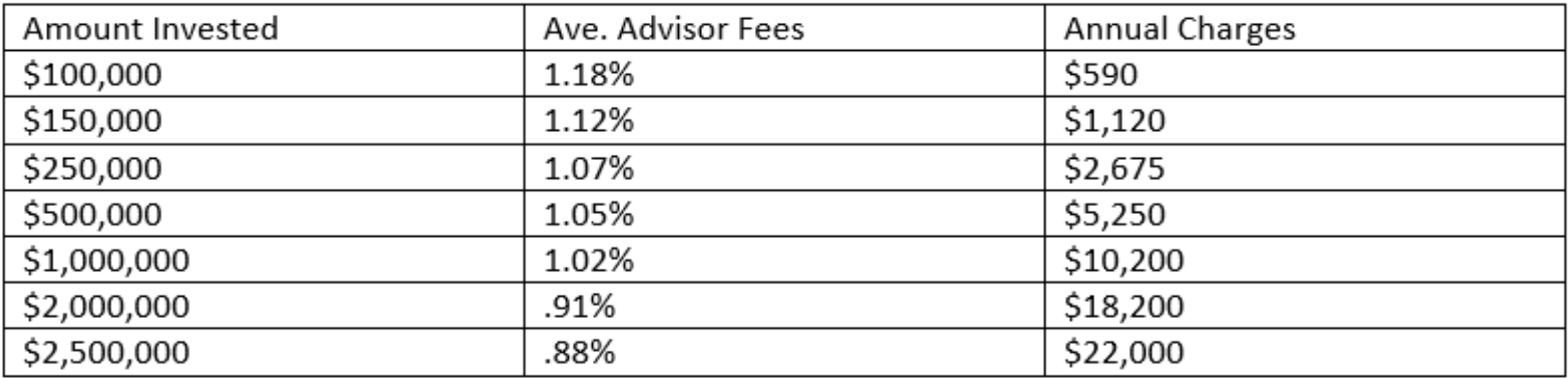

The dominant fee structure is based on assets under management, hence, that will be our focus. The below chart shows the average fee structure of wealth advisors, registered investment advisors, and other asset management firms courtesy of data from Advisory HQ’s 2017 Report. “Average Financial Advisor Fees & Costs.”

A few observations from the chart:

- The data does not include the cost of owning the assets i.e. mutual fund expense ratios which average 0.65% of the value of the fund per year for bond funds and 0.89% percent for equity funds. The annual cost is even higher if you own “A” or “C” share class funds.

- Understand what you are paying in both percent & dollar amount each year for the investment management fee and the cost of owning the assets (I can’t stress this enough).

- You can see smaller accounts are charged a higher fixed percentage than larger accounts. This never made sense to me, as smaller accounts require less customization and often more simplistic client dynamics.

Advisors will almost never talk about the cost of owning the assets or the negative tax implications from using mutual funds. In addition, the mutual fund expense ratio charges will not appear on your statement. The fund company will debit the investors account daily to provide a smoothing effect for the fee. This is equivalent taking a penny each day rather than a lump sum at the end of the month (the advisor is hoping you aren’t paying attention).

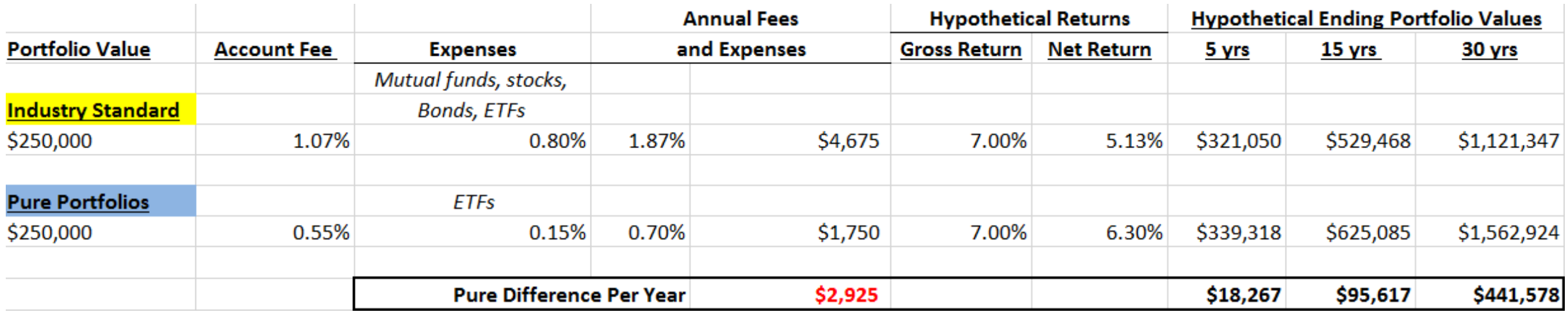

Let’s run through an example:

You can see the annual savings of $2,925, however, the profound impact of compounding net of fee returns for 5, 15, & 30 years is enormous!

Ask your advisor to disclose the total cost of investing during your next conversation. If you’re not pleased with the answer, the cost of doing nothing is a mistake that compounds through time.

“The days of the traditional financial representative hanging an investment advisory shingle out, giving a client a 10-question questionnaire, putting the client in a couple of mutual funds and sitting back and collecting 1% are going, going… gone. I give it two years. I also say ‘good riddance.” – John Lohr, Legal Counsel Wealthcare Capital.