“Rising overseas tensions usually don’t cause economic slumps or bear markets… but it’s not unheard of.”– Ben Levisohn, Barron’s

The CFA Institute’s Enterprising Investor blog published a timely piece on “What Happens to the Market if America Goes to War?”

As rhetoric and military provocation between the United States and North Korea hits a fevered pitch, this becomes an important question. Mark Armbruster, CFA examines previous wars to better understand how risk & return characteristics change during military conflict.

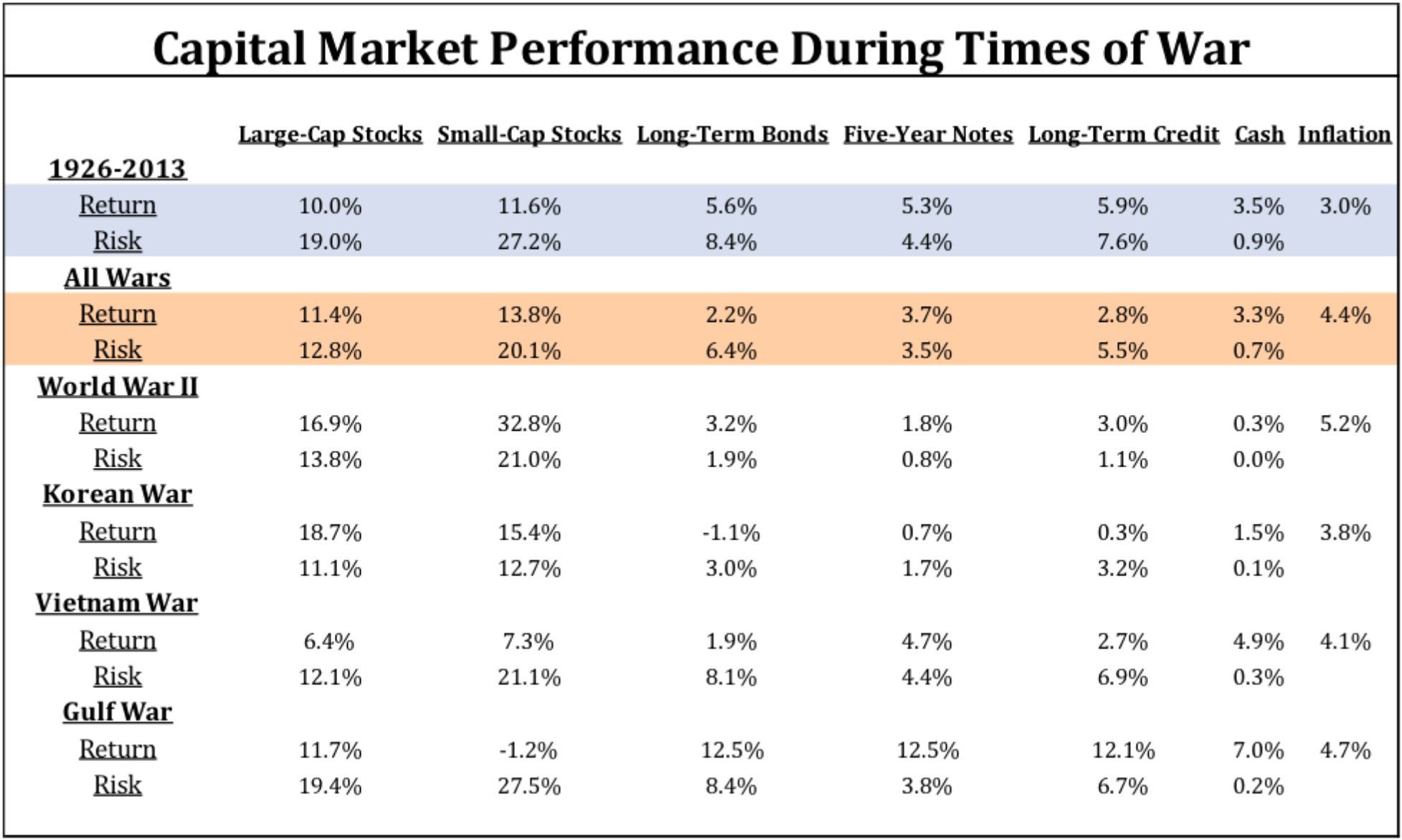

Capital Market Performance During Times of War

Source: CFA Enterprising Investor blog

The blue shade shows financial asset returns from 1926-2013. The orange shade aggregates the risk and return for “All Wars.”

Note: The study excludes the Iraq War due to the major economic boom and bust of the financial crisis.

Observations:

- Volatility was lower during war-time across asset classes. This might seem surprising at first glance, but financial markets are forward looking. Often, the threat of an adverse event has a greater impact on financial markets than the actual event itself.

- Inflation levels were much higher during the “All Wars” period (orange) vs. the 1926-2013 control period (blue). Inflation is lower today, and foreign energy supply disruptions are not as much of a concern due to the U.S. energy revolution (Call for U.S. Domination in Global Energy Production). During military conflicts, foreign supply disruptions caused a spike in oil prices which led to domestic inflation hurting bond prices.

- Bonds under-performed during war-time. The author infers bonds will not provide as much protection during the next military conflict. We would counter that lower inflation and U.S. energy independence should continue to make bonds an attractive hedge against risk (When Times Are Bad).

- To follow up on the previous point, long-term U.S. Treasuries were the best performing fixed income asset class in the month of August +3.4% (+8.4% year-to-date). The U.S./North Korea tension hit an apex when the regime fired a ballistic missile over Japan.

Mark Armbruster, CFA sums up the historical relationship between wars and financial market returns:

“There are many economic and fundamental factors that impact security prices. Occasionally, a single event is powerful enough to dominate these other factors to singly influence capital market returns. However, historically speaking, this has not been the case with wars.”