“The trouble with retirement is that you never get a day off.” – Abe Lemons, college basketball coach

It’s a delicate balance every retiree faces. Achieving a meaningful return, managing risk, and human emotion.

Which should a retiree prioritize?

There’s no one-size-fits-all answer.

Here are a few important factors that could impact your stock allocation in retirement.

Some of the below circumstances would allow for either a conservative, aggressive, or somewhere in-between approach. The investor’s risk capacity, emotional disposition, and behaviors would be the tie breaker.

For example, a person with $100 billion could make a rational case for being allocated to 100% cash (why take any risk?) or 100% stocks (I have more than I’ll ever need, let’s grow this for future generations!). The allocation decision would come down to the investor’s personality type.

Let’s get to it…

The below list might use some extreme examples to make a case in point. For allocation purposes, aggressive = 100% stocks, conservative = 100% bonds.

Income Not Tied to Financial Markets

Bertie is a retiree with Social Security, pensions, annuities, rental property, and part-time employment income that covers her monthly expenses many times over. Bertie could make a case for an aggressive investment allocation.

Expenses

Jimmy lives an extravagant lifestyle funded by his retirement portfolio. He needs the portfolio to grow, but can’t afford a large drawdown that would impair his capital base.

A conservative allocation wouldn’t keep pace with inflation and Jimmy’s outsized distributions.

An aggressive allocation wouldn’t survive a large drawdown and Jimmy’s distributions.

Jimmy settles on 50% stocks & 50% bonds.

Retirement Age

Gustavo wants to retire early. He estimates that three more years of work and saving should make his goal attainable. However, Gustavo knows a market pullback could derail his early retirement dream. The day Gustavo retires starts the longest period of time in which his assets need to last.

Gustavo understands the biggest risk to new retirees is sequence of return risk. He promptly adjusts his 100% stock exposure lower during this critical period.

As Gustavo ages, he fully expects to increase his equity exposure, with the next generation in mind.

Life Expectancy

Bush is a new retiree at the age of 65. Bush’s grandfather lived until 115. Bush’s father lived until 113. Bush knows he is likely to live well into his 100s. He needs an allocation that grows to keep pace with inflation.

Bush decides on an allocation of 70% stocks and 30% bonds.

Fast forward, Bush is approaching 100 years old. He has more than enough assets to meet his lifestyle needs. With the end near, Bush allocates 100% to stocks with the intention of donating his entire portfolio to charity.

Risk Profile

The most important factor is a retiree’s investment personality and capacity to take risk. Risk tolerance questionnaires cannot recreate panic and fear that comes with a market selloff. How have you behaved during past market events? Think 2008, 4th quarter of 2018, spring 2020.

If you have plenty of income not tied to financial markets, low expenses, and worked until 70, but are a nervous Nelly, stay true to yourself and build a conservative portfolio.

Conversely, if you’re a risk seeker, stay true to yourself and build an aggressive portfolio.

Don’t discount how how your personal experiences shape the way you view money.

For example, the bulk of Stanley’s career was during the roaring 90s. Stanley’s baseline is stocks going up by ~15% per year. Stanley is comfortable owning 100% stocks.

Beatrice graduated from college in 2007. The economy imploded as she started her job search. She was unemployed for almost a year before finding an opportunity. Beatrice is comfortable with a modest allocation to stocks.

Some of the above factors will conflict. You can add up which factors favor an aggressive vs. conservative portfolio, factor in your investment personality, and make an retirement allocation decision that fits you.

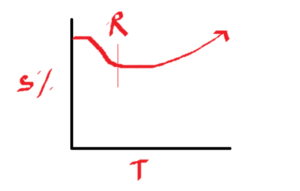

A retiree’s stock ownership percentage glide-path might look like this…

The above graph (it’s crappy I know) shows how a retiree’s stock allocation might evolve during retirement. The vertical axis shows stock %, the horizontal axis shows time, and the R is the retirement date. The retiree lowers their stock exposure before and a few years after retirement to mitigate sequence of return risk. Gradually, the retiree increases their stock allocation as time passes.

A couple other nuggets…

- Don’t take risks where the best case won’t change your life, but the worst case will derail your plan. Leverage and retirement usually don’t mix (see Spectacular Implosion).

- If you bail on stocks during times of market stress, you are invested incorrectly.

- If you embrace risk when times are good, but shun it when times are bad, you’re invested incorrectly.

- If you’re constantly worrying about what the market does next, you’re invested incorrectly.

The ideal retirement portfolio is one where you could not look at the balance for one year and not give it a second thought.