We started every day the same. Our team of “financial planners” gathered in a vast conference room with a sprawling white board at the front. I use quotes around financial planner because we were really slinging random products.

Standing over the room was our boss, calling on individuals one by one to record our activity from the previous day. He tracked our daily dials, contacts, and sales closed. I eagerly awaited my turn as I had just landed my first investment client. After sharing my good fortune, I broke protocol and asked the group an honest question;

“What resources do we have to build investment portfolios?”

The room erupted in laughter. A senior salesperson bellowed out, “Dude! Just pick a fund!”

The year was 2005. I knew I had much to learn and this wasn’t the place to do it.

Fast forward ~ 15 years and I’ve seen quite a bit. I’ve sold life insurance, made hundred million dollar block trades, earned a Chartered Financial Analyst designation, worked as a portfolio manager at a large private bank, built individual equity models, pitched a former NBA star, and launched a wealth management company. At times I’ve felt inadequate, other times full of hubris and arrogance.

Here’s what I’ve learned over my 15 year career.

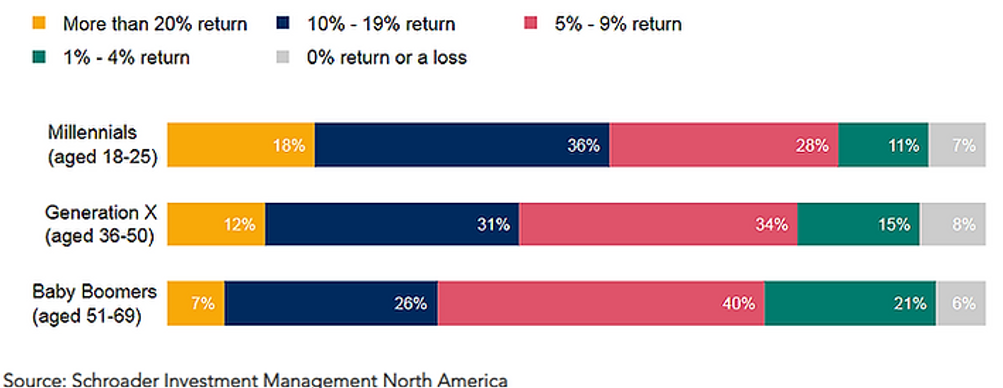

Many Investors Have Unrealistic Return Expectations

The above graphic shows over 50% of millennials expect an annualized return greater than 10%. The yellow area shows the percentage of investors (by age) that expect annual returns greater than 20%! It’s imperative to marry return expectations with reality.

Forecasts are Incredibly Stupid

S&P 500 price targets. Recession calls. Interest rates predictions. Many financial institutions publish these fairy tales to give the illusion of control to their clients. There is zero consequence to being wrong, which encourages outlandish behavior.

Can you imagine pretending to know how trillions of dollars of global capital is going to react in three months, six months, or a year? It’s completely fine to say “I don’t know.”

Don’t Be Offended When Someone Ignores Sound Advice

I used to lose sleep when someone ignored my sound advice. I learned quickly you can’t help everyone. People anchor to odd things to justify irrational behavior.

No Shortcuts to Building Wealth

Saving + investing + time = wealth. The biggest input for determining investment success is savings rate, especially for young people.

Extreme Market Timing Doesn’t Work

I’ve heard many tales of investors selling all of their equity holdings during the Great Financial Crisis. This provides immediate gratification as it stops the pain (market losses). However, making large active bets i.e. going from fully invested to all cash (and back) is a dangerous game. The first decision of selling is easy. The second decision is much trickier, when to get reinvested. I have found most investors get the latter wrong 100% of the time.

Having Information Filters is Crucial

They say we’re the average of the five people we are around the most. It’s the same with information. We are heavily influenced by the content we consume. For example, if I read a daily doomsday report, I’m likely to be a skittish, pessimistic investor.

Develop filters for the information you consume, or understand the potential angle of the author. For example, annuity sales people love to sell gloom to pitch investors guaranteed income streams.

Buy and Hold Investing is an American Privilege

Ask a Japanese or European investor if they’re a buy and hold investor. You’ll likely get a blank stare. Buy & hold investing only works if there’s an expectation of the market going up over time. We are blessed to live in a country that has a stock market that compounds positively.

Incentives Drive Human Behavior

This is proven time and again. If someone is paid to sell life insurance, that’s what they’re going to pitch. If someone is paid to sell annuities, that’s what their recommendation is going to be. To a sales person with a hammer, everything looks like a nail.

Understand the incentives to make sense of the behavior. Some of the most egregious offenses I’ve witnessed come from life insurance salespeople. Insurance and investing do not mix!

Successful Investors Focus On What They Can Control

I’ve seen a prospective client obsess about the Greek sovereign debt crisis and the potential impact on their portfolio. Their portfolio owned expensive mutual funds, was tax-inefficient, and they hadn’t done any financial planning. Focus on what you can control i.e. investment costs, behavior, tax efficiency, and building a sound financial plan. Turning our focus inward can exponentially increase the odds of a successful outcome.

Fear of Missing Out is Very Real (FOMO)

For some, seeing their friends or neighbors get rich is the worst. An old Russian tale goes something like this:

A fisherman encounters a genie. The genie offers the fisherman three wishes. The fisherman begins to dream of gold, palaces, and riches. The genie says the only caveat is your neighbor will get double of what you receive. The fisherman says, “In that case, poke out one of my eyes.”

Now the year is 2019, and I still have much to learn. I am excited to continue the journey, and Pure Portfolios is the perfect place to do it.