Looking back at 2017, the resounding theme from our clients has been disbelief around the perplexing nature of the runaway U.S. equity markets. However, most are quite happy to be wrong about which direction the market is heading if they continue to make money. As professional investors, our job is to position portfolios for the next phase of the cycle, while giving clients the best probability of achieving their desired outcome.

That leads us to ask ourselves…what’s attractive in this environment?

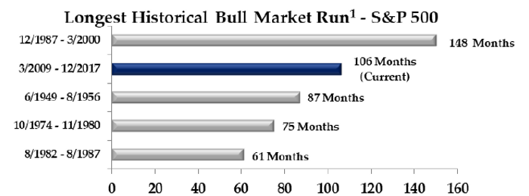

First, let’s look at the historic starting place of U.S. equities:

Source: Bloomberg

The second longest upward streak on record. 106 months (soon to be 107) and counting.

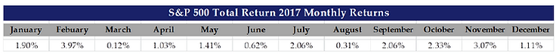

Source: LCG Associates

2017 marked the first time in market history we did not have a negative month during a calendar year!

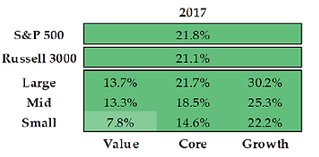

Source: Bloomberg, S&P, Russell

U.S. investors across size, quality, and style made out quite nicely.

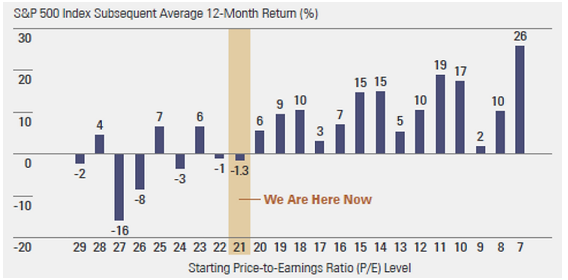

Source: Bloomberg, State Street

We aren’t into market timing, but we can say with confidence that higher starting valuations lead to lower future returns. The left part of the graph shows subsequent returns for the next 12 months when the S&P 500 is expensive (higher P/E level). The right of the graph shows returns are more likely to be positive when starting valuations are cheaper.

You can see where we are headed. Stretched valuations and lower future returns could lead us to look elsewhere to realize our total return objectives.

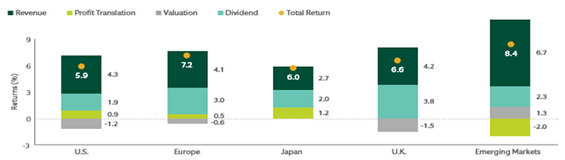

Source: Northern Trust, Bloomberg, MSCI

Emerging Markets and Europe could provide a more attractive return framework for the next five years.

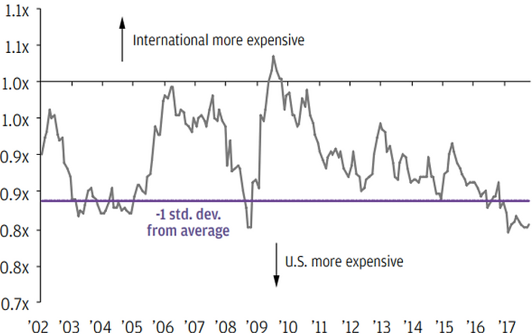

Source: Bloomberg, Oppenheimer, Blackrock, Thomson Reuters

International stocks look more attractive relative to U.S. on a forward looking basis.

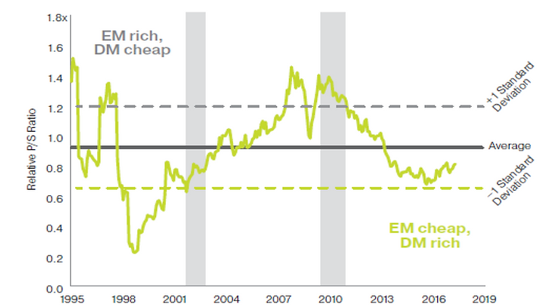

Source: Bloomberg, Oppenheimer, Blackrock, Thomson Reuters

Emerging Market stocks look cheaper relative to U.S. & International markets.

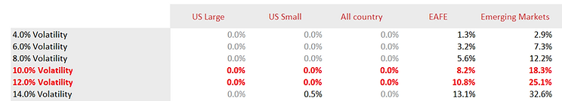

To drive our point home, we modeled optimal asset allocations for the next 10 years. The software attempts to build the portfolios that offer the highest return and lowest risk based on current valuations.

Amazingly, the future portfolios did not include any U.S. stocks. The red highlights would be the equivalent of the popular “balanced” investment objectives.

The projected favorable combination of underweight U.S. equities and overweight to foreign/emerging markets is running counter to the current allocation of many investors.

We hope the above information gives you insight into our portfolio management process, while offering a checkpoint for your equity allocation.