“We were told this summer would see a recession and bear market. Instead, we just had one of the best summer rallies ever.” – Ryan Detrick, Chief Market Strategist, Carson Group

You are the product. Your eyes, ears, and attention are valuable.

The media knows this. Financial TV knows this. Every influencer on YouTube, TikTok, Instagram knows this.

The entire digital economy is tapping into a quirk in human psychology.

Our ancestors that paid close attention to potential threats—predators, famine, or conflict—were more likely to survive and pass on their genes. This created what psychologists call negativity bias: a tendency to prioritize, remember, and respond more strongly to negative information.

For example, commotion in the bushes might be the wind…or a predator. Assuming the worst, such as a lion ready to pounce, kept our ancestors alive.

Historically, shared warnings about dangers—plagues, enemy attacks, bad weather—strengthened community bonds. It’s the old “we’re in this together” mentality. Bad news wasn’t just information; it was actionable.

This means bad news doesn’t just grab our attention, it feels more urgent to process and act upon.

Conversely, good news comes off as aloof and blind to risk. There’s no upside to shunning risk if the downside is our demise.

A tribe member warning, “the river is poisoned” had higher survival value than “the river looks extra sparkly today.”

If you spend any time clicking buttons on the internet, the media’s awareness to this quirk in human psychology becomes obvious.

Headlines emphasizing fear, conflict, and outrage generate more clicks and shares than neutral or happy ones.

“If it bleeds, it leads” persists because bad news keeps audiences engaged longer, boosting ad revenue.

Social media algorithms reward engagement for influencers, creating a feedback loop where negativity dominates feeds.

The same phenomenon applies to investing.

A positive headline, “The Dow climbs 200 points in steady rise,” feels less urgent than a negative one “The Dow crashes 800 points due to wild trade policy!”.

Constant scrolling of short, high-stimulation content can train the brain for distraction and quick emotional reactions. It’s not an accident that short-form platforms i.e. X, TikTok, Instagram Reels, and YouTube shorts are wildly popular.

This urgency messes with our perception making the world feel more dangerous or unstable than it really is.

Violent crime is down. We are living longer than ever. The U.S. stock market has seen one of the greatest runs in history.

Source: Creative Planning, Charlie Bilello

The above graph shows the S&P 500 (blue) since 1989. Despite a myriad of headwinds and steep declines, the market climbed the wall of worry and has rewarded patient investors.

Why does the financial media complex keep pumping out negativity?

Doom predictions are lucrative.

According to Value Stock Geek, one of the most profitable niches in investing media is forecasting disaster. You’ll often find sensational warnings in newsletters and YouTube videos (Source: securityanalysis.org).

Peter Schiff aka “Dr. Doom” is a prominent example, well-known for his bearish outlooks and frequent warnings of crisis (Wikipedia).

Check out some of Dr. Doom’s sensationalized YouTube video titles…

“Dr. Doom’s SCARY Prediction: MASSIVE Economic Danger Ahead” (Source: YouTube)

“Stock Market & Economy Still Frustrating Doom & Gloomers” (Source: YouTube)

Source: YouTube

The above thumbnail attracts clicks with its title predicting stock market doom. This was from two years ago. During the same period, the S&P 500 posted back-to-back 20+% return years (2023 & 2024)!

Any investor following the advice of these click bait videos would have lit money on fire during the past 10+ years of U.S. stock market prosperity. Amazingly, these videos get many more views than practical educational videos on time tested investing principles.

Throughout history, there’s always something to worry about. No generation has received a “license to print money in the stock market without a care in the world” pass…

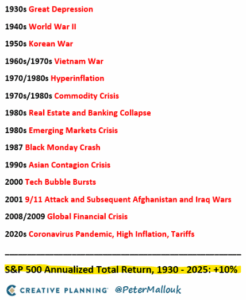

Source: Creative Planning

The above graphic shows challenges by decade going back to 1930. We feel every present moment is unprecedented and the scariest thing ever, however, when looking at history, we understand that every generation had its challenges.

How can an investor avoid falling into the pessimism trap?

My mother used to tell me in high school you are who you hang out with. In 2025, you are what you pay attention to.

- Engage more with history, pay little attention to forecasts, predictions, or doomsday conspiracies.

- Build an information filter. An underrated hack in the digital age is being mindful where you get information. Seek balanced information from a few trusted sources.

- Avoid mixing investing and politics.

- Social media algorithms create information bubbles, where we mostly see content that matches our existing views. This reduces exposure to challenging perspectives, which can make beliefs more rigid and polarized. Seek opinions that challenge your views, rather than confirm them.

In 2025, pessimism is cool, but it’s an expensive characteristic.

According to Charlie Bilello of Creative Planning, from 1928 to 2024, the S&P 500 is positive 73% of the time (71 out of 97 years).

Based on market history, it’s okay to be pessimistic, it’s not okay to stay pessimistic.

To borrow a phrase from Morgan Housel…

“The best financial plan is to save like a pessimist and invest like an optimist.” – Morgan Housel, author and investor

If you’re prone to emotional decisions, shoot us a note at insight@pureportfolios.com to learn more about our rules-based investment approach.